It was way too tedious to type out all the tax calculations, so I used AI to help me create the formulas (note taxable income in negative thousands in cell AP3):

Federal tax 2023

=IF( - AP3 > 912.6, ( - AP3 * 1000 - 912600) * 0.115 + 104949,

IF( - AP3 > 147.7, ( - AP3 * 1000 - 147700) * 0.13 + 5512,

IF( - AP3 > 145.8, ( - AP3 * 1000 - 145800) * 0.12 + 5284,

IF( - AP3 > 143.8, ( - AP3 * 1000 - 143800) * 0.11 + 5064,

IF( - AP3 > 139.9, ( - AP3 * 1000 - 139900) * 0.10 + 4674,

IF( - AP3 > 134.2, ( - AP3 * 1000 - 134200) * 0.09 + 4161,

IF( - AP3 > 126.5, ( - AP3 * 1000 - 126500) * 0.08 + 3545,

IF( - AP3 > 116.9, ( - AP3 * 1000 - 116900) * 0.07 + 2873,

IF( - AP3 > 105.4, ( - AP3 * 1000 - 105400) * 0.06 + 2183,

IF( - AP3 > 92.0, ( - AP3 * 1000 - 92000) * 0.05 + 1513,

IF( - AP3 > 76.7, ( - AP3 * 1000 - 76700) * 0.04 + 901,

IF( - AP3 > 59.4, ( - AP3 * 1000 - 59400) * 0.03 + 382,

IF( - AP3 > 51.8, ( - AP3 * 1000 - 51800) * 0.02 + 230,

IF( - AP3 > 28.8, ( - AP3 * 1000 - 28800) * 0.01, 0)))))))))))

Federal tax 2024

=IF( - AP3 > 928.7, ( - AP3 * 1000 - 928700) * 0.115 + 106801,

IF( - AP3 > 928.6, ( - AP3 * 1000 - 928600) * 0.13 + 106788,

IF( - AP3 > 150.3, ( - AP3 * 1000 - 150300) * 0.13 + 5609,

IF( - AP3 > 148.3, ( - AP3 * 1000 - 148300) * 0.12 + 5369,

IF( - AP3 > 146.3, ( - AP3 * 1000 - 146300) * 0.11 + 5149,

IF( - AP3 > 142.3, ( - AP3 * 1000 - 142300) * 0.10 + 4749,

IF( - AP3 > 136.6, ( - AP3 * 1000 - 136600) * 0.09 + 4236,

IF( - AP3 > 128.8, ( - AP3 * 1000 - 128800) * 0.08 + 3612,

IF( - AP3 > 119.0, ( - AP3 * 1000 - 119000) * 0.07 + 2926,

IF( - AP3 > 107.2, ( - AP3 * 1000 - 107200) * 0.06 + 2218,

IF( - AP3 > 93.6, ( - AP3 * 1000 - 93600) * 0.05 + 1538,

IF( - AP3 > 78.1, ( - AP3 * 1000 - 78100) * 0.04 + 918,

IF( - AP3 > 60.5, ( - AP3 * 1000 - 60500) * 0.03 + 390,

IF( - AP3 > 52.7, ( - AP3 * 1100 - 52700) * 0.02 + 234,

IF( - AP3 > 29.3, ( - AP3 * 1000 - 29300) * 0.01, 0)))))))))))

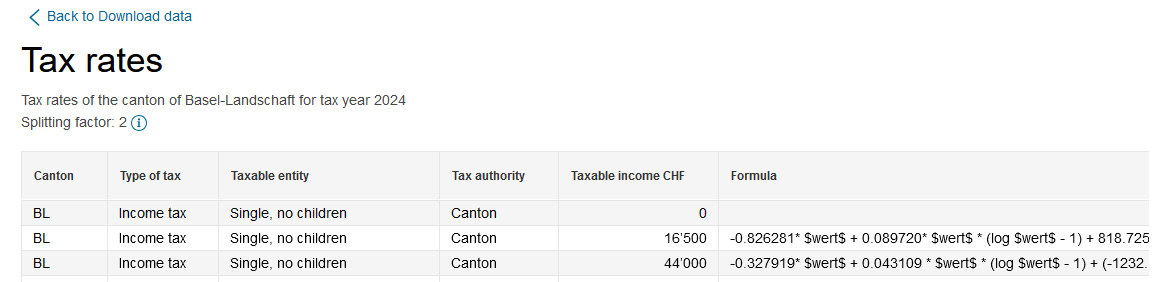

Basel-land 2024

=IF(BP4 > 1265000, 232436.77 + 0.1862 * (BP4 - 1265000),

IF(BP4 > 110000, 0.051298 * BP4 + 0.010441 * BP4 * (LN(BP4) - 1) + (-4825.535525),

IF(BP4 > 44000, -0.327919 * BP4 + 0.043109 * BP4 * (LN(BP4) - 1) + (-1232.14815),

IF(BP4 > 16500, -0.826281 * BP4 + 0.08972 * BP4 * (LN(BP4) - 1) + 818.725099,

IF(BP4 > 8250, 0.49 * BP4 / 100,

0)))))

All are for married w/kids rates.