@Bojack MSCI and VWRL don’t follow the same indexes. To make a good comparison, you should take MSCI World ETFs . Anyway, the differences dividend differences are too high in your table.

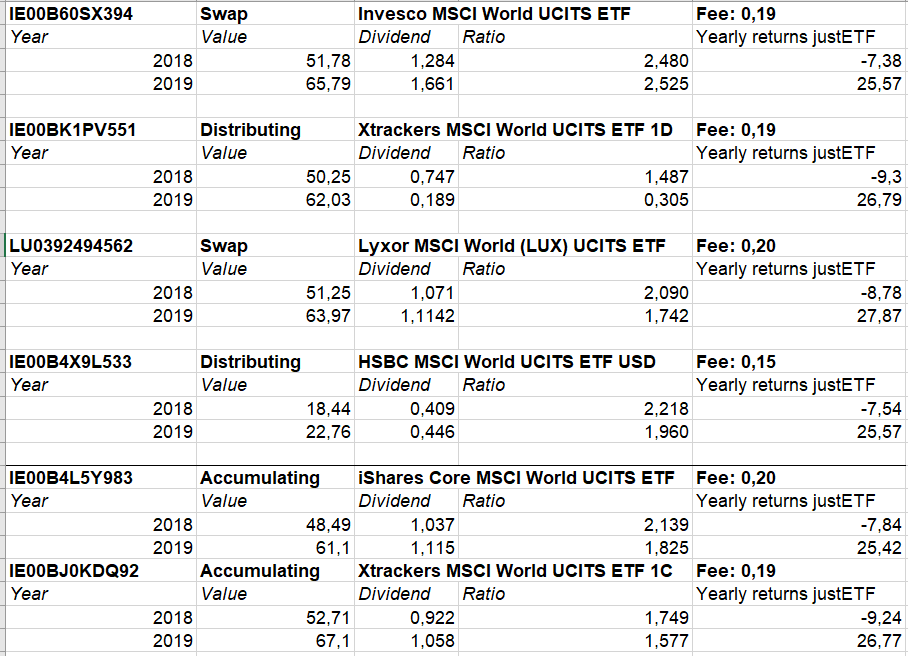

I have tried to compare multiple ETFs with the ICTAX data (all currency is CHF). There are no major trends and now I have even more questions ![]() .

.

Few observations:

- IE00BK1PV551 distributes only once a year. This would potentially have an impact on the ratio

- I have some doubt about the return data from justETF

- Why so much differences ?