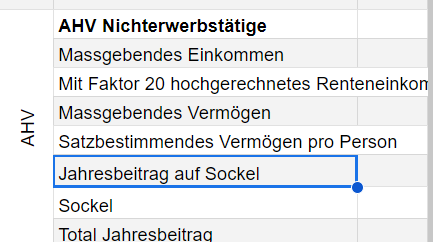

Not really helpful I guess and has some terrible Spaghetti code too, but this is the function I ended up with for my convoluted “Jupyter notebook of life, the universe and everything”. Speaking of rabbit holes… But maybe somebody gets a kick out of it.

Note that the DA-1 code is not validated, while it gets close to the actual figure it is still somehow a bit off in a way I cannot explain. The rest gets quite close to the actual tax bill figures.

# calculate tax, based a) on previous year's income & assets (provisional) or b) on final income & assets.

def Tax(Year, TaxType='provisional'):

import pandas as pd

import datetime

if TaxType == 'provisional':

Offset = 1

elif TaxType == 'final':

Offset = 0

ChildAge = (datetime.date(Year, 1, 1) - DoBChild).days / 365.2425

# import relevant variables from DataFrame

TotalTaxableIncomeSpouse1 = df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Type'] == 'Income Taxed') &

(df_portfolio['Person'] == 'Spouse1'),

'Value'].sum() + df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Type'] == 'Income Deductions') &

(df_portfolio['Person'] == 'Spouse1'),

'Value'].sum() + df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Name'] == 'Child Benefit'),

'Value'].sum()

NetDividendIncomeSpouse1 = df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Name'] == 'Dividends') &

(df_portfolio['Person'] == 'Spouse1'),

'Value'].sum()

PensionIncomeSpouse1 = df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Name'] == '1st Pillar Pension') &

(df_portfolio['Person'] == 'Spouse1'),

'Value'].sum()

VoluntaryDeductionsSpouse1 = df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Name'] == '2nd Pillar Voluntary Deduction') &

(df_portfolio['Person'] == 'Spouse1'),

'Value'].sum() + df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Name'] == '3rd Pillar Deduction') &

(df_portfolio['Person'] == 'Spouse1'),

'Value'].sum()

TotalTaxableIncomeSpouse2 = df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Type'] == 'Income Taxed') &

(df_portfolio['Person'] == 'Spouse2'),

'Value'].sum() + df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Type'] == 'Income Deductions') &

(df_portfolio['Person'] == 'Spouse2'),

'Value'].sum()

NetDividendIncomeSpouse2 = df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Name'] == 'Dividends') &

(df_portfolio['Person'] == 'Spouse2'),

'Value'].sum()

PensionIncomeSpouse2 = df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Name'] == '1st Pillar Pension') &

(df_portfolio['Person'] == 'Spouse2'),

'Value'].sum()

VoluntaryDeductionsSpouse2 = df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Name'] == '2nd Pillar Voluntary Deduction') &

(df_portfolio['Person'] == 'Spouse2'),

'Value'].sum() + df_portfolio.loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Name'] == '3rd Pillar Deduction') &

(df_portfolio['Person'] == 'Spouse2'),

'Value'].sum()

TotalTaxableAssets = df_portfolio['Value'].loc[(df_portfolio['Year'] == Year - Offset) &

(df_portfolio['Type'] == 'Capital Taxable Assets')].sum()

# remove dividends, voluntary 2nd & 3rd pillar deductions for tax assessment (item 100 / 101 in tax return)

NetEmploymentIncomeSpouse1 = TotalTaxableIncomeSpouse1 - (NetDividendIncomeSpouse1 +

VoluntaryDeductionsSpouse1 +

PensionIncomeSpouse1)

NetEmploymentIncomeSpouse2 = TotalTaxableIncomeSpouse2 - (NetDividendIncomeSpouse2 +

VoluntaryDeductionsSpouse2 +

PensionIncomeSpouse2)

# total dividends with US withholding tax removed for CH tax assessment

TotalDividendIncome = ((NetDividendIncomeSpouse1 + NetDividendIncomeSpouse2) / 0.85)

# calculate and remove flat rate portfolio administration allowance, resulting in item 150 in tax return

if TotalTaxableAssets < 3000000:

PortfolioAdminFlatRateDeduction = TotalTaxableAssets * 0.003

else:

PortfolioAdminFlatRateDeduction = (TotalTaxableAssets - 3000000) * 0.001 + 9000

TaxableIncomeFromPortfolio = TotalDividendIncome - PortfolioAdminFlatRateDeduction

TotalNetTaxableIncome = (NetEmploymentIncomeSpouse1 +

NetEmploymentIncomeSpouse2 +

PensionIncomeSpouse1 +

PensionIncomeSpouse2 +

TaxableIncomeFromPortfolio) # item 199 in tax return

# professional deductable expenditures (item 238 / 239 in tax return)

if NetEmploymentIncomeSpouse1 > 0:

Spouse1ProfessionalDeductions = 1490 + 3200 + min(max(2000, NetEmploymentIncomeSpouse1 * 0.03), 4000)

else:

Spouse1ProfessionalDeductions = 0

if NetEmploymentIncomeSpouse2 > 0:

Spouse2ProfessionalDeductions = 1490 + 3200 + min(max(2000, NetEmploymentIncomeSpouse2 * 0.03), 4000)

else:

Spouse2ProfessionalDeductions = 0

# dual income deductions (assumes that spouse1 is having a higher income than spouse2, needs additional logic if not always the case)

if NetEmploymentIncomeSpouse2 > 0:

CantonalDualIncomeDeduction = 4700

FederalDualIncomeDeduction = max(8100, min(13400, NetEmploymentIncomeSpouse2 * 0.5))

else:

CantonalDualIncomeDeduction = 0

FederalDualIncomeDeduction = 0

# intermediate sums of deductions to check against individual deduction cap

IncomeRelatedDeductionsSpouse1 = Spouse1ProfessionalDeductions

if (NetEmploymentIncomeSpouse1 + VoluntaryDeductionsSpouse1) < IncomeRelatedDeductionsSpouse1:

IncomeRelatedDeductionsSpouse1 = max(0, (NetEmploymentIncomeSpouse1 + VoluntaryDeductionsSpouse1))

CantonalIncomeRelatedDeductionsSpouse2 = Spouse2ProfessionalDeductions + CantonalDualIncomeDeduction

if (NetEmploymentIncomeSpouse2 + VoluntaryDeductionsSpouse2) < CantonalIncomeRelatedDeductionsSpouse2:

CantonalIncomeRelatedDeductionsSpouse2 = max(0, (NetEmploymentIncomeSpouse2 + VoluntaryDeductionsSpouse2))

FederalIncomeRelatedDeductionsSpouse2 = Spouse2ProfessionalDeductions + FederalDualIncomeDeduction

if (NetEmploymentIncomeSpouse2 + VoluntaryDeductionsSpouse2) < FederalIncomeRelatedDeductionsSpouse2:

FederalIncomeRelatedDeductionsSpouse2 = max(0, (NetEmploymentIncomeSpouse2 + VoluntaryDeductionsSpouse2))

# deduction for insurance premiums (item 270 in tax return)

CantonalInsurancePremiumDeduction = 4900

FederalInsurancePremiumDeduction = 3500

if ChildAge < 21:

CantonalInsurancePremiumDeduction = CantonalInsurancePremiumDeduction + 700

FederalInsurancePremiumDeduction = FederalInsurancePremiumDeduction + 700

# child deductions

if ChildAge < 14:

CantonalChildDeductions = 8200

FederalChildDeductions = 6500

elif ChildAge < 21:

CantonalChildDeductions = 7200

FederalChildDeductions = 6500

else:

CantonalChildDeductions = 0

FederalChildDeductions = 0

# federal only deduction for married people

FederalDeductionMarriedStatus = 2600

# cantonal taxable income calculation

CantonalNetIncome = (TotalNetTaxableIncome +

VoluntaryDeductionsSpouse1 +

VoluntaryDeductionsSpouse2) - (IncomeRelatedDeductionsSpouse1 +

CantonalIncomeRelatedDeductionsSpouse2 +

CantonalInsurancePremiumDeduction)

CantonalNetIncome = max(0, CantonalNetIncome)

CantonalTaxableIncome = CantonalNetIncome - CantonalChildDeductions

CantonalTaxableIncome = max(0, CantonalTaxableIncome)

# federal taxable income calculation

FederalNetIncome = (TotalNetTaxableIncome +

VoluntaryDeductionsSpouse1 +

VoluntaryDeductionsSpouse2) - (IncomeRelatedDeductionsSpouse1 +

FederalIncomeRelatedDeductionsSpouse2 +

FederalInsurancePremiumDeduction)

FederalNetIncome = max(0, FederalNetIncome)

FederalTaxableIncome = FederalNetIncome - (FederalChildDeductions + FederalDeductionMarriedStatus)

FederalTaxableIncome = max(0, FederalTaxableIncome)

# asset deductions

if ChildAge < 21:

AssetDeductions = 137000

else:

AssetDeductions = 125000

NetTaxableAssets = TotalTaxableAssets - AssetDeductions

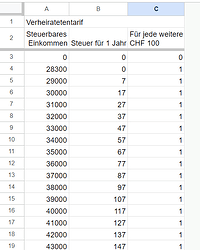

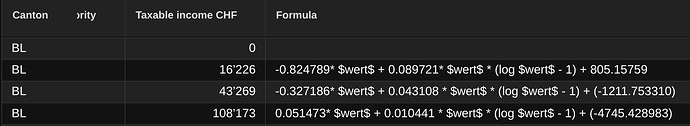

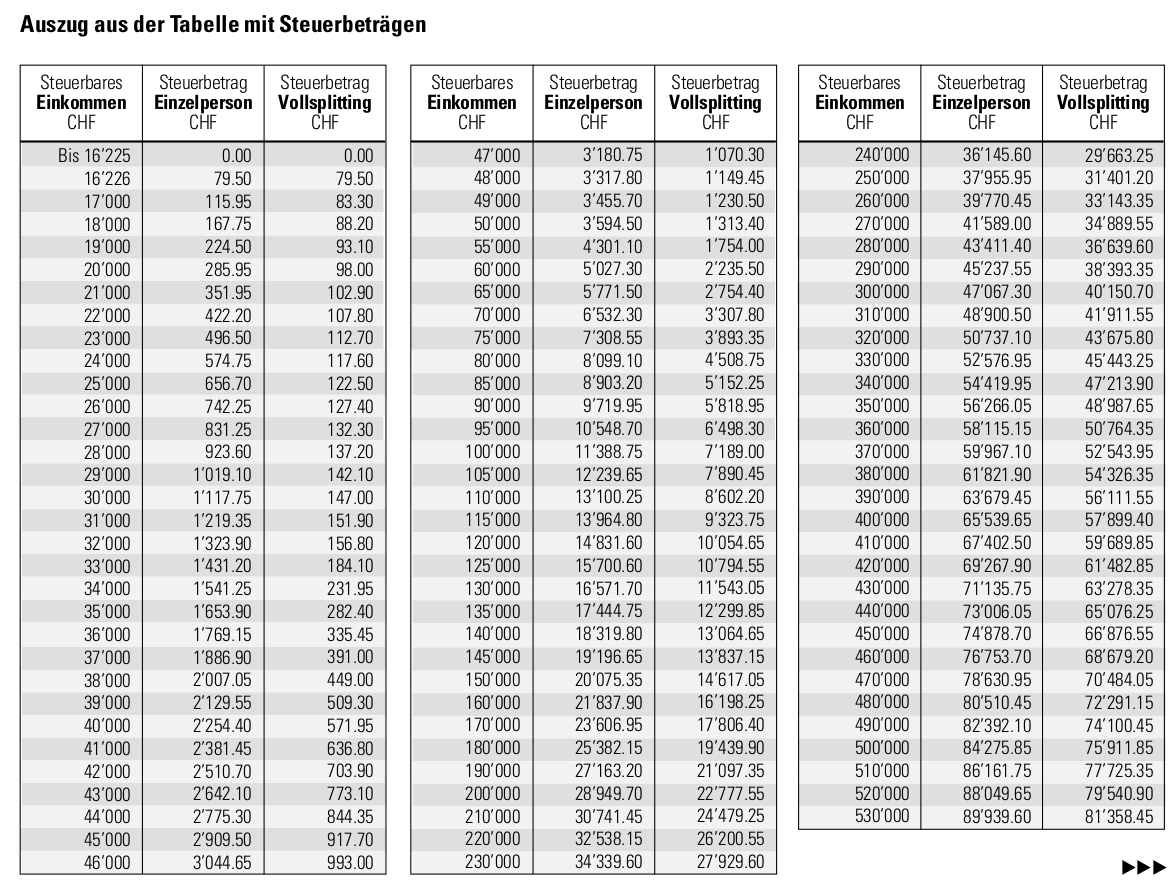

# cantonal tax (married/with children, from https://swisstaxcalculator.estv.admin.ch/#/taxdata/tax-scales)

if CantonalTaxableIncome < 18800:

CantonalIncomeTax = 0

elif CantonalTaxableIncome < 22700:

CantonalIncomeTax = (CantonalTaxableIncome - 18800) * 0.005

elif CantonalTaxableIncome < 23700:

CantonalIncomeTax = (CantonalTaxableIncome - 22700) * 0.015 + 20

elif CantonalTaxableIncome < 24800:

CantonalIncomeTax = (CantonalTaxableIncome - 23700) * 0.025 + 35

elif CantonalTaxableIncome < 26800:

CantonalIncomeTax = (CantonalTaxableIncome - 24800) * 0.03 + 62

elif CantonalTaxableIncome < 30800:

CantonalIncomeTax = (CantonalTaxableIncome - 26800) * 0.035 + 122

elif CantonalTaxableIncome < 93800:

CantonalIncomeTax = (CantonalTaxableIncome - 30800) * 0.045 + 262

elif CantonalTaxableIncome < 130600:

CantonalIncomeTax = (CantonalTaxableIncome - 93800) * 0.05 + 3097

elif CantonalTaxableIncome < 150600:

CantonalIncomeTax = (CantonalTaxableIncome - 130600) * 0.055 + 4937

else:

CantonalIncomeTax = (CantonalTaxableIncome - 150600) * 0.058 + 6037

# cantonal wealth tax

CantonalWealthTax = NetTaxableAssets * 0.000875

CantonalWealthTax = max(0, CantonalWealthTax)

# apply combined cantonal + communal tax multipliers

CantonalIncomeTax = round(CantonalIncomeTax * 3.45)

CantonalWealthTax = round(CantonalWealthTax * 3.45)

# add fire service duty to cantonal tax

Spouse1Age = (datetime.date(Year, 1, 1) - DoBSpouse1).days / 365.2425

Spouse2Age = (datetime.date(Year, 1, 1) - DoBSpouse2).days / 365.2425

if (Spouse1Age < 51) and (Spouse2Age < 51):

FireServiceDuty = round(CantonalTaxableIncome * 0.0045)

FireServiceDuty = max(60, FireServiceDuty)

FireServiceDuty = min(800, FireServiceDuty)

elif (Spouse1Age < 51) or (Spouse2Age < 51):

FireServiceDuty = round(CantonalTaxableIncome * 0.0015)

FireServiceDuty = max(10, FireServiceDuty)

FireServiceDuty = min(133, FireServiceDuty)

else:

FireServiceDuty = 0

# 'personal' flat rate tax to cantonal tax

PersonalFlatRateTax = 50

# add up cantonal (& communal) level tax

CantonalTax = CantonalIncomeTax + CantonalWealthTax + FireServiceDuty + PersonalFlatRateTax

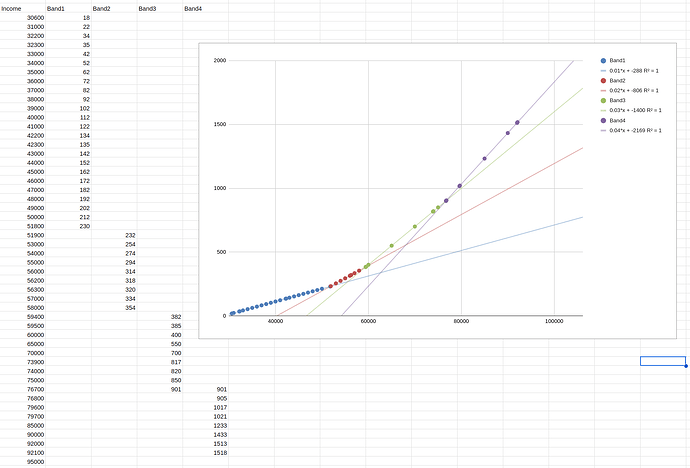

# federal tax (married/with children, from https://swisstaxcalculator.estv.admin.ch/#/taxdata/tax-scales)

if FederalTaxableIncome < 28300:

FederalTax = 0

elif FederalTaxableIncome < 50900:

FederalTax = (FederalTaxableIncome - 28300) * 0.01

elif FederalTaxableIncome < 58400:

FederalTax = (FederalTaxableIncome - 50900) * 0.02 + 226

elif FederalTaxableIncome < 75300:

FederalTax = (FederalTaxableIncome - 58400) * 0.03 + 376

elif FederalTaxableIncome < 90300:

FederalTax = (FederalTaxableIncome - 75300) * 0.04 + 883

elif FederalTaxableIncome < 103400:

FederalTax = (FederalTaxableIncome - 90300) * 0.05 + 1483

elif FederalTaxableIncome < 114700:

FederalTax = (FederalTaxableIncome - 103400) * 0.06 + 2138

elif FederalTaxableIncome < 124200:

FederalTax = (FederalTaxableIncome - 114700) * 0.07 + 2816

elif FederalTaxableIncome < 131700:

FederalTax = (FederalTaxableIncome - 124200) * 0.08 + 3481

elif FederalTaxableIncome < 137300:

FederalTax = (FederalTaxableIncome - 131700) * 0.09 + 4081

elif FederalTaxableIncome < 141200:

FederalTax = (FederalTaxableIncome - 137300) * 0.1 + 4585

elif FederalTaxableIncome < 143100:

FederalTax = (FederalTaxableIncome - 141200) * 0.11 + 4975

elif FederalTaxableIncome < 145000:

FederalTax = (FederalTaxableIncome - 143100) * 0.12 + 5184

else:

FederalTax = (FederalTaxableIncome - 145000) * 0.13 + 5412

# child deduction from federal tax, if applicable

if ChildAge < 21:

FederalChildDeduction = 251

else:

FederalChildDeduction = 0

FederalTax = FederalTax - FederalChildDeduction

FederalTax = max(0, FederalTax)

# DA-1 double taxation claim:

DA1Claim = TotalDividendIncome * 0.15

# Max. DA-1 claim, capped on maximum of CH tax on this income (max tax rate to be confirmed / calculated, TBD)

# Also assumes that all dividends result in a DA-1 claim, e.g. no CH stocks

if CantonalNetIncome > 0:

EffectiveCantonalTaxRate = CantonalIncomeTax / CantonalNetIncome

else:

EffectiveCantonalTaxRate = 0

if FederalNetIncome > 0:

EffectiveFederalTaxRate = FederalTax / FederalNetIncome

else:

EffectiveFederalTaxRate = 0

DA1Max = (TotalDividendIncome - PortfolioAdminFlatRateDeduction) * (EffectiveCantonalTaxRate + EffectiveFederalTaxRate)

DA1Credit = round(min(DA1Claim, DA1Max, (CantonalIncomeTax + FederalTax)))

# invert tax since it is an outflow

CantonalTax = round(CantonalTax * -1)

FederalTax = round(FederalTax * -1)

data = {

'Year': [Year, Year, Year],

'Type': ['Tax', 'Tax','Tax'],

'Name': ['Cantonal Income and Capital Tax', 'Federal Tax', 'DA-1 Tax Credit'],

'Person' : ['All', 'All', 'All'],

'Value': [CantonalTax, FederalTax, DA1Credit]

}

df_Tax = pd.DataFrame(data)

return df_Tax