Yes, iirc when they changed things they always wrote it down.

Hello, i will fill for the first time the Vaud Tax Declaration via VaudTAx 2020 ( just got my C permit 2 months ago).

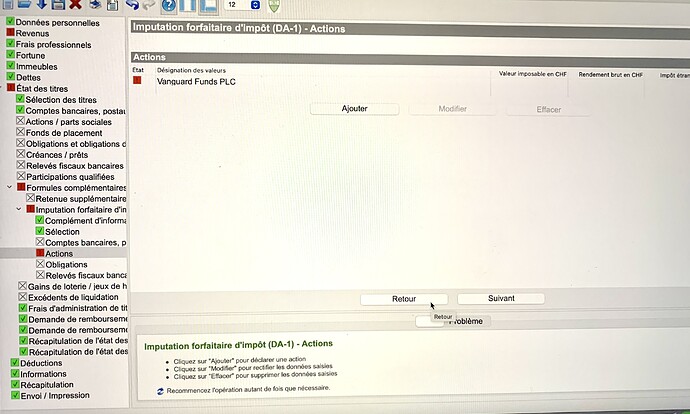

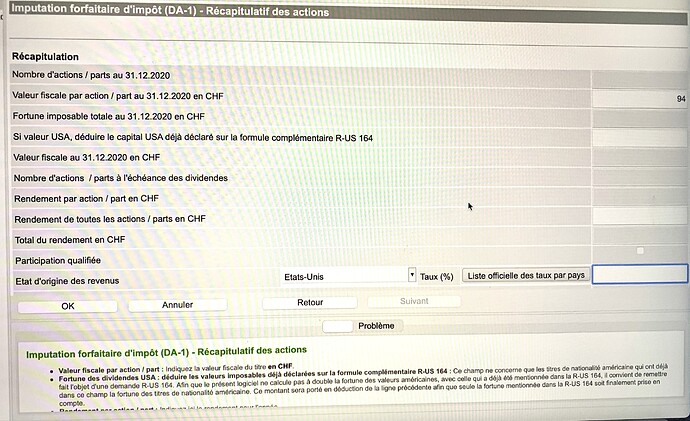

I own the the ETF VWRL on Degiro and the VT on Interactive Brokers, i need to fill all the purchases of the ETF(one per month) and each dividend received ( four times per year) in the form “DA-1”? Something else?

Thanks

I merge all purchases into one and calculate the correct amount for the dividends on the ictax website.

I assumed they don’t care about all the details since when you take the time to write everything, it does not show up on the file you send them.

What needs to be correct is the number of shares on 31.12 and total income from dividends.

Anyway if they want the details later you can always send it if needed, so far they never asked me for anything extra. I never sent them any documentation from the broker.

(also in VD)

Is much more simple like that, so all this is in the form “DA-1-récapitulatif des actions” right? the total income from dividends are on “rendement de toutes les actions/parts en CHF”? Thank you for the help

Yes but in your case you have to put VWRL in “fonds de placement” instead of DA-1. Only VT goes in the DA-1 form. Also, make sure the number of shares at the top of “récapitulatif des actions” is correct.

Hi everyone!

I have a quick question that hopefully you can help me with.

I have my tax declaration ready to go and wanted to submit it online (Canton Schaffhausen).

They are asking for the “Übermittlungscode” and telling me that it’s on the declaration they sent by post. Unless my vision is terrible I cannot find this code anywhere…

If you have had to enter this code before, could you tell me where in the documents I got it is and/or where can I get it?

Thank you in advance!

P.S. A1.1 German so I am using google translate for most of my translation.

I always submitted it in person in the office close to Kanton Hospital but anyway my tax advisor always ask me for a photo of the first page of the form to be completed by hand you should have received, it must be there. At the left bottom there is a barcode with a number below, have you tried it? Sorry for not being able to help

…though it just occurred to me: Are you using the general forms? You mentioned you moved to Switzerland in September 2020, so your employment income should be taxed at source according to the newly arrived foreigner scheme (unless above CHF 120’000 or you’re Swiss).

To BS-located folks: having looked at both ZH and BS papers, it seems that in ZH one could use a lump sum deduction of 0.3% of taxable invested assets without proving the actual costs, while in Basel-Stadt one needs to prove the costs in any case - is my understanding correct? (LINK)

This is in fact how I have approached the BS tax return in previous years, however wanted to make sure I am not missing on any possible deductions.

Hi!!

I have the same question…I have VWRL but I don’t know where fill the info? DA-1? “Fond de placement”? and for request for return of withholding tax?

VWRL is a UCITS fund, just declare it normally.

Man you are an absolute hero. Been stuck with this for hours. I owe you a beer.

FYI it should just work this year, since it’s properly marked as qualified in ictax.

I spent a while checking the documents and I understand that up to 3º/ºº you don’t need any proof:

" the investment practice allows a flat-rate deduction of a maximum of 3 ‰ of the market value of

relevant investments as administrative costs without requiring proof of their profitability characteristics"

OR from another document:

" Administration or with the investment of the assets are entitled to the deduction of the proven effective costs up to 3 per thousand of the market value of the capital investment concerned, without requiring proof of their quality as acquisition costs"

I tried doing this. Everything similar. As soon as I write the Valoren-Nr and click somewhere else, AUTOMATICALLY he will change the Rubrik to “B” and all the other fields.

I have solved it in a different manner. I write everything myself, below in “Art/Schuldner/Bank” I write "Vanguard Total World Stock ETF, ETF, Valor Nr: “4354003” BUT in the Valoren Nr. field I write the number with a space in between “435 4003”, then the system won’t recognize / overwrite anything. When I go to the end in the steuerkalkulator the correct value is there “Abzüglich Steuerrückbehalt USA und Anrechnung ausländische Quellensteuer”

What a nightmare to find this out.

I spent a while checking the documents and I understand that up to 3º/ºº you don’t need any proof

This is certainly the case also in canton Neuchatel, the instructions of the tax office are really clear on that point (although in our case the flat rate is 0.2%)

Question. Is this the 0,3% of the value of all my securities in IB?

But also the 0,3% of the money in my bank?

Do I also put here the 10 CHF per month from IB and the 5 CHF per month from postfinance? (Account management)

Thanks for the help!

But also the 0,3% of the money in my bank?

No, you cannot apply this deduction to bank and saving accounts, only securities.

Do I also put here the 10 CHF per month from IB and the 5 CHF per month from postfinance? (Account management)

You cannot deduct the flat rate AND the actual costs. It’s one or the other.

Speaking for Neuchatel but it should be similar in other cantons.

The interface this year changed a bit, but the same problem with Baltax happens (not possible to insert a DA-1 amount if you check the box for the automatic search).

Thanks dbu for this quick guide, I am trying a “leaner” approach and will put the amount at the end of the year, the dividends received in total (then the software calculate automatically the amount in chf and the tax to get back). I am not going to list when / how much I hase sold or bought. I will send them a report from Interactive Broker where everything is listed.

I hope they will accept my method.

I have some questions: should we put something in “R-US Rückbehalt USA in CHF”?

how should I list my spare cash in the IB account? (end of december I had more than 100k USD)

can we deduct commissions or only fees? how can I deduct “Vermögensverwaltungskosten” (for example the TER of the ETFs)

Thanks to whomever will respond!

R-US Rückbehalt USA in CHF

Zusätzlicher Steuerrückbehalt USA only applies to distributions through Swiss brokers/banks.

how should I list my spare cash in the IB account?

As a cash position in the tax declaration. I don’t quite understand the question? You‘d list it just like any plain Swiss bank account?!

how can I deduct “Vermögensverwaltungskosten” (for example the TER of the ETFs)

The costs incurred within your investments are not (deductible) „Vermögensverwaltungskosten“.

Neither are your broker commissions to acquire them.