Good morning,

the statement from UBS on my savings account has the amount from the credit and then the 35% withholding tax. When I declare this bank account I put the full amount in the “Intérêts bruts soumis à l’impôt anticipé” category.

The withholding tax is automatically calculated or I have to declare it also somewhere else?

Should be automatic, but you can double check the final form.

Yes you are right, now that I filled it gets auto-completed.

And one more question, an account closed in 2023 I just remove it from the tax declaration. The closure was declared in the tax form of 2023.

One more question although not with savings

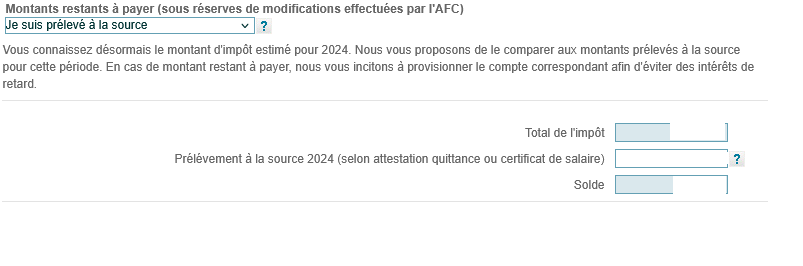

Do i need to fill it? if yes the value is number 12 in salary certificate?

You don’t need to, be as they say it’s useful to compare to avoid paying interest if you owe money.

Ok 2 questions to get that:

- What is the value I compare the taxed amount calculated?

- How do you pay the amount so you do not generate interest?

So far I was waiting for the tax declaration to be cleared to pay? What is the best way to do it?

Value should be the one from your salary certificate.

For 2 depends on Canton but usually there’s a form somewhere to request a payslip.

The value is the one Retenue de l’impôt à la source - Number 12?