It‘s plain and simple illegal - though they might (and hope to) get away with it.

Pay taxes in Zürich as a Wochenaufenthalter in Basel & deduct your Basel rent… mmh, sounds to me like you may be taxed in Basel soon instead ![]()

Basically it depends, what ties do you have to Zürich that prevents you from moving to Basel? Married with kids is a great reason. A Basel apartment for “Convenience” may not be enough reason, but maybe you have to be near your work for emergencies etc?

Plain and simple: no! Everything under 2h one-way doesn’t qualify for deduction (statement from my old tax advisor)

I hope you registered in Basel as Wochenaufenthalter. Otherwise, the Basel tax office might want to tax you for some days as well.

It doesn’t matter if you want to be close to work for emergencies or not. You won’t be able to deduct the room in Basel, unless you also want to pay some taxes there.

Plain and simple: it’s called “Kantönligeist” ![]()

Because every canton and every Gemeinde has a different tax rate, the cantons with higher tax rates also want to have their share. Otherwise, everyone would just rent a room in Zug or Schwyz and only pay the low taxes there.

I don’t say it’s fair, and I was also questioning this in the past. But I guess we have to live with it.

You are trying to deduct even more from your already low taxes in Zurich. Just think of all the people who are commuting every day between Zurich and Basel and don’t have a room. So basically you pay a little bit more because you have to pay rent, but the quality of your life is much better.

Nah, It’s just not that defined, it’s more like under an hour chances are low, 1-1.5h chances are fair & above 1.5h chances are good. Above 4h chances decline again (eg Engadin to Bern) since they don’t believe you will do that every weekend.

Heck, if we think about it from a sustainability and footprint point of view, people blocking two residences should be slammed with taxes. It’s a severe waste of resources! I understand there can be a reason for it, but in most cases it should and is taxed.

Which admin office? It’s no problem to apply & not difficult process at all if you fulfill & can prove a few of the criteria.

Did you register with Basel Stadt? And what status?

Can you also deduct supplementary health insurance premiums or just mandatory ones?

Afaik both, but at least for me, even with the cheapest, I already max out the deduction with mandatory.

That! For me it’s at least 7 months (going probably for 10) of home-office by now ![]() . Clearly has an offset with the commute deductions, I guess.

. Clearly has an offset with the commute deductions, I guess.

Actually not. Depending on your canton, they might allow your deductions for transportation as if there was no corona. Source.

I wonder if we can deduct the costs for buying masks?

In canton Vaud it could be the case if a doctor prescribed it:

"For expenses that can be deducted for cantonal and municipal tax purposes, the following are required

Pharmaceutical costs (as long as they result from medical prescriptions),

doctor, ophthalmologist and dentist fees as well as the cost of the usual measures and

necessary that the taxpayer has to bear as a result of illness or accident (prostheses, etc.).

dental, glasses, etc.)."

Well the cantonal doctor and health authorities prescribed wearing masks, so if you have the proof of payment, you could try I guess…

Yes, but only

lorsqu’il supporte lui-même ces frais et que ceux-ci excèdent 5% du montant figurant sous code 700

and this has been a pain for me with the dentist. I’ve spent a lot but since the total medical expenses were below 5% of my taxable income, I couldn’t list any deduction. Lucky me, I guess.

Sorry for reopen an old thread but didn’t want to start a new one – Have anyone tried to deduct the German lessons under “Berufsorientierte Aus- und Weiterbildungskosten”? What the Kantons think about it?

It should work, I once deducted a course my wife took and it was accepted. “too bad” my German courses are paid by my employer

From FF 2011 2429 https://www.fedlex.admin.ch/eli/fga/2011/381/fr

Les cours de langue qui n’ont pas au moins un lointain rapport

avec l’activité professionnelle sont considérés comme des loisirs. Ce serait sans

doute le cas d’un employé de l’administration fédérale qui désire apprendre le russe

parce qu’il veut passer ses prochaines vacances en Russie.

Sprachkurse ohne minimalen Zusammenhang mit der beruflichen Tätigkeit werden

der Liebhaberei zugerechnet. Dies wird wohl dann der Fall sein, wenn ein Verwaltungsangestellter russisch lernen möchte, weil er Russland als sein nächstes Ferienziel ausgesucht hat

Hoy!

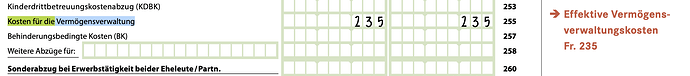

I am in Zug and I would like to put something under “Kosten für die Vermögensverwaltung”. What is resonable to put there? It is not like in ZH where you can put 0.3% of your total assets right? But then what? CHF90 yearly fee from Postfinance? Does it even qualify?

Vermischung von abziehbaren und nicht abziehbaren Vermögensverwaltungskosten — Kanton Zug seems relevant.

Edit: the question is what kind of Nachweisung they want.

You can try and deduct what you want, the only risk being that it is not accepted. Of course you should be able to provide some proof and argumentation. Don’t know though what the consequences are of deducting non existing exepenses (i.e. lying). Fine ? Blacklist ?

What you should not do, is hide wealth or income

Thanks, so it seems 3 ‰ is also a common number here for Zug. But is the same idea than for ZH? I did definitely incur some costs this year such as transferring securities from Postfinance to IB, paid quite a bit in sales fees, duty stamps… I think those do not count… But then what does? When I read this it seems like nothing counts…

has incurred costs for asset management by third parties

This seems to apply to a third party? Does that mean the broker Postfinance or IB? Or it has to be a financial advisor of sort?

Should I just try 3 ‰ and just hope it is ok? It seems the general advice that 3 ‰ is just accepted, at least it was for ZH… Worst case I am wrong and I don’t get the small benefit…