In my case I deduct all the custody fees from swissquote (maximum 200 CHF). I also keep a spreadsheet to estimate what is the cost of the Total Expense Ratio of my ETF on indices and I deduce the sum obtained as fees. My vision here is that the TER is like a custody fee in order to keep the basket of shares that makes the ETF. This deduction has nothing to do with financial counseling or tax advising. I was never asked to bring proof of my deduction so this vision has never been challenged nor approved by the tax office.

For Zurich I doubt they’d care if it’s below 6k and 0.3% (that’s the limit where no justificatif is needed)

Which canton? If this is for ZH, you’re doing it wrong. This is a pauschal (no proofs needed) deduction in ZH, based just on the value of declared securities, min(6k, 0.3%). You need proofs only if you want to deduct more, but that’s unlikely to be the case unless you’re a multimillionaire already

This is for Bern. I was once told by a bank employee that as long as you deduce less than 0.3% of your wealth they will not bother you but be ready to provide proofs if there is any question. My total deduction is very close from 6k.

Are you supposed to provide receipts for these? I am in GE and in the end of the declaration they ask me to attach proof (“justificatifs”) for other professional deductions.

is this per person?

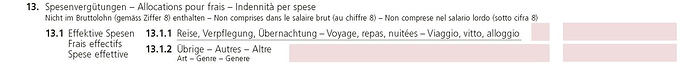

This will be listed/marked in your Lohnausweis / salary certificate, which you receive at the end/start of the year, and has an indicator whether you have discounted meals or not.

It’s a pauschal thing in both cases AFAIK, so just this certificate should suffice.

Now I’m confused. I guess you are referring to the field in the image below.

If there would be an amount there, it would mean that you were paid for your meals. Why would they let you deduct it when you are paid for it and don’t let you deduct when you have to pay from your pocket??

I loved tax at source…

This is getting too cantonal but it is the other way around at least in Vaud. Here if the employer doesn’t pay anything (the box is empty) then you can deduct the maximum amount which is 3200.- Otherwhise you can only deduct half of that amount.

Good luck, it’s only hard the first year.

Same in Basel.

And that’s what I had in mind too, when I said that “both options are pauschal”; but maybe was not clear enough.

So eg. for Basel:

- 1600 if you as (internal) employee have some sort of discounted meals at your company (I guess even “having a canteen” counts - really depends and take a look at what your salary certificate states - the checkbox is checked in my case, no numbers)

- 3200 if you don’t and for example need to go eat outside of your company’s premises.

That’s how I understood it at least.

But: in Basel-Stadt, if your employer has discounted meals and you cannot go home for lunch, the full deduction can only be made if the meal costs more than 10 chf.

Otherwise they accept only the “pauschal” deduction.

Ok gotcha. I tought they were requiring receipts of every single meal which I did not keep!

Here is the salary certificate that being empty justifies the fact that you can deduct.

I also deducted the CHF 700 for the bike + 500 for transport pass in the canton. How to you justify the 700 (did not buy bike this year)?

it’s a pauschal deduction, but if you declare both bike and train you better have an explanation why both are necessary (such as long distance to train station), otherwise chances are they’ll pick the lower of the two for you.

I think the since the federal court’s clear call on this matter no tax office will discuss this.

In which section did you do so in the ZH Tax Declaration? I have invested in a proper Home Office room (FYI I rent an apartment, I don’t own it) in 2019 and stay at home at least twice a week but I don’t know how to deduct it i.e. in which section of the form and how to calculate it. Thanks in advance for your help

I did not do it for ZH but TI.

I did it as part of the yearly tax correction as I pay the witholding tax.

I was instructed by the tax office to simply divide rent+expenses by 3.5 (rooms).

Something to keep in mind for next year: presumably a lot of us will be able to deduct “home office” expenses for a good portion of 2020?

Did you have to show some kind of proof that you worked from home? Like a declaration signed by your employer or something else? I live in TI too…

No declaration, but I think there must be a certain distance from home to the office

My tax advisor prepared my tax declaration for 2019, and I have a few questions to that one:

- if the flat rate for labor costs (Pauschalabzug für Berufkosten) is used (=4’000.-), bicycle can’t be deducted? I had a GA last year.

- reduced costs for lunch (CHF 1’600; employer is paying something) also can’t be decucted, according to them?

- ETFs don’t need to be separated for DA-1. It’s enough to send the IB report to the tax offices, according to the tax advisor.

They are using Dr. Tax (don’t ask questions about this one, I think I should switch the tax advisor…), and the program is not allowing bicycle+lunch to be deducted when using the flat rate for labor costs of CHF 4’000.-

I would understand that the bicycle can’t be deducted if you are using GA, but what does it have to do with costs for meals? Also, did anyone just declare their total portfolio value for DA-1 and got refunded?

We^re talking about Basel-Stadt here.

I don’t understand what you mean with “tests”? I’m talking about point “500 - Pauschalabzug für Berufskosten”. You can deduct a maximum CHF 4’000.- flat for the canton.

Update: berufskosten = work-related costs. Labor costs are indeed a different story ![]()