Hi!

Could you FIRE in Switzerland, and then expat to another cheaper country to live? Or would you still stay in Switzerland, even the high cost of living?

I think a good approach is to plan as if you were going to stay in Switzerland permanently. That way, the high cost of living here drives you to earn and save more. It also gives you the choice of whether you want to stay in Switzerland or move abroad, as opposed to only having the option of moving abroad.

I do follow this strategy, but it might mean delaying FIRE by several years, depending on which other country one would consider.

For me, 1M is not nearly enough, given 4% withdrawal rate, living on 40k p.a. is no fun in CH. I think you need 1.5M, better 2M for a decent lifestyle.

I don’t see how one would survive with less than 2 million in Switzerland. My goal is something around 2.5 million and to retire in Switzerland. If I end up living abroad and saved “too much”, I’ll be happy anyway.

A big chunk of my expenses are linked to me not having a lot of time and going for more expensive options when I’d derive more satisfaction from enjoying doing things differently: growing my own food, not having to deal with work clothes, having a smaller car (my SUV is needed for work), walking/hiking more…

40K/year is plenty enough for a frugal single in Switzerland. 80K/year is more than most earn. The median disposable income (granted, that’s more room for discretionary expenses than with gross income but not 60% more) was very slightly above 50K in 2020. I live outside of the cities, though. Living in Zürich or Geneva may make things more difficult.

Edit: just to be clear, I’m mainly reacting to the notion that it would be unfathomable to envision even survival on 2M assets. We can all aim for the standard of living we want to but the wants of some of us are way above what most people manage to make do with (and way above what I’d need to allow happiness - my lean FIRE treshold is at 750K).

@Patron I agree to your points and share your view on lifestyle, hence my comment that living on 40k/yr is no fun.

Of course it’s doable and can be enjoyable as mentioned by @CHRad but it really comes down to your personal situation, especially if family/kids come into the picture. With 1M you are certainly on the Lean FIRE side of things in CH.

Inflation and erosion of buying power should also be factored.

In Switzerland the inflation was reported to be quite low over the last 10-15 years (although the feeling of real inflation is different, when adding eg the health insurance cost that is not included in CPI index).

With just a 3% real inflation over 25 years, in principle you’ll need about 100k revenue to get the same buying power as with 50k today.

The target FIRE number needs to be reviewed regularly !

With regards to the 4% rule, inflation is already factored in, although it is based on US data. The rule states that one can withdraw 4% of the starting amount of the portfolio annually for 30 years and adjust that amount on inflation. Also note that this will only give you a success rate of 95%, meaning that you still might end up broke. 3.25-3.5% are essentially safe for an unlimited amount of time.

You are right however that we need to pick a sensible starting value of the portfolio and adjust it until we are FIRE.

As far as I can remember, @anon95353169 did some simulations using swiss data once. But I could be mistaken on that one. Love these kind of posts btw if you are reading that!

Back to topic: I think FIRE in Switzerland is doable, mainly due to the fact that salaries here are way higher than in many parts of the world. Personally, I aim for 60k withdrawal at 3.5%, meaning roughly 1.7M. This is around double of what I spend right now, meaning I could cut down my spending if the market doesn‘t behave as we all wish. Flexibility in spending is one of the biggest factors regarding the success rate, and I plan to take advantage of that.

Indeed, I did ![]()

A few points when using Swiss stocks and Swiss inflation:

- Historically, having only Swiss stocks (100%) has not been performing well

- The history of the dollar (gold standard, Bretton Woods) makes it very difficult to do backtesting since it was either flat or falling wildly

- Historically, we would have been better off with Swiss inflation than US inflation

- Best results were achieved with no more than 20% of Swiss stocks. Having more means a lower withdrawal rate

Awesome! I’ve been looking for it and for the data you’ve used, great work, thanks!

Another data point to add: I’m in my late 30ies now, living in Zurich and my 2021 expenses were ~38k.

My expenses peaked around my late 20ies / early 30ies, when I was enjoying things as I could afford them and then gradually went down. One part of the reduction came from the fact that with time I genuinely started enjoying stuff that doesn’t cost much (got tired of eating at restaurants and started to enjoy cooking, got into fitness and started to prefer cooking so that I can fully control the composition of my meals, hiking, hanging out at the lake). Another reduction came from getting into a relationship - sharing of expenses/rent and more fun experiences which don’t cost money.

my 2021 expenses were ~38k.

My expenses peaked around my late 20ies / early 30ies, when I was enjoying things as I could afford them and then gradually went down

Same here.

given 4% withdrawal rate, living on 40k p.a. is no fun in CH. I think you need 1.5M, better 2M for a decent lifestyle.

For reference, the median gross salary in Switzerland is about 6665 CHF/month (or, I assume about CHF 80’000 a year, before social security contributions). And that doesn’t even account for families with non-working persons and their expenses.

While many people would complain that they’ll feel a bit underpaid, and wish for an improved lifestyle, I don’t think that more than half of the population would, in earnest, say they can’t live a “decent” lifestyle.

I think a lot of people associate Switzerland with Zurich, or at least Northern Switzerland, where yes, the cost of living is higher. And whilst the cost of living is generally higher than the neighboring countries, there are many places in Switzerland where costs are cheaper. In Southern Switzerland for example, Ticino, the cost of living can be 20-30% less than Zurich for example, and you still border Italy where you can easily pop into for everyday items where the costs are substantially cheaper.

I am always amused when people mention the cost of living as a negative. I understand why. But it is also the reason why the country operates as it does, why the trains run, more or less on time, why things are generally clean and orderly and people enjoy a relatively comfortable life regardless of their income. I understand this can be to the hindrance of the FIRE system, but cheaper cost of living does not always mean better.

FIRE in Switzerland means about ± 1-1.5M as a minimum.

I guess it depends on many other factors, like age, life expectancy, children etc

Some of the heavily upvoted comments here portray FIRE-ing as some sort of irreversible act that you have to be 100% sure of in advance. But it usually isn’t?

Some ways this might be the wrong way to look at it for you:

- You might expect to still have some income that you’re not accounting for before triggering.

(Maybe you’ll sell your semi-popular paintings? Or get paid for shooting drone videos for weddings? Or write a niche software for fun? Or go dog-sitting because you love dogs?) - You can still reevaluate your strategy after RE.

- If your portfolio performs badly within the first 5 years, you might just want to get a job, or other source of income again.

Especially 3. might seem very aversive for some on the forum, and that’s fine.

But just ask yourself:

- Would I rather retire now and have a 10% chance that I have to work again in 5 years?

- Or, would I rather work another 3-5 years to bring this chance down to 1%?

(Making up the numbers but you get the basic idea.)

I think either choice can be reasonable for people with differing preferences. But I think one should be aware that if you “don’t make a choice” you’re actually choosing the default option.

You are still a human with skills and agency after FIRE, you can still adapt and make new plans.

I would advise caution in assuming you will be happy to live the same, austere budget lifestyle when you are in your late 40s or 50s

If you get it wrong you potentially throw away a well paying career that you can’t get back. For sure you lose the time value of money and compounding effect

Fully agree, but my point is that you can still reevaluate when your life circumstances change.

It’s true that “you lose some of the career capital when you stop working for a prolonged period of time” is one consideration you should take into account. But so should be “in 50% of the cases my portfolio will develop in a way that allows me to increase my living standards anyways”.

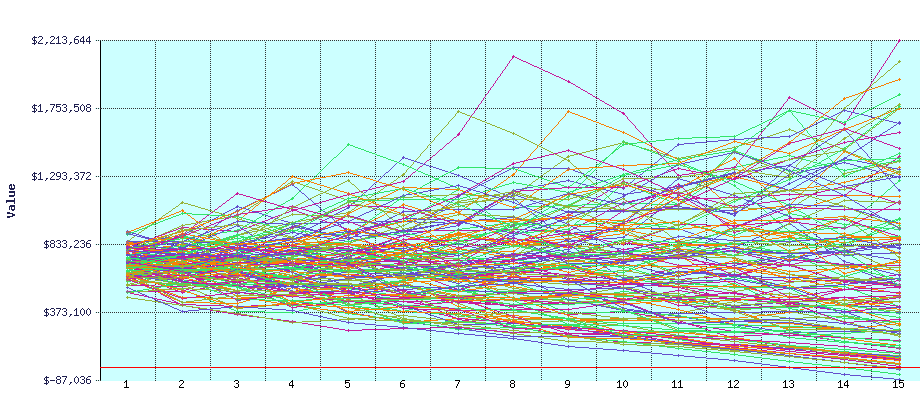

To illustrate, look at this portfolio development after FIRE from FIRECalc, for 700k starting volume and 40k withdrawal rate:

As you can see, in many scenarios your portfolio doesn’t considerably decrease after 10 years.

In the scenarios where market developments are unfortunate you can still act, and take on a (lower paying) job for a couple of years to get you over a bump in your FIRE strategy.

Especially 3. might seem very aversive for some on the forum, and that’s fine

I’m in that group, but thank you for the good comment. What is guiding me in my assessment is that I will probably be in my low fifties, and age discrimination especially after a few years out of the market is real. Have witnessed with a friends dad in the late 1990’ies, it was sad to watch.

So my approach is to try for a 99% certain lean FIRE, that then leaves a likely better than lean end result. I’m also interested in tapering out of work with a sabbatical / part time work for a while to mitigate the sequence of returns. Or possibly spending a few years in a lower cost country before finally retiring in Switzerland.

With 1.5M in Germany, a few miles across the border, you’d have a very comfortable Lifestyle. You are basically playing in hard mode

Though this might appear to be true, is it really? Are we truly comparing apples to apples here?

First of all, let’s make sure that we include all the taxes in our expense calculation.

Then, let’s compare equally attractive places to live when it comes to nature, infrastructure, architecture, cleanliness, safety. Sure, you can afford a place to live in a remote part of Germany or Poland, but are you going to enjoy living there?

I’ve been to Mallorca last week and I had a look at the real estate ads that are put on the display. It’s shocking, nice houses are put for sale for over 3 million euros. I posted this to my Polish friend and he was like “you think this is a lot? in the attractive spots in Poland you will also pay this much”.

My point is, just as you will pay over $300 per night in a top-rated 5-star hotel anywhere in the World, regardless if it’s Spain or Germany, or Poland, you will also pay a lot for the real estate.

Also, the current inflation trends makes all other goods and services in Poland quite expensive, and somehow the gap in living costs between CH and PL is slowly closing.

Finally, if you have $50’000 in savings, you may think “oh I just need $1 million to FIRE”. Well, I reached $1.5m and I don’t think I can FIRE yet. There is the unavoidable lifestyle inflation, but also if my partner is still working, what am I supposed to do? Sit at home and play games?

People who say you can FIRE in Switzerland with $2 million, I don’t know what they imagine. That you will rent a flat into infinity and travel the World? If you buy a house, you will spend this $2 million and be left with nothing to live. You will get no mortgage with no income.

So, regarding the original question: yes, I think I would like to retain my Swiss domicile and tax residence. In my dreams, I would like to purchase some real estate here, but I mean really a piece of land, not some crappy flat with neighbors to deal with, but a whole plot which is mine. Then, I could frequently travel for longer periods of time, but always have this place in Switzerland to come back to.

To reiterate: if I wanted to settle down somewhere else, it would have to be as nice and high standard as here in Switzerland. Think Mallorca, or Dalmatia or some other tourist hotspots. Real estate is as expensive there as it is here, sadly. Guess what, you’re not the first rich guy who had this idea…