The 3rd year, you will only pay ~74CHF, and from the 4th year, you will only pay ~28CHF per year. Numbers can vary but that’s an estimate. Btw, I am not sure you took the stamp duty into account; did you ?

At IB, if you have over 100k in your account and if you only invest 4x 10k per year based on my calculations you would only pay approximately USD 9 per year. Most of that cost is because of currency conversion from CHF to USD. Buying ETFs is under USD 1. To buy 10k VT ETF I pay around USD 0.21. Currency conversion on the other hand is around USD 1.80.

Maybe I am missing some IB costs here? I just started IB beginning of this year. but so far this is my cost experience and I must say I am very pleased with the low fees.

I dont have over 100k and personally speaking I wont keep over 100k in IB even if I have it (especially after latest news due to Brexit). I will split once i reach around 50k.

If you only make transactions in CHF and have low portfolio value then the difference is small. But if you need to buy something in USD, SQ will charge you up to 0.95% for conversion.

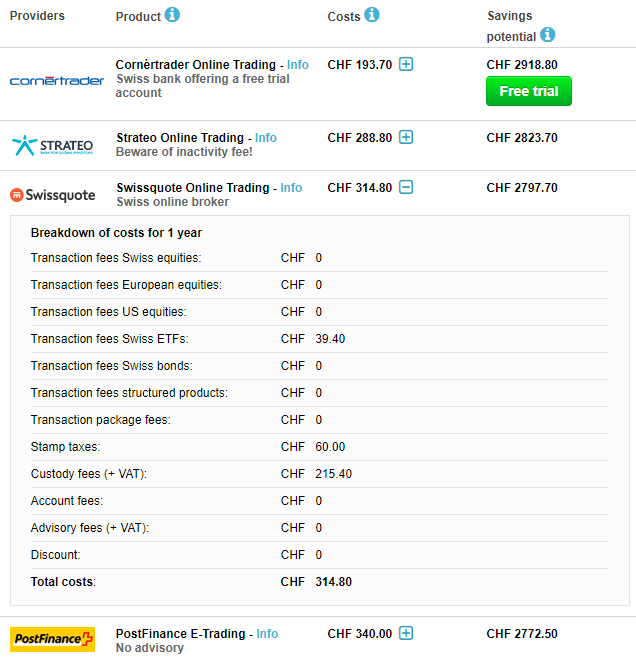

If you make larger trades, the cost difference gets really big. Here are the cheapest Swiss brokers when buying 4 x 20’000 CHF per year.

Now, consider 1% of 80’000 for conversion from CHF to USD. That’s 800 CHF on top of that!

At IB your annual cost would be something like $20-30, at SQ CHF 1’100.

Yes i just ran a demo calculation and what is showing is roughly around 20chf which has stamp duty and fee included. (On VWRL, no exchange needed).

Thank you but in IB it is 120CHF for me, as I said I am not going over 100k on IB. Plan is always sticking to CHF so no need to exchange 80k to USD (I dont see any reason)

For custody fees, SQ was saying 0.0025% so I am surprised to see 215CHF for 80k of assets. Do you have any other assets increasing it here? Also my use case is around 20-30k per year, so I will appreciate if you can give me the link and I can run this calculation. Many thanks!

Is this decrease happening in IB or in SQ?

I put 200’000 assets. Better plan ahead of your FI journey and not have to switch brokers after 5 years.

SQ custody fee is 0.025% per quarter, or 0.1% per year, but no more than 200 CHF. So already at 200’000 portfolio value you pay 200 CHF per year. Personally, I think, if you do not plan to get to 200k within 5 years, then the goal of early retirement might be hard to achieve ![]()

What are you gonna buy then? VWRL.CHF? In this case, you will lose money with each paid dividend. On $200’000, your annual dividend of 2% would be $4’000. 15%* of that ($600) is withheld by the US and if you hold VWRL.CHF instead of VT, you cannot reclaim it.

(*) it’s actually less than 15%, because 15% only applies to US assets within the ETF. Kept it for simplicity. I think the real number is closer to 10%.

120USD, not CHF (which today is 110CHF, but was probably 100 a few weeks ago ![]() ).

).

Here you can run comparisons for yourself.

Oh, I thought you were going to invest 10k/quarter ad vitam eternam, so that you would be over 100k after 2.5 years, that’s why the cost would decrease at IB.

Hey don’t destroy my dreams. Not saving 40k/year yet ![]()

I knew writing this will bite me in the ass

So, to elaborate. If you’re not yet saving 40k per year then your main focus should be this. It’s good to start investing early, to get the feeling of it and get used to volatility, but it’s fine if you postpone it until you’re saving more.

I’m saving 100k per year and it already feels like it will take forever. I’ve got no real family, no kids, no possessions like real estate. And even living like this, I will need 1, preferably 1.5M to be safe. So if someone is not even reaching 40k then that is my feeling.

if you are saving 100k CHF per year, then you are in a different league amigo.  my early retirement goals luckily aren`t in Switzerland - so still doable with close to 40k a year.

my early retirement goals luckily aren`t in Switzerland - so still doable with close to 40k a year.

whooo. Imagine how much you could save if you stop buying pre-made food every other day

![]()

(joking)

On topic: How much is Swissquote insured for similar situations? 100k for cash and?

Just learned recently, that you can call them for the CHF>USD transaction and will get a better forex price if your account is over 50k.

Correct, I would precise that every stock/bond you purchase are in your name and registered at your name (X has purchased 100 shares of TSLA ; 80 shares of VT) so if your bank or broker get bankruptcy, you will only lose the cash sit at the broker. For Swissquote, your cash is guarantee until CHF 100’000.- (I suppose that for professional trader it is not unusual to have 500k /1M in cash in order to trade everyday).

I don’t know where I read that SQ has to register your stock/bond in a official swiss registration.

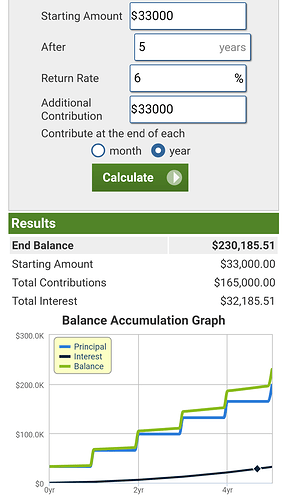

Oh ye of little faith in compound interest. To get to 200k in 5 years you only have to invest 5x33k and the interest will do the rest. ![]()

Sorry guys, you missed the point. The same rule apply to IB. The point is not what could happen in a normal bankrupcy, the point is what would happen in a fraudolent case. Until now, SIPC will pay 500k ( at some point). In the future EU will intervene and will pay only 20000EUR.

What happens instead in Switzerland for SQ?

This is not unique to switzerland, it’s the same in the rest of civilized world, called client asset segregation. The difference to countries like UK or US, is that there you get some extra insurance (FSCS / SIPC) if your broker lies to do. But in swiss you get nada. You have to pray that your swiss broker doesn’t lie

Completely incorrect.

At best you are recorded as a beneficial owner even on those few exchanges that do record such fine details. Swiss and US exchanges don’t, jus your broker’s name.

It’s actually pretty simple - as long as you can trade at a moment’s notice through your broker, your securities are in principle not safe from broker fraud.

You have to go through excruciating moves like DRS or paper certificates to get some sort of guarantee that your broker wuldn’t be able to sell your sh*t while you are not looking

They don’t. And often they can’t - e.g. in case of US shares, DTCC doesn’t record beneficiaries