If you compare the FX rates from 10 years ago to today in CHF:

USD: 1.0425 -> 0.9038 (-13.3%)

EUR: 1.3400 -> 1.0758 (-19.7%)

GBP: 1.6259 -> 1.2072 (-25.8%)

JPY: 0.012208 -> 0.008571 (-29.8%)

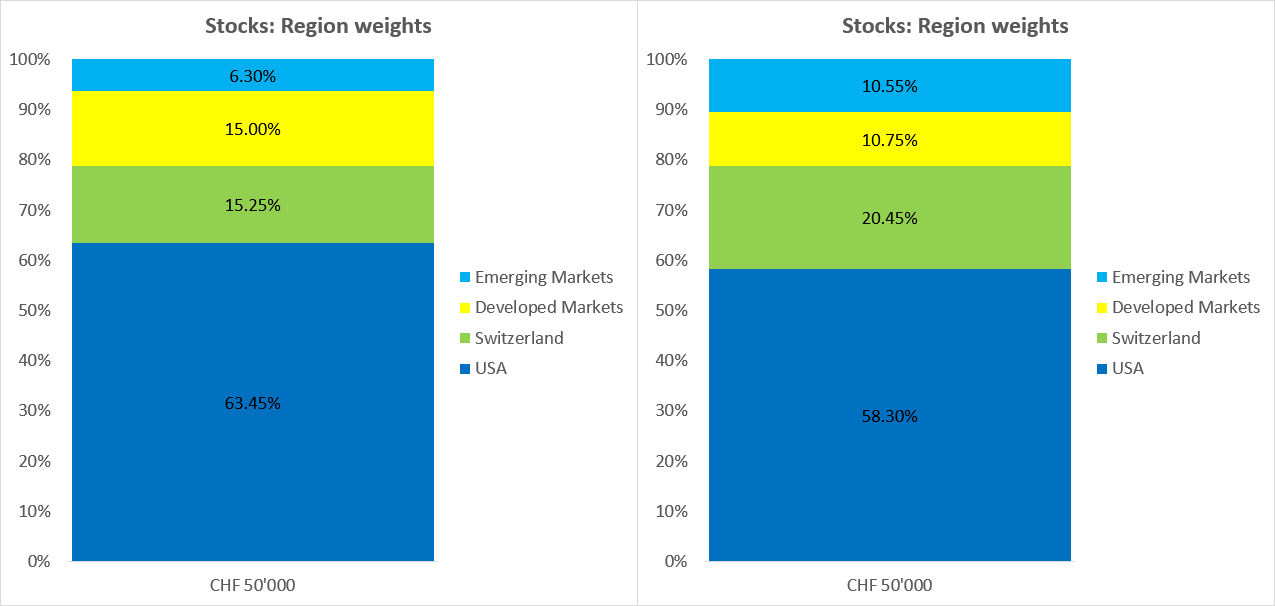

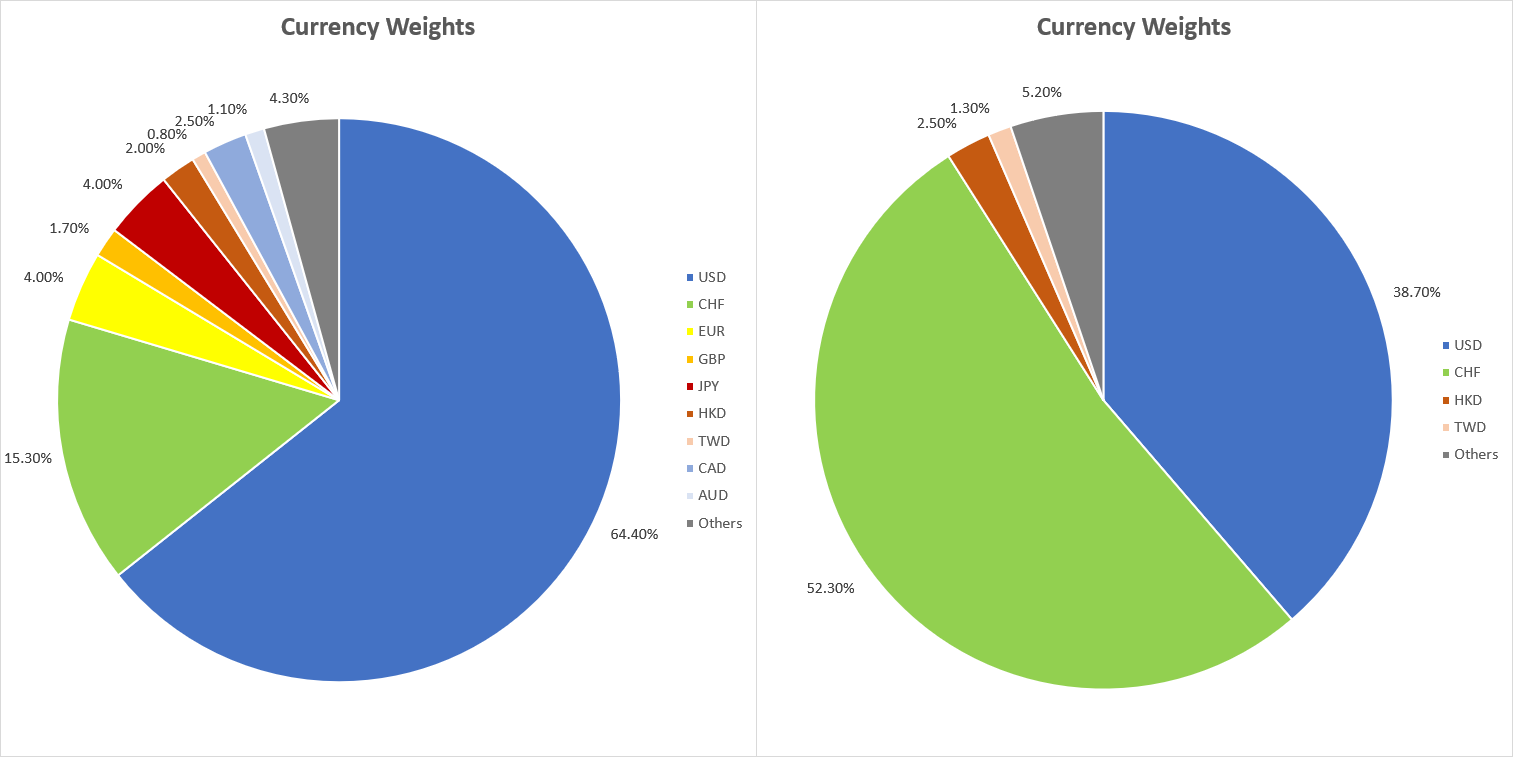

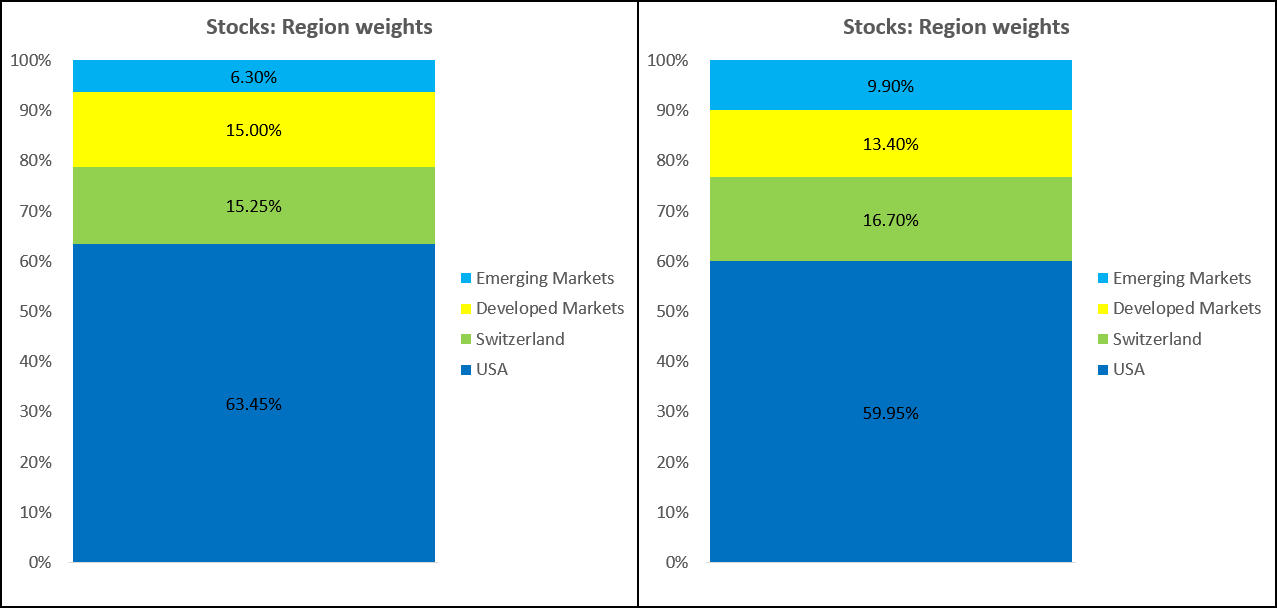

You can look further back in history and you’ll notice that all major currencies lost a lot of value compared to the CHF. At least US stocks overcompensated it with great returns, but Europe and Pacific? Terrible. So that’s why I’m thinking that Swiss investors aren’t compensated enough in general for the currency risks they are taking. I was always against currency-hedged funds, mainly due to the massive performance drag due to the high interest rate difference. But nowadays the central bank rates are pretty close which leads to way lower currency hedging costs. Hedging USD for example lead to a performance drag of 2.5-3%/year in the past, currently just around 1%/year. The recent devaluation of other currencies made me overthink my current investment strategy. That’s why I’m changing my asset allocation. There isn’t a lot of rebalancing required because I already have a 15% CH home bias, but I’ll exchange some funds in VIAC and ValuePension with the CHF-hedged version to get my desired allocation, which is:

60% US (20% CHF-hedged)

20% Switzerland

10% Europe, Pacific, Canada (10% CHF-hedged)

10% Emerging markets

It’s very close to VT (currently at 57% US, 32% developed and 11% emerging markets), main difference is that Switzerland is replacing most of the exUS developed world. Country risk is limited as 90% of the revenues from Swiss companies are made abroad (Nestle for example even 98%), so see no issue here. There are also a couple of papers from Vanguard suggesting that 20% is a reasonable home bias for British or Japanese investors, so it will probably also translate to Swiss investors. I’m getting a total currency exposure of 50% CHF, 40% USD and 10% EM currencies. Of course still exposed to foreign currencies, but only half of my assets. How am I going to implement it with my accounts at IBKR, VIAC and ValuePension:

IBKR (CHF 16’400)

100% VTI

VIAC (CHF 17’100)

3% cash

20% SMI

30% SPI Extra

27% MSCI World ex CH (CHF-hedged)

20% Emerging markets

ValuePension (CHF 18’400)

1% cash

9% SMI

10% Emerging Markets

15% MSCI USA

65% MSCI World ex CH (CHF-hedged)

It’s not just randomly distributed across those accounts, it’s also tax-optimized. IBKR only VTI because I can reclaim the whole dividends through DA-1 form. Viac and VP mostly exUS assets because of the higher dividends which aren’t taxed as they are tax-deferred accounts. Also reduces costs because FX costs in Viac aren’t as cheap as IBKR.

Would appreciate some feedback. What do you think?