So, I did some math.

Problem statement -: If an investor were to invest 20K (10K in MSCI WORLD & 10K in CH Bonds), where should the bonds be placed?

Assumptions -:

Total TER would not be impacted irrespective of where you place what because assumption is 0.1% costs for Taxable account & 0.40% costs for Pension account

Dividend yield for MSCI World is 1.85%

MSCI world when placed within pension account have 0.1% advantage due to WHT

Time period 20 years

Goal -: Maximize total value post tax at end of 20 years.

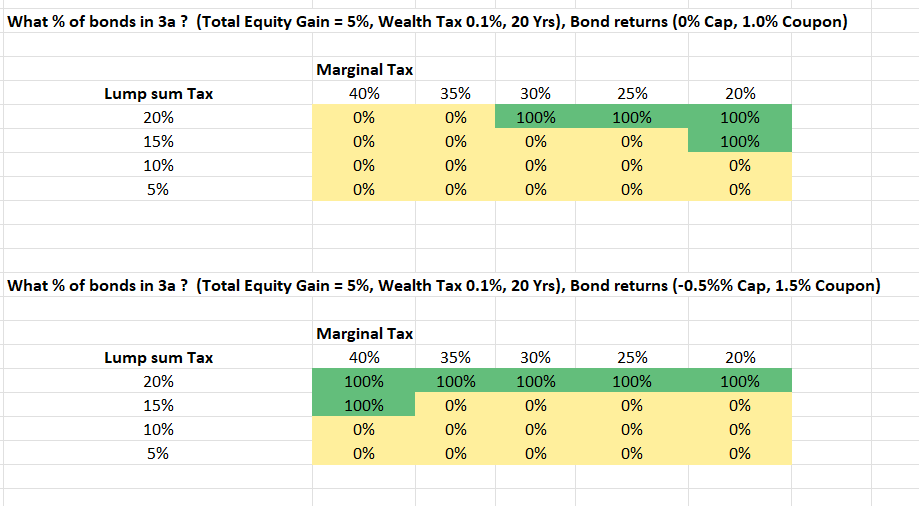

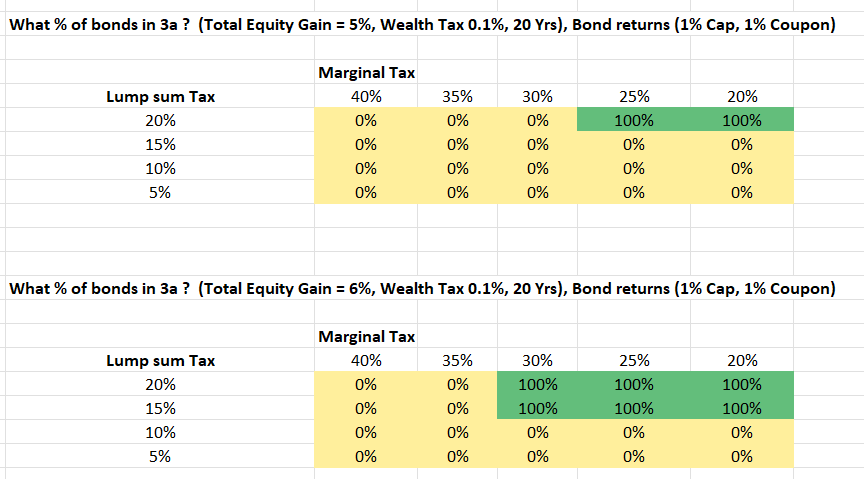

It turns out , the answer as usual is complex and depends on Wealth Tax, Marginal tax, expected returns from Equities & Bonds and the breakdown of Capital gains vs Dividends

Conclusions based on scenarios I ran

- If 3a regulations do not change and investors can withdraw staggered, I think keeping Bonds in Taxable account seems to be advantageous because lumpsum rate will remain low for individual tranches.

- For 1E accounts, since lumpsum taxes can be higher, the choice is a bit more complex and depends on marginal tax rate

- Personal surprise for me is that it seems dividend yield is a bigger driver than the capital gains tax

Note -: If anyone has a different view, I would love to hear.