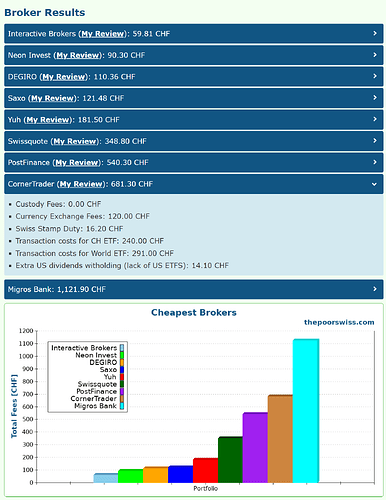

For those looking for a Swiss broker just to keep their securities. Cornertrader has changed its rates. There are no more inactivity fees or custody fees. The only cost left is 20 chf that they automatically charge everyone for the tax statement. It could be more interesting than postfinance

Did they change the Transaction costs or currency exchange fees? Because these were the main parts that made it so stupidly expensive so far…

(Link)Transaction costs depend on the deposit amount. I think it has decreased. Below 100,000 it is 0.15% for american stocks (min. 15 chf). Their exchange fees has not changed, still 0.5%.

It was more in the idea of buying on ibkr and then transferring to cornertrader and having no custody fees.

I think it is the only swiss broker where you can transfer positions and where there are no custody fees.

Interesting comparison from MoneyLand

I used them in 2019/2020 and was quite happy. Also the service was very responsive.

Changed to IKBR in thr meantime.

But if I decide to open a second custody for diversification, cornertrader would probably be one of the first i would check.

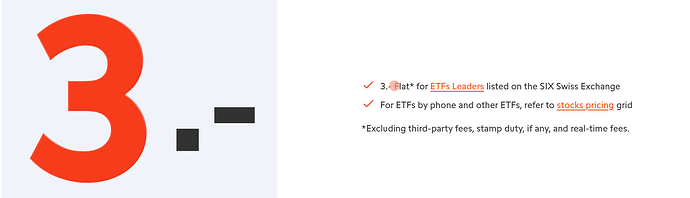

Swissquote just announced a reduced pricing, lowering typical ETF buys from 9.85 CHF + stamp duty to 3.85 CHF + stamp duty.

You mean their “ETF leaders”? Great news, things are moving in the right direction.

No, they are bastards with stupid marketing. Just checked the details:

It’s now 3.85 CHF for a trade up to 500 CHF, 5.85 CHF for a trade up to 1’000 CHF and unchanged 9.85 CHF above that. No real change at all.

And for those small amounts, where SQ is too expensive in general, they already offered selective free trades with Yuh anyway.

I invest at the Saxo Bank and I would like to invest in fractional shares. Hope they will integrate this also.

Swissquote also introduced fractional shares together with their updated pricing. Better for savings plans where a unit of a product is large.

According to an article on tippinpoint:

Wie Swissquote schreibt, werden Aktienbruchstücke in echte Aktien umgewandelt, sobald die kumulierten Bruchteile ein Ganzes ergeben. Damit werden den Besitzern wie vollen Eigentumsrechte an ihren Investitionen übertragen.

Actually they did reduce the fees for ETF leaders

The original fees was

9 CHF Flat + stamp duties + 0.85 + exchange fees

Now it seems the new price is

3 CHF Flat + stamp duties + 0.85 + exchange fees

For the rest of ETFs and stocks, I don’t remember what was the old number but I remember for 500 CHF trades it used to be 5 CHF +++ and now it’s 3 CHF +++.

Notice the “from”. Its CHF 3 up to a volume of 500.–, CHF 5 from 500-1000 and still the original CHF 9 from 1000.– upwards.

Actually I only buy ETF leaders because rest is a bit ridiculous pricing

So I am happy that some reduction happened for following

- SPDR ACWI

- SSAC

- CHSPI

Do you invest less than 1000.– at once? I usually only invest in 1 ETF at once, this month ETF A, next month ETF B etc. (usually the one that diverges the most from my desired portfolio weight.

They were from 1 inch to be interesting… Why did they not just go with a flat CHF 3… Maybe one day…

Normally I combine amounts at SQ , so try to keep it to higher values and few transactions per year

I think this has something to do with underlying stocks

For example, if an ETF leader is bought, SQ might be able to optimise the total buy sell and negotiate a better rate with ETF providers / market makers .For other stocks - liquidity would be lower and wouldn’t enable optimisation

I have to say with 3 CHF ++ SQ and IB will be very close in terms of trading fees at SIX for ETF leaders. IBKR is about 5 CHF for flat fees.

Stamp duty is not fault of SQ, so we shouldn’t judge them. I welcome the move in right direction

So the cheapest you get ok SQ now is for around 999.-: 0.5% or above 1800.- (<0.5%, with 9.-)

For 499.-: it is 0.6%

I would like to mention, something is a bit confusing. The ETF leader fee is mentioned below as “flat”. But in the detailed schedule, I see some tiers. I do not know if this is matter of updating the PDF but it would ridiculous if they call something FLAT and then there is a tier too

That what I was saying.

It’s flat**

**We didn’t say for how much so please check our pricing-PDF document to know how much you can purchase with this “”“flat”“” fee of CHF 3…