Well the graph’s legit but he’s cherrypicking his timeframe all too well as well. Gold essentially had two (or three) major periods of stratosperic growth: notably the 70s that you already mentioned and late 2000s, the banking crisis, while at other times it was mostly laying dormant or losing value.

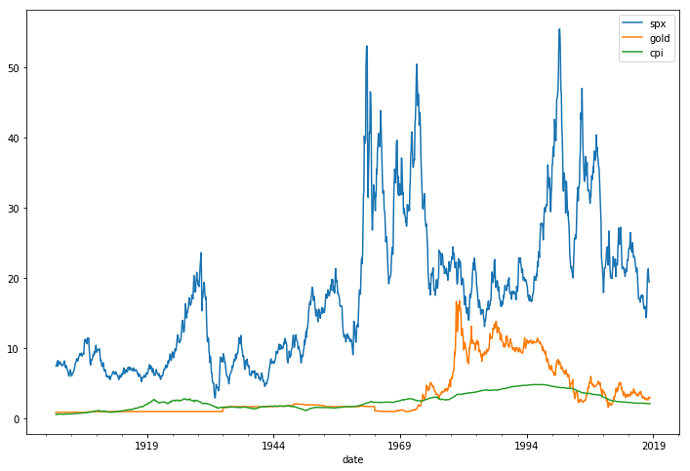

Here’s a graph that tells a different story - trailing 30 year total return of S&P500 vs gold:

You were better off holding S&P no matter where you started

Notebook here with a few more graphs and if you want to massage this data further