Maybe capital gains distributions and paying PILs are different tax classes? Could be useful to shift taxable gains to another class in some jurisdictions.

No lending of the ETF of the TOPIX. As a side note, I read on IB that their SYEP is not available for JP customers. Maybe there’s no demand, but it could also include regulatory restrictions.

Care to clarify the connection between PIL, JP, US and this obscure fund you and Compounding are referring to? Me or others might be much more motivated to look into the reports again when there’s time and the objective is fully clear ![]()

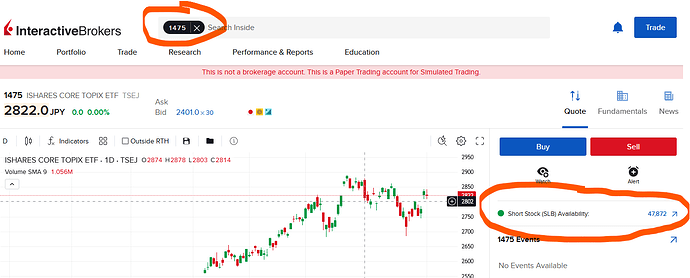

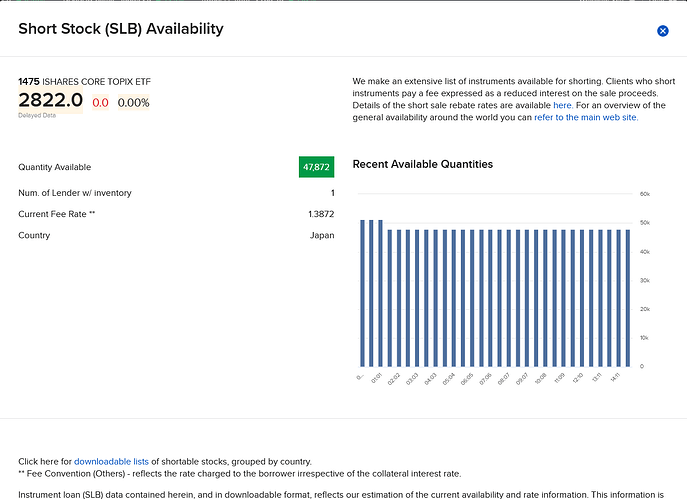

Maybe chance? On IBKR, I see 47872 shares of the JP domiciled 1475 ETF available for shorting for 1.39%.

I assume the connection between PIL, JP and US is clear? Then you ask what KMLM has to do with this?

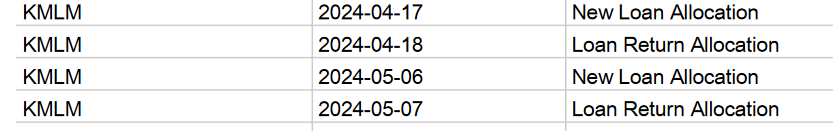

KMLM is a managed futures ETF. We have a thread about them. There were huge gains in 2022 and distributions around 10% of its value. They were mostly classified as capital gains (ICTax even claims all of it was). This is tax free (no WHT in the USA, no income tax in Switzerland). I assume receiving PILs instead does not have this benefit. Paying 1.5% (10% x 15%) of the value as WHT would hurt.

Ergo, this was just another example of possible pitfalls with SYEP and PILs (and has nothing to do with JP).

Having these three datapoints for a lent security, one can easily calculate how it’s handled (I hope).

Possible. Maybe those are all mine ![]()

Where do you see this, by the way? Could you share a screenshot?

Anyway, rounded up that’d be 0.0% of outstanding shares.

For the sake of science, I’ll have a look tomorrow ![]()

To see shortable stocks: On the web interface search for any security. “Short Stock (SLB) Availability” is on the right side. You can click on the arrow to open a modal with more information (including rates). I remember that on the TWS application you could also show historical rates.

Interesting, thanks.Never used it or looked for it. Found it on TWS, as well under Analysis tools, SLB conditions.

I still don’t get the point, since I don’t see a tax effect. If you do, the program would be a disaster ![]()

Pattern around ex-dividend dates looks like this.

It’s illustrative and a personal observation based on one account. Maybe others care to share their observations?

| US | IE | JP | |

|---|---|---|---|

| gross dividends | 10’000 | 500 | - |

| PIL received | 10’000 | 500 | - |

| US withholding tax stated | 1’500 | - | - |

| thereof reclaimed | 1’500 | - | - |

| Interest received | 1.39 | 0.52 | - |

| Interest received whole year | 1.39 | 187.50 | - |

As said, the European ETF is lend in smaller numbers throughout the whole year, the rate between 1% and 1.5% (total, you get half).

Hence the interest received is higher, whereas the PIL are tiny. Borrowers seem to not mind or even avoid ex-dividend dates.

The US ETF borrowing is concentrated in large numbers on ex-dividend dates, the rate between 0.1% and 0.2%.

So the PIL are high, but the interest received tiny. The PIL are taxed and reclaimed like dividends via DA-1.

No borrowing on a JP ETF.

edit: fixed an error on the interest received

Ah, so there was no US withholding tax on PILs of IE domiciled dividends. I would have expected them to.

Am I right to assume that the PILs of US domiciled dividends was 10’000, but they took 1’500 US WHT from that, and you then only had 8’500 more in your account?

Now the only case left is some data of securities that do have distributions with foreign WHT. (IE doesn’t do WHT on ETFs).

But that is exactly the point. We confirm that there is no effect (instead of all kinds of disastrous tax consequences). Thanks for providing this anectotal evidence.

PS: The numbers are scaled, right? To big round numbers for the first 4 rows and per one security for the last 2?

Why would there be?

Yes, net it’s 8’500. You’d get back the 1’500 once the tax office processed your DA-1.

Skimming through the whole thread, some people mentioned they couldn’t reclaim the withholding tax. I could. Obviously, with the above example, there’d be no point to get some 189 CHF extra, if you lose 1’500 CHF in delayed tax credit.

Yes, this is illustrative for a provocative exchange of ideas. ![]() But the lending fee is not per share, it’s on the whole amount. I meant to illustrate that there’s some extra returns, but they are tiny compared to the dividends or lending involved if they only happen on single days.

But the lending fee is not per share, it’s on the whole amount. I meant to illustrate that there’s some extra returns, but they are tiny compared to the dividends or lending involved if they only happen on single days.

I picked a low number on US, though. Lending fee last year was 0.2-0.3%, half of that being 0.1-0.15%, most of the time. In one quarter, above 2%. Other example of this looks like this:

| A)US ETF | 1’000’000 |

|---|---|

| B) Quarterly dividend (2%/4) | 5’000 |

| C) Lending fee p.a. (A*0.2%/2) | 1’000 |

| D) for one day (C/360) | 2.78 |

My thoughts were: Money from unclear sources with unclear taxation status flowing through a US broker’s program. Why couldn’t this be some kind of income paid by the broker? Then the US just taxes it so no one is able to transfer money without being taxed somewhere (and get the tax money).

We are serviced by IB UK.

I considered that, but then why is there any US WHT on PILs of US domiciled distributions?

If I agree to pay you any money on the price and distribution difference of some security, where is there any US? How would they even know?

The domicile is relevant, not the broker. You’ll also pay WHT in JP, CA or PL (just some examples), whether you are with IB US or UK.

In an US-only scenario, the borrower gets the dividend, but can deduct the PIL payment. The lender gets taxed on the PIL. For lenders outside, WHT is applied on the PIL. Yet only for US stocks.

For the securities themselves this makes sense. But not for PILs. The borrower often doesn’t even have the security anymore, because they are a shortseller. You (the lender) don’t have the securitiy either, you have a right to receive the security and PILs. An unknowing third person has the real security and receives the real distribution and has taxes withheld on them.

Putting WHT on PILs taxes a non-existing distribution.

None of us actually holds any US securities at that point.

I mean it seems to happen as you describe it, but you asked for my reasoning, and I say what happens doesn’t make that much sense.

Either securities lending is somehow taxable as income originating from the (US) broker, or it is not taxable. We don’t have any underlying securites, only some contract on them. But I could imagine that the USA has some laws explicitly targeting lending their local securities. Who doesn’t comply gets hit with some other nasty. So brokers comply, where a private foreign contract could just ignore their laws.

Switzerland has this too. In the ESTV “Kreisschreiben 13” in Chapter 3.1.1, if you (a Swiss resident) borrow CH securites to shortsell, you have to apply CH WHT to whatever you pay as PILs.

That means, if IBKR takes it in gross, you have to send an additional 53.85% (= 1/(100%-35%) - 100%) to ESTV.

Switzerland doesn’t care, though, if the borrower is not a Swiss resident. Or if the underlying securities do not have CH WHT.

Turns out I was very wrong on that one.

It seems to get lent out very regularly.

I honestly wonder why. Why would someone short a specific managed futures fund, that is long/short in multiple directions and not the futures themselves?

So now I also really wonder what will happen in case ofdistributions in lieu. Will there be withholding tax? If so, then it will probably not be reclaimable if it would otherwise be tax free capital gains distributions.

So for now: If you have managed futures fund, the SYEP is probably not a good idea to have turned on.

I will do the live experiement though and hold some of them til year end and report back on what happens…

Maybe they do trend following of trend following funds ![]() trend following inception

trend following inception

I just got an email from ibkr about my 10k or so chdvd. Apparently I’d get 270 usd I lend them. I wonder if they calculate it with or without the dividends.

Haha as you figured out, no update yet.

I‘m inclined to think though, that there won‘t be withholding tax on payments in lieu of capital gains distributions.

As any capital gains distributions short term or long term, do not have withholding taxes applied normally. This would somehow need be converted on the way, which does not seem likely.

There will be however on the income distributions from the collaterals, as well as the commodity futures gains from the Cayman subsidiaries. But that will turn up as dividends anyway and treated like other dividends.

So in summary

SYEP disabled

Investor pay tax on dividends

SYEP enabled

Investor pay tax on interest earned through lending + income through payment in lieu of dividends

I have two questions on tax return

- regarding dividend part , since WHT tax is not applied, does it mean such securities cannot be declared in Tax return using Ictax information? Ictax would classify them differently than what really was paid and how much WHT was held

- For the interest I believe this can be reported together with broker interest on cash. So not an issue. Right?

Withholding tax IS applied. It specifically lists it as withholding tax in IB, and also declares it as dividend.

Yes should be no problem. All interests are summarized in a single tab.

Also if you for example pay interest on your margin it should be no issue to report the net interest.

Aso it cancels each other right out. Normally you‘d deduct the interest and get back your marginal tax. Amd the interest you gain is taxed at marginal rate. → cancels out.