What is the behaviour? Are these customers receiving the gross amount as payment in lieu?

Or are they receiving the net amount (dividend less WHT) as payment in lieu and a “withholding tax withheld” line in the withholding tax report?

Do these people then order a German tax voucher for 30 EUR from IBKR, to reclaim WHT from Germany? And will this tax voucher name the the account holder - even though they didn’t even receive the original dividend payment?

It is not a question of cash or margin account, but if you are participating in stock lending program.

Any updates on what yield (in %) you get on your VT investment for participating in the program? Market volatility’s high currently, so I suppose more VT lent out?

Also, no troubles with tax authorities so far explaining this additional, non-dividend yield?

Forget about it. Borrowing rates for biggest and most liquid securities has a floor at 0.25%, and you get a half of it.

I also found this article which talks about the problem from the perspective of a foreign investor.

tl;dr: It becomes “other income” with full withholding taxes likely not reducible by treaty.

I believe that when you have a margin account you can’t opt-out of security lending. If your CH stocks are lent at the time dividends are paid, you get an en lieu payment from which 35% is withheld for taxes. You do not recover such 35%, which is likely to result in a loss, since interests on security lending are unlikely to cover 35% of the dividend amount.

I learnt about it in the hard way.

You have to opt-in to security lending. Although there are still situations where you can get PIL instead of dividends.

I am not sure this is true…

My Payment in Lieu of Dividends are received as usual, 15% witholding, I just checked.

Security lending is an option in margin accounts that you can select if you wish, it is not activated by default.

Whether we can recover the witholding tax in the tax declaration is not sure, I haven’t done the declaration yet.

Margin accounts are quite convinient to have a small amount of leverage or be capable of investing when good opportunities arise.

While you use margin, IBKR is allowed to lend out securities up to 140% of your loan value. You have no choice in that and you won’t earn anything from that. The optional IBKR Stock Yield Enhancement Program applies to

“fully-paid” stocks (stocks not held on margin) and “excess-margin” stocks (stocks held on margin but whose market value exceeds 140% of your margin debit balance).

I.e., the forced security lending only applies if you actually use margin (and not to your whole account). I don’t know whether they also lend out securities when investing unsettled cash (without having negative cash balances). If you want to be sure to not get PIL, make sure to not invest right before dividend distributions.

Sorry to dig up this old thread, but I beg to differ.

If you participate in the stock lending program (SYEP), you know what you are getting into (a lot of trouble… impossible to get your withholding tax back).

BUT: if you merely have a margin account and do not participate in the SYEP, you’d think you’re safe right?

Well, no! If you look closely at IBKR’s Client Agreement, point A2.1.4:

A2.1.4 IBUK is not required to compensate you for any differential tax treatment. If you are allocated a substitute payment in lieu

of interest, dividends, or other payment, you understand that such a payment may not be entitled to the same tax treatment.

IBUK may allocate payments in lieu of interest, dividends, or other payments by any mechanism permitted by Applicable Law.

Source: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=3207

So beware: if you want to be 100% sure of not getting a Payment In Lieu, you need to have a cash account!

That‘s simply not true. Why would that be the case. I have gotten payments in lieu and those are listed the exact same + correctly declared and withheld tax as normal dividends. The only difference is that it says payment in lieu.

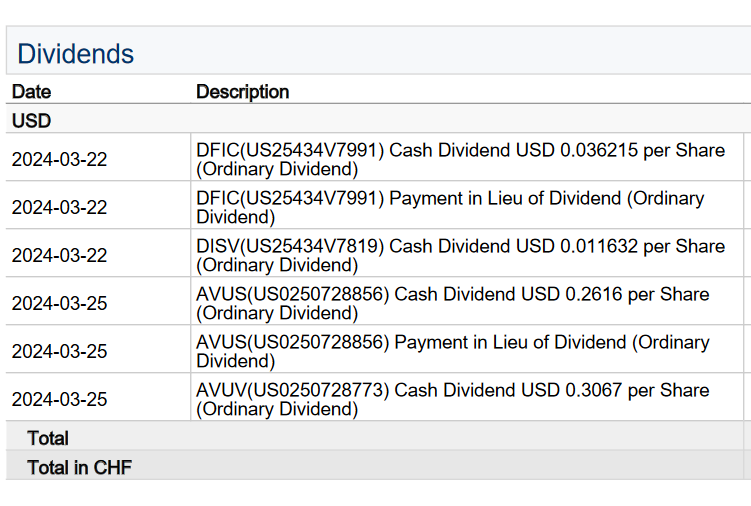

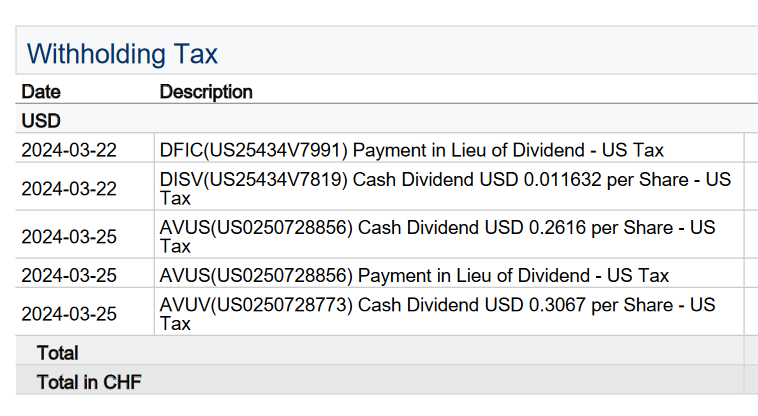

This is how they are listed for me:

I see exactly zero reason why it should be a problem getting back the withholding tax with DA-1

Additionally the interest I got on the lending was even higher than the tax withheld.

I wonder if it is gross dividend minus US WHT regardless of where it came from.

E.g, Switzerland and the US have no treaty with Randomland. Randomland has WHT of 50%. Company A from Randomland pays a dividend of 1.00 USD. We normally would receive only 0.50 USD, but our stocks were lent, so we get 0.85 USD (15% US WHT).

No. To not have your shares lent out with margin account, you have to opt out of SYEP and have no debts. If you have a debt, some securities will be taken as a collateral by IB and can be lent out even if you don’t participate in SYEP.

Did you read the client agreement?

I have a margin account, no debt, don’t participate in SYEP and some shares were still lent out at the unfortunate time of ex-dividend date.

You can ask IB, they will tell you exactly that.

Also, you can’t see that your shares are lent out, it will not appear on your statement.

Well good luck to you. Swiss authorities won’t grant your money back, sorry ![]()

Don’t believe me? Try it yourself, or read other’s experiences in the other thread:

https://forum.mustachianpost.com/t/tax-treatment-of-ib-stock-yield-enhancement-program/7752/2

I will just do it like this:

I only have US stocks, so this should work in my opinion.

I don’t want to continue this argument, maybe you are right.

You can actually see how many of your shares are segregated and how many are borrowed. It is hidden pretty carefully, and you have to do some tricks to access this information.

You have to run a standard activity report, not a customized template, for a specific date, but not too early. Something like after the beginning of the next trading day in US.

Then you get a section in the report called “Collateral for Customer Borrowing”. It has columns:

-

“Securities Segregated”: number and value of shares in your name, that are separated from IB’s assets. These shares are not supposed to be used by IB.

-

“Securities Not Segregated”: the opposite of the previous one. You are still, well, a beneficial owner, but IB is using them somehow.

-

Securities Not Segregated: Third Party “Right to Use”: securities lent out without your explicit consent and with no lending revenue shared.

-

Securities Not Segregated: Subject to Stock Yield Enhancement Program.

If you have a debt (negative cash positions), some stocks are taken by IB as a collateral (Securities Not Segregated) and they can be lent out no matter your settings and with no interest payments for you (Securities Not Segregated: Third Party “Right to Use”).

However, securities that you bought are not segregated until the trade is settled (2 days 1 day now) and can be also lent out without your permission.

So, IF you have bought shares around an ex date AND IB have lent them out before the trade had been settled AND these shares distributed something while being lent out, THEN you you get PIL instead of “true” dividend. In this case, I guess it doesn’t matter if you have a cash or margin account.

It is correct that a tax authority can reject reimbursement of withholding tax for Payment in Lieus. However it seems that many don’t care or their employees does not have enough knowledge to do this.

BTW, I have never paid 30% on Payment in Lieus. It was always 15%, like for normal dividend.

Is this an at-will thing, or actual legal precedent? Because legally I paid tax to the US, and therefore the double tax treaty should apply.

If I just put one line of US stock and then put the NAV + dividend report, I would expect this to go through.

Anyway the interest I receive seems to be higher than tax withheld, so I‘m net benefitting either way.

Also see this blog article from Mr. Mustachianpost himself: IBKR Programm zur Optimierung der Aktienrendite: 1 Jahr danach

It worked for him and Kreisschreiben 13 I will look into as well.

Revived discussion in “Stock Yield Enhancement Program” of Interactive Brokers" had me revisit this thread. Got merged

Publication 550, Investment Income and Expenses

I looked deeper into the article I linked above. The classification of PILs as “other income” is based on IRS “Publication 550, Investment Income and Expenses” which does have a section on

Reporting Substitute Payments

If any broker transferred your securities for use in a short sale or similar transaction and received certain substitute dividend payments on your behalf while the short sale was open, that broker must give you a Form 1099-MISC or a similar statement reporting the amount of these payments. Form 1099-MISC must be used for those substitute payments totaling $10 or more that are known on the payment’s record date to be in lieu of an exempt-interest dividend, a capital gain dividend, a return of capital distribution, or a dividend subject to a foreign tax credit, or that are in lieu of tax-exempt interest. Do not treat these substitute payments as dividends or interest. Instead, report the substitute payments shown on Form 1099-MISC as “Other income” on Schedule 1 (Form 1040), line 8z.

Substitute payment. A substitute payment means a payment in lieu of:

- Tax-exempt interest (including OID) accrued while the short sale was open; and

- A dividend, if the ex-dividend date is after the transfer of stock for use in a short sale and before the closing of the short sale.

Somewhat hard to read, but if I read correctly: Substitute dividend payments can (sometimes must) be recorded on Form 1099-MISC. Those are then not dividends (or interest) but “other income”.

Income Tax Treaty between Switzerland and the USA (1996)

Versions: Switzerland (German) and USA (English)

The Article 21 (Other Income) Paragraph 1 gives the state of residence taxing jurisdiction over income not dealt with in the preceding articles (Articles 6 through 20). (Exemptions for real property and gambling in Paragraphs 2 and 3.)

Now, just because two things share a name “other income” doesn’t mean they are the same. But why is Article 21 important? Because either something is “other income” and there can be no tax in the USA or it is not and it must be one of the other categories.

Additionally, the Article 23 (Relief from Double Taxation) applies. In Paragraph 1, Switzerland can’t tax any income that is taxed in the USA except for subparagraphs b) and c) (and d) which doesn’t apply, and paragraph 3 which only applies to US citizens).

b) says dividends get tax relief as: i) tax credit, ii) lump sum, iii) deduction of gross income by at least paid taxes

c) also gives deduction of gross income for: i) certain special dividends and interest which do not get any reduction of US withholding taxes. ii) taxes because Article 22 (Limitation on Benefits)

Reading closely, c) also doesn’t apply here.

Summary

I think that there are two possible cases:

- This is “other income” and the USA should not tax.

- This is “dividends” and Swiss tax law chooses Article 23 Paragraph 1 b) iii): “deduction of gross income by at least paid taxes” instead of i) or ii)

I think number 2 is more likely. I can’t find where they say so, though. In Chapter 4 of the Kreisschreiben 13 (German, about Securities Lending) they only say: When lending with foreign securities, the PIL statement must not show withholding tax. (Which is not helpful…)