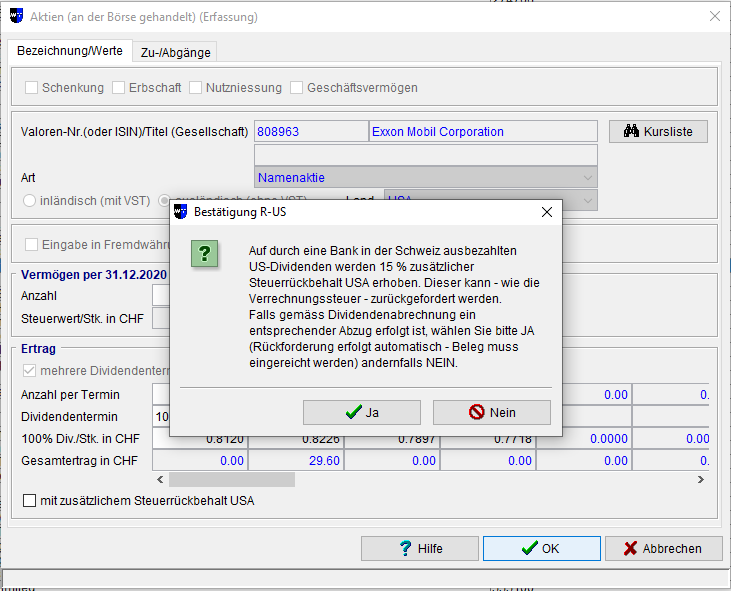

In easy tax, at page where you fill out all your assets. Once you specified security name and dividends distributed, you need to make sure you have an empty field in box below

Once you done that, you press ok and on the next window below

you press nein, and then you can see that your stock now classified as DA-1. Once you marked this in easy tax, you also need to fill out DA-1 form itself and send it all in tax office.

Notes:

- Same rules applied no matter where security is domiciled if there is treaty on double taxation you just need to find out what is withholding tax in there.

- securities both in easy tax and in DA-1 shall be fill out in alphabetical order of their respective domiciles - both in DA-1 and easy Tax.

that how i undestand it from the tax office.

What I don’t understand yet is how to get back withholding tax from ETFs distributed dividends.

Does anyone know?