(Source)

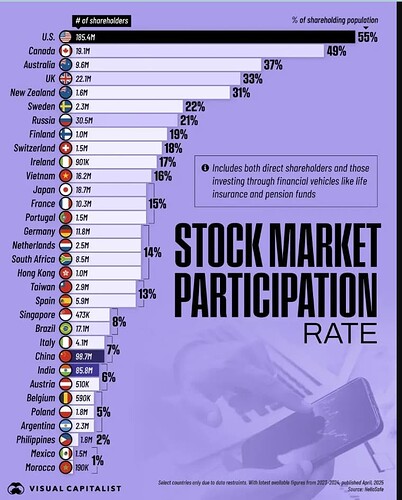

Would like to know what it’d look like for CH when excluding pension funds.

On the other hand, way more than 18% have money in the second pillar, no? So maybe it already is excluded, contrary to the note in the box on the right?

Even without any relation to this illustration, I have no idea if a person having a pension fund balance in Switzerland or another European country should be counted as a shareholder or not. On the other hand, should US residents, whose employer is contributing to their retirement account,but who never looked at it and never changed the strategy from the default Vanguard target date 20XX fund, be counted as more shareholders than people from the previous sentence?

P.S. Sorry, it turned out convoluted, but it is not on purpose and I am not profiting from it!

Personal (ie worthless) opinion: no and no ![]()

Came across this visual and was truly surprised that only 18% of (1.5M) Swiss people participate in the stock market where US shows 55%

anecdotally this does not seem accurate to be honest but curious about your thoughts.

As this is supposed to include indirect investing through pension funds, I would agree that this can’t be accurate. Outside pension funds, it might not be unrealistic but I haven’t checked any other sources.

Swiss pension funds are probably not included because there is no direct economic exposure to stocks

Can you explain what you mean by that? Profond, as example, invests 47% in equities.

Your second pillar is not directly impacted by market movements. You get your pension according to your pension rules. Stocks go down ? That’s not your problem

They are Defined Benefit Plans in the international definition, not Defined Contribution Plans

Your pension fund is also exposed to the stock market, it’s just that others (future generations, when the pension fund has to rebuild reserves after your retirement) or the reserves (money you didn’t receive earlier) have to step in. I would therefore not say that you are not participating in the market with the pension fund. But perhaps that is a matter of definition?

this is my understanding as well. this is why the pension fund has a worst case, base case, best case modeling of your pension retirement plan. i think the infographic does not consider pension fund investments

If you follow this logic, you invest in the stock market when you contribute to the first pillar because they own some investments that slightly help the sustainability of the system and delay the necessity of a reform. You also invest in the stock market when you pay the building insurance because when the investment result is good it increases the probability of a lower premium the next year (at least in Vaud)

Hhm. There are 3a insurance with guarantee. You decide how high the % invested in equities should be. When you retire, you will receive your deposit + winnings. At the same time, there is a guarantee that you will receive at least what you paid in for this part of the 3a Insurance*.

Do I participate in the stock market with this or not?

If the answer is no, I would understand you like this:

- If my money is invested in equities and I can lose money, then I participate

- If my money is invested in equities and I cannot lose money then I do not participate

I have no opinion on this, I’m just wondering.

*Yes, I know that 3a insurance companies get the money via fees, insurence part etc. which is definitely gone

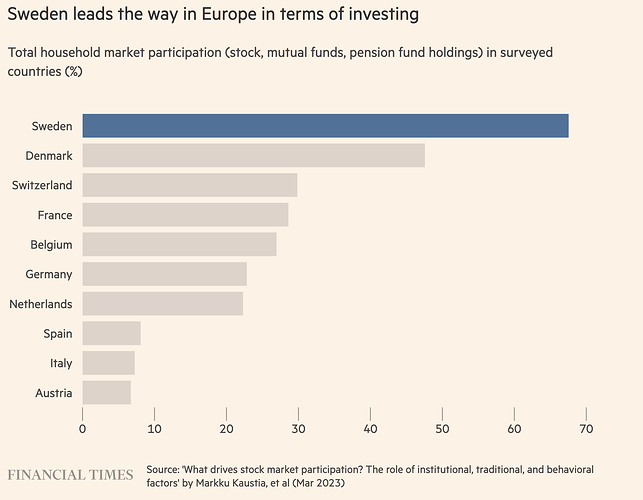

Recent article on European Capital Markets and how to make it competitive. Link to article without paywall.

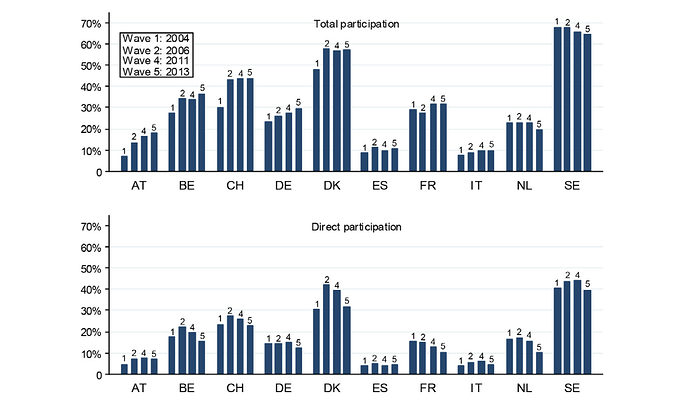

Not quite sure what is meant by total participation, maybe % of total household assets incl. pension invested? Switzerland is at around 30%. Also the article mentions that Europeans save 3x the rate of Americans, so definitely some potential for strong european capital markets.

EDIT: Looking at the original paper (source), the graph from the FT looks a bit simplified: