For those of you considering Poland as a retirement destination, the current conservative-socialist government plans to introduce an exit tax, i.e. a tax you would have to pay on your wealth when leaving the country. They plan to have it live already in 2019. What do you think? I think: keep domicile in Switzerland, visit Poland as a guest.

God, I hate these bandits so much. An interesting thing about Poland is that “left-wing” government introduced a flat income tax for entrepreneurs and the “right-wing” government introduced the biggest welfare transfers (and increased taxes) in the history of this country. Your description (conservative-socialist) makes more sense these days than the classical left-right axis.

Yes, PiS (a.k.a. pisiory  ) is a party that is ideologically conservative (nationalist, catholic, anti-abortion, anti-immigrant, pro-family, etc) but economically very socialist and populist (500+ for each kid, for seniors, for buying a flat, just buying votes with taxpayers money).

) is a party that is ideologically conservative (nationalist, catholic, anti-abortion, anti-immigrant, pro-family, etc) but economically very socialist and populist (500+ for each kid, for seniors, for buying a flat, just buying votes with taxpayers money).

Ironically, they managed to use the current prosperity into their advantage, and by tightening the taxes and increasing consumpion they manage to have very low deficit for the time being! But a consumption-based GDP growth is unsustainable. The lack of investments will have its consequences sooner or later.

It’s already happening, there’s lots of economical analysis that show that investments are falling.

What I meant is that already since a few years the investments are a very low portion of the GDP. So why does the GDP grow? Consumption. The companies don’t want to invest, so they realize their profits, and pay high taxes in effect. Great for the budget! But you can only do this once.

Arf, that’s a shame. One generation goes by and people already forget how it is like when the state controls everything…

Most of the voters of this party are 50+, so it’s not really a generational change - it’s rather return to the “roots”. People who elected these people were brought up in communist times. They’re more of a homo sovieticus mentality - I have some people in my extended family who haven’t worked a single day in their entire life and they obviously are in love with economic policies of this party.

Some younger folks usually vote on them because they’re are the most catholic-natonalistic mainstream party.

What they mention in the article, is that this tax will be introduced due to an EU directive. So we could see this kind of tax in all of Europe.

So if you live in Poland and own some shares since a long time, and you decide to move abroad, they will tax your unrealized capital gains. That’s how I understand it.

I’ve got a friend who’s got a PhD in computer science and votes for PiS. His reasoning is, that the current system is too much rooted in the communist times (e.g. judges) and too corrupt. In his eyes, Poland is a client state to the Western Europe, providing cheap labor, buying western goods and selling their crown jewels for pennies to foreign companies.

Please go on…

how do they survive? Sorry I don’t know much about Poland. I plan to visit it sooner or later though.

Social benefits and health benefits with faked (and in later age real) diseases. I guess in most countries, it’s easy to abuse the welfare system - in some countries it’s just considered clever instead of immoral and shameful. (PS. Don’t take me wrong. Poland is a beautiful country, but there’s a huge part of the population that is really corrupted by the communism and poverty it generated.)

That’s why I’m less and less fan of EU. It evolved from subsidiarity-principle-based free-trade and common standards union to a massive tax-cartel welfare-redistributionist super-bureaucracy controlling every year more and more of our lives. (Not that I prefer Orban’s or Kaczynski’s Europe of nationalist states.) I hate both options - I guess that’s why I live in Zug.

This my understanding as well. It’s good that I haven’t started investing back in Poland and I have only a bank account there with some cash savings.

That’s indeed very sad. These are exceptions though. Most people voting PiS are uneducated, middle-aged or older, country-side, conservative-nationalist minority.

FYI - they are forced to introduce it by EU and this tax is already present in other European countries. The only difference is (as far as I was able to google it) that they want to apply it to private people, not only companies.

For the ones interested: some details surfaced. The tax would be 19% for companies and 3% for private persons for income over 2 million PLN.

I’ve been recently looking into Portugal, and the more I look the more i like it so far. Great weather, ocean, stable developed economy with healthy respect for human rights unlike some other countries i could name, low cost of living and fairly cheap real estate for western europe, advanced english knowledge among younger generation at least, and last but not least special “Non-Habitual Residence” tax regime with tax-free dividends and capital gains for your first 10 years there. Any thoughts?

And what happens after those 10 years? How much do you have to pay, assuming you’re not doing any work?

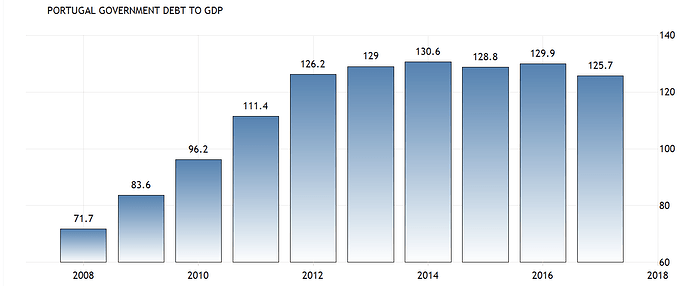

Portugal indeed has many pros, but one con I can think of is high public debt:

They haven’t been really reducing it in times when debt is cheap. What happens when interest rates go up? They will have to tax everything they can in order not to go bankrupt, or?

the standard reaction is such a situation is make more debt. because it hurts less than cutting spendings. see greece, italy, basically all the eurocrisis-countries that saw debt (bonds) interest rates drop by 5-10% when they joined the euro regime

[just a side remark]

OK but this is also a trap. I think it works kind of like this:

- A political party wants to win the election

- It offers shiny new social programs with all the welfare

- It basically buys the people’s vote with their own money

- (or rather buys votes of low incomers with high incomers money…)

- They start making a huge deficit, but since debt is cheap, nobody cares

- Pretty soon they have accumulated a public debt of over 100% of their GDP

- Interest rates go up, debt becomes expensive

- ???

People in big cities there (Lisbon, Porto) are starting to see the Airbnb effect that people in Barcelona already hate. Rent is going through the roof for them and some probably are starting to hate foreigners for that.

This whole “tourists go home, refugees welcome” mania irritates me a lot. So illogical. If they really believe in this concept, that the World is for everybody and has no borders, then they should not try to introduce some harmful laws, that will protect their low rent.

If they can’t afford rent then why not move out to a cheaper location? There are many nice cities to live in Spain. But of course they want to stay in Barcelona, because it has more to offer.

This hate towards tourists is also misallocated, because tourists bring money to the city, which they can also benefit from.

I know, you can say that these people have all the right to be angry, because they were born and grew up in these places and now they are being pushed out economically. But tourism is not the only thing contributing to it. It’s also business development, gentrification (see San Francisco).

As a Portuguese myself, I’d be very surprised if I saw that happen in my country. I’m not saying it’s impossible, and I haven’t lived there for the last 7 years, but people there have always been very welcoming and respectful towards foreigners. That said, I wouldn’t go to Lisbon or Porto anyway if I returned to live there, but a quieter place.

What would be a nice place with good sunshine round the year and mild temperatures ?