That would be good news. From where did you get this information ? It looks like other customers got a different answer from the IB support.

Yep, also blocked. Since I am a US citizen, I cannot invest in an European based ETFs either (e.g. VWRL).

My entire FIRE plan just went on fire lol. Maybe I will open a Charles Schwab account using a relative’s US address. Or stop investing.

I’d wait a bit, there’s a good chance this will be resolved. (If this isn’t a mistake they need to update all their documentation, it currently don’t cover Switzerland wrt KID/KIID requirement, it only mentions UK+EEA)

If this is not resolved and options are the way to go, I hope one of you bloggers makes a nice “How to…” post for idiots like me…

Isn’t Charles Schwab available to Swiss residents anyway? It’s included in this comparison: https://www.mustachianpost.com/best-trading-platform-in-switzerland/

And while swiss brokers are more expensive, many of them allow trading US ETFs.

Aha, as a US citizen, I cannot open an account with any Swiss broker. While you guys will be screwed by PRIIPS, I will be screwed by a legion of mind numbing acronyms from both sides of the Atlantic (PRIIPS, PFIC, FBAR, FATCA, bla bla)

I believe Swissquote does accept US persons living in Switzerland and you can buy US ETFs. However, it’s a lot more expensive than IBKR, of course (fees and stamp duty tax).

Got blocked here too this morning…

During the upcoming days/weeks, I’ll consolidate all exchanges with IB support documented here, as well as your shared insights, and put together a doc for one of my contact at IB to see if they can provide additional infos.

Not sure the person will be able to clarify it all, but worth a try.

A dedicated blogpost will follow once things settle more clearly.

Yes, as I don’t fulfill the trading requirements with my IBKR account alone, I’ve uploaded a statement from my second broker.

Thanks, great to know that! Just found out that I could buy one of my favourite funds there without load.

Anyone got experience with Charles Schwab?

I think they may (and probably are) subject to regulation based on their Swiss place of residence.

You don‘t get to (legally) be a foreign broker that officially services Swiss residents and say „oh, but we aren’t subject to Swiss legislation that prohibits brokers from offering products to consumers“.

Especially since Interactive Brokers (U.K.) seems to have an representation in Switzerland that is authorised by FINMA.

As far as I know, Swiss FIDLEG doesn’t apply to foreign brokers even if they advertise that you can create an account as Swiss resident. I’m not certain about this, though. They do have an office in Switzerland for institutional clients but it might not be involved in the brokerage service provided to retail clients. At least our customer relationships are directly with IB UK, not anything from Switzerland.

If IB UK was classified as a Swiss intermediary, we’d also have to pay stamp duty tax.

Furthermore, IB is referring to MiFID client classification, which is similar to the FIDLEG client classification but not the same. Also, FIDLEG has an exception for execution-only brokers, which would apply here. That’s also why Swissquote can still allow customers to trade US ETFs.

Yep, but they’re applying EEA legislation, not swiss here.

Also the swiss requirements for pro classification are different (eg there’s a NW based threshold that’s sufficient). Anyway I bet this wasn’t thought through (they’re in their right to apply whatever restriction they want but they definitely didn’t have to).

No, it’s the total trade volume over the last 4 quarters that has to be at least USD 200k (and at least 40 trades in total), as I understand it. I normally wouldn’t meet this requirement either but it happens that I shuffled some ETFs around a year ago and now I should just about meet this. Let’s hope I got that right.

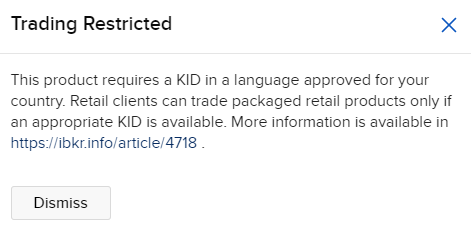

In my account I also can’t buy. But there is a notice with the following text:

The link points here: Frequently Asked Questions - IBKR

In this KB one paragraph says

However, clients of IBKR have agreed to receive communications in English, and therefore if a KID or KIID is available in English all EEA and UK clients can trade the product regardless of their country of residence.

I immediately asked the customer service how I can agree to receive communications in English (I asked in english) and I will report back, when I hear from them.

Now, does someone here get a different notice why his VT / VTI / … is not tradeable any more?

They will likely reply that no Kiid exists at all for these etfs

As far as I understand it, Swiss legislation does (will) apply. See here, for example (page 628 in particular), too.

Even though the implementation details and customer communication are still a bit muddy.

They aren’t Swiss - but they do have to adhere to (some) Swiss legislation as part of their cross-border business.

I bet that they won’t be doing this for long. It they still do it today at all (Do they? Yuh has stopped offering them as well).

What is the second cheapest broker after IBKR that allows to buy US ETF?

I had just converted some CHF to USD to trade but the order was cancelled with “no trading permission” reason. Wondering where can I send these dollars to and trade now…