Hi everyone,

So enough lurking and reading, it’s time for me to start doing.

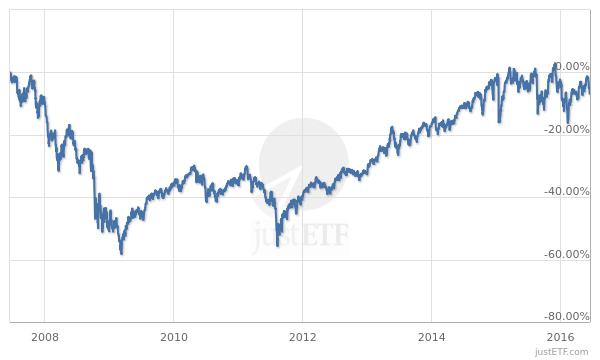

Since first learning about MP, I opened my 3a VIAC account end of 2019, then COVID hit, then I hoped everything would crash further but no, had too much work to allocate enough time to do anything so I simply didn’t move forward with my FIRE plans. So I missed opportunity of buying in at a 30% discount. On top of the missed opportunity of just starting investing when I got out of uni having studied management and finance…

Hindsight 20/20 and all that, anyways, here I am.

Current Situation

32 yo EU national living in VD since 2018. Love it here, planning to stay, my gf is doing her PHD in BE, she also loves it here.

I am a Finance/IT consultant and have been working from home since feb 2020. I would like to move to BE or ZH at some point this year and hopefully move jobs too as I can’t say I love what I do.

No plans to buy a place for the coming 5 years or any other major purchases I believe.

Financial situation

Cash: 65k

“Yolo account”: 7~10k crypto (mostly ETH) ; +2k fiat ready for the next buy opportunities.

Pillar 2: I believe it is maxed out by my employer, I need to recheck this actually.

Pillar 3a: 3 full years (incl 2021 contribution) @Glob100 ~ 21k VIAC

Debt free: no loans, borrowings, leasing, mortgage. Nothing of the sort.

Investment goals

I think I would be ready to allocate 50k for investment “immediately”, the remaining 15k being the emergency money.

Initial investment method: (need your advice here)

Should I entirely “lump sum” it immediately as statistics would tell me to ?

Or sort of “DCA” it over the next 6 months in three “lumps” of 20k (extra 10k from the additional cash saved by then) ?

Or initial 20k + bi-weekly/monthly buys spread over the 6month time frame or other ?

Any other strategy to “spreading out” the initial investment I should consider ?

Is one method better than the other from a fees perspective ?

Once the initial investment is “in”, how do I best proceed with my monthly savings ? Monthly or Quarterly ? Going forward, I should be able to allocate between anything between 1.5 and 3k. Depending on the month.

Broker (need your advice here)

I just opened an account at Degiro as it was supposed to be more interesting than IB if under 100k in assets. However I am also seeing contradictory posts.

Is it ok to start with that now and move to IB once I pass the 100k mark? (Not before second half of 2022 I assume) Or should I close my Degiro account right away and move to scary IB ?

Investment product (need your advice here)

This is where my current knowledge is still a bit lacking as I haven’t taken the time to correctly research best practices in portfolio building and DDing ETFs. I’d be greatfull for any links you might have to catch up on these topics. More than just replicating someone’s portfolio, I’d like to know how to build mine, why balance certain variables in a way etc… Even if end up if the same portfolio as initially advised!

But my understanding is that, SWX | VWRL | IE00B3RBWM25 | CHF is the holy grail of diversified “invest & forget” available on Degiro ?

Similarly to my crypto account/practices, I will also at some point allocate 5k to the “yolo account” for stock picking or other “WSB considerations” (no options or leveraged investments though, only stocks, my yolo has limits). Unless ETH/BTC crashes back to March/2020 prices, in that cas, that goes all to my crypto accounts

But this isn’t really relevant to today’s post anyway.

Is there anyting I missed and should take a look at ?

Also should I keep a certain amount of cash for the taxman or is this taken care of withing Degiro/IB ?

Thank you for your help!