Recently a person from the Uni Zürich confirmed to me that it is a fatal mistake to control the production of coins through the useless consumption of one of our main ressources. Especially as the “puzzles” neeeded to solve are getting increasingly more complicated and therefore even more energy hungry. As it is a currency and depends on stability and continuity there will be no option to simply change the system or switch it to a different model. It is an ecological disaster essentially, developed by someone with very little thought about the damage their system will inflict. Damage that would have been fully preventable.

To be fair, the author might not have anticipated that little more than 10 years later, the CEO of the world‘s 6th largest corporation (according to MSCI World market cap) would pour more than a billion dollars into it.

The scale has changed, true, but the wastefulness of the system should have been obvious while it was being developed. And it is not that sustainabilty was not a thing in 2009. As oil companies have been under immense scrutiny, i cannot see why Bitcoin should not.

I wonder what you mean by scrutiny? You mean banning bitcoin? Banning people to use electricity to whatever reason they may have? Let’s also put an air conditioning temperature limit to 21 C. Unless you mean something else by scrutiny.

Most mining happens in China, and China is already leading in terms of renewable energy capacity. Hopefully in a few years it won’t be in the discussion anymore. No idea what scrutiny will bring in this context.

80% of China’s electricity comes from coal as far as I know.

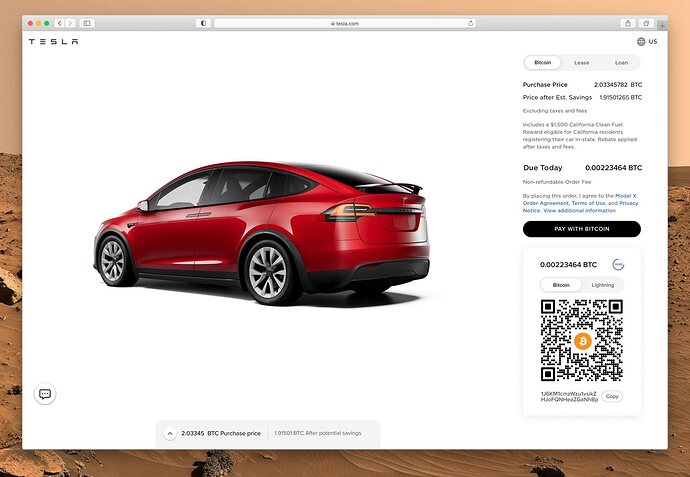

By scrutiny I mean that there seems very little ecological concern revolving around Bitcoin, even though it is a waste of energy by design. For example while Tesla is lauded for shifting away from ICE, the company itself does not seem to mind the energy consumption of Bitcoin and the public reaction is also more focused on the novelty of it.

I’ve thought a bit about it and it actually makes sense: some people are getting quickly rich with Bitcoin, why not buy a Tesla with it? I wonder how they’ll deal with Bitcoin’s price fluctuations, though.

I wonder what crypto enthusiasts think about it. Anybody knows of a good community? Preferably one interested in all kinds of cryptos and not Bitcoin focused.

Is this screenshot legit? If so, it’s funny that they don’t round it up a bit. Model X, now for just 1’999 mBTC!

Jumping on the band-wagon… Tesla-Leasing by Swissquote ![]()

Not exactly ground-breaking, how about accepting payment via one’s Swissquote bitcoin account or buy it using margin on your Aktiendepot?

On the other hand there’s now the Swissquote App optimised for the Tesla screen. In the name of us pedestrians & cyclists, I hope that auto-pilot is reliable!

No, it’s (a good) photoshop. ![]()

But I wouldn’t be surprised seeing it for real soon.

They finally jumped the shark with their BTC stunt earlier this week.

So I bought a 150’000 leveraged shorts on TSLA.

As a value investor, I am smelling value.

Seriously ?

Aren’t the $1400 stimmys at the doorstep ? …

Haha, game on! Who knows, maybe you borrowed some of my stock to sell

What does 150’000 mean? Dollars? How many pieces are these? How much leverage? To be able to know when your position is washed out.

Here are Google’s suggestions on “invest stim” :

If you choose “stock market” you’ll find TSLA quickly…

Just (leveraged short) ETFs.

I’ve never had 150’000 units of anything in my IB account before.

Feels good. ![]()

Thinking of doubling down on this till I have a million units! ![]()

![]()

So…? That’s a few hundred thousand ![]() buying one share each.

buying one share each.

Maybe two, by foregoing the daily tendies for lunch for a while.

Did you get SPXU or one specific for Tesla?

Also, are you ok?

I think the scale is larger.

- 28% of Americans bought GameStop or other viral stocks in January: Yahoo Finance-Harris Poll - so around 90 million people, right?

- How many people get stimmys? Didn’t find it. I guess it matches well the meme stock traders.

- Don’t forget funds replicating retail trades.

- What happens if Papa Elon tweets with an allusion to the stimmys?..

Did you get SPXU or one specific for Tesla?

Wouldn’t bet against S&P 500.

28% of Americans bought GameStop or other viral stocks in January: Yahoo Finance-Harris Poll - so around 90 million people, right?

Flawed data and/or extrapolation.

A high share of internet users that were willing to complete an online survey with questions related to brokerage investments bought Gamestop or another viral stock in January. Unsurprising to me.

Extrapolating to the whole population and say it was 29%?

They can (and have tried to) adjust all they like… I don’t buy it.

Here we go for another 5 minutes of research…

“online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated”

39% of the U.S. population is below 18 or above 65 years old, according to census statistics. Rates of viral stock buyers will be negligible among these age groups (they indeed are for the elderly, even in that very survey itself).

Of the respondents answering that they did buy viral stocks, more than half “invested” less than 250$ in total over the whole month. Median investment amount in viral stocks across all respondents was 150$.