Dear Mustachians,

A bit of background first:

I have been investing in VT through IB for almost a year now and my gf also wants to start investing (hopefully she doesn’t grow a mustache). Thing is, she would rather invest in high-quality, high-end real estate in a big European capital.

She is currently sitting on almost CHF30K and would love that number to grow over the next 2-3 years so she has a decent contribution to buy a place.

My take on this:

I don’t see the value of her opening an IB account right now and invest in a dividend-paying ETF. In my opinion it would be better to go for a Custody DEGIRO account and buy only an accumulating ETF (thus avoiding DEGIRO Custody fees that leech on dividends), and withdrawing the cash in 2-3 years.

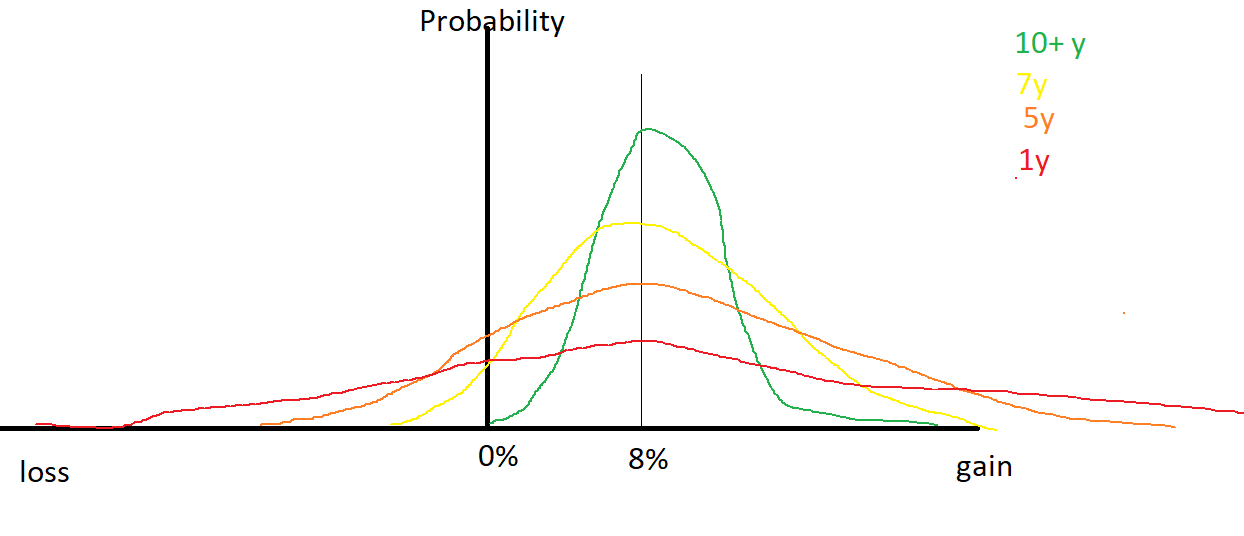

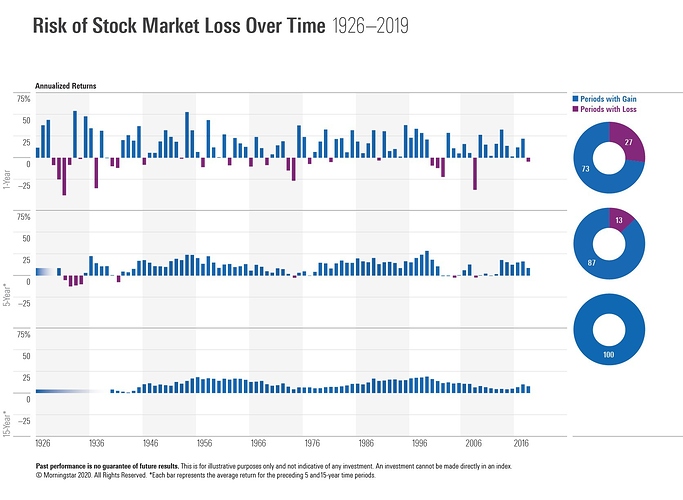

However, I’m here for the long run and while I know Index funds/ETFs are the way to go for me, I’m not too familiar with the efficiency of ETFs in short term, this is why I’m asking for your opinion on this.

Also, if ETFs would still be the way to go for you in this case, which accumulating ones would you suggest? (ideally from DEGIRO’s list of commission-free ETFs)

Thanks in advance for your input,

iNeedMoney