So today I got my usual salary and the bonus. 40.8k net. Never received that much in one single month. Feels kind of surreal now that it‘s actually paid out.

Well deserved, I guess! So, have you already dumped it into VT? ![]()

I maxed out my 3rd pillar, bought 0.1 BTC for 4.7k, refunded my emergency fund (back to 10k), converted 5.5k in USD (not yet invested, my fault waiting for stock markets to drop a little), paid around 5k for our 4 weeks Thailand trip (2k for flights already paid last year) which will end by end of this week, bought 3 new suits with 3 troussers each and 8 new shirts for 1.5k in Bangkok for my new job that will start in 5 weeks. And my private account is now down to 200 CHF lol. All gone.

In essence, I saved/invested ~20k of it. 9.5k went to my taxes savings account anyway, rest for bills and the vacation.

Of course we could have stayed at home and I could have invested an additional 7k, but I think I‘ll never regret having spent an amazing time here.

If it helps, you can consider the holidays an investment in yourself. Adding to experiences and knowledge that should hopefully compound to make you happier, more knowledgeable and wiser.

Talking about salary progression i asked 4% today to cover inflation. Legit? (Backed by a very good performance of myself though)

2024 update:

Moving from 150k in 2023 to 170k

Promotion within the same company

I just realized I was able to achieve a 88% growth from 2018 until today, fairly happy with it!

I guess this is in IT?

Nope - it’s within Treasury

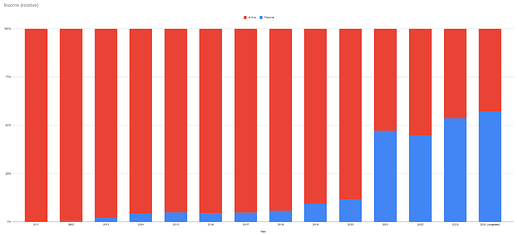

A couple of years later I’ll add two charts on salary progression to further mess up things.

My favorite one first:

Favorite chart because in 2023 I definitely crossed the line of passive income being greater than active income.

Of course this can very easily be achieved by lowering your active income accordingly … ![]()

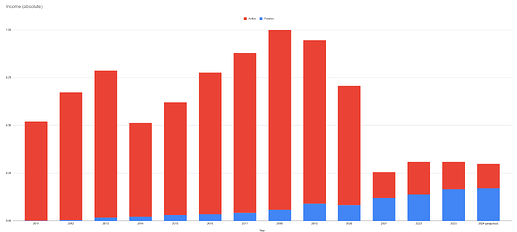

… hence also the “absolute” numbers chart:

(all charts based on pre-tax numbers, though I suppose the charts would be congruent post tax as both income parts are taxed the same way)

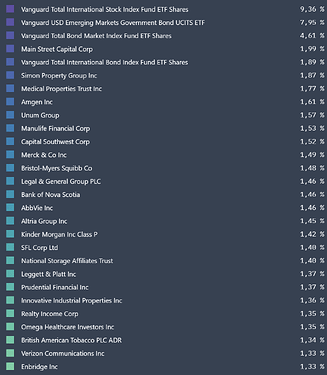

Based on your previous posts, do I understand correctly that your passive income is based exclusively on the (high) dividends of the stocks you own?

Mostly right.

I don’t only hold stocks, I also own ETFs (including bond ETFs). In my tradable (non-retirement) accounts I hold about 1/4 ETFs and about 3/4 individual stocks. The top income generators are these:

(see for yourself here if you’re interested in the full list; the data is only accurate as of now, but not historically, as I haven’t entered transactions but only track current holdings in the tool [which then calculates past returns as if I had always held all my current holdings])

I’d also claim that I don’t only own “high” dividend stocks. My average return on the entire portfolio (including ETFs, at its current valuation) is “just” 4.27%. Looking just at my active stock picking portfolio the average return is 4.37% (again based on current valuation). Same league as US treasuries.

Thank you for sharing. This is very impressive, you must have put a lot of work into that. I believe this requires quite some time to manage such a portfolio and at this stage you could simply call it a day and live out of that passive income… May I ask how much time you spend per day or week to manage all that?

By the way that DivvyDiary website seems very useful to track exactly that type of portfolio. It must feel like pay day nearly everyday with all these dividends ![]()

This feels somewhat off topic, I hence replied on thread FI(RE), pulling the trigger likely in 2020: ~50, male, married, one kid - Share your story - Mustachian Post Community

Update - only “inflation adjustment” this year.

| Year | Base | Step | Relative | Absolute |

|---|---|---|---|---|

| 2014 | 74’400 | Postgrad | ||

| 2016 | 95’000 | Permanent | 27.69% | 27.69% |

| 2019 | 107’000 | Promotion | 12.63% | 43.82% |

| 2021 | 135’000 | Company change | 26.17% | 81.45% |

| 2023 | 142’500 | Promotion | 5.56% | 91.53% |

| 2024 | 146’775 | Raise | 3.00% | 97.28% |

Plus yearly bonus of ~15k on avg.

Edit: Data role in the financial industry, mid 30s.

Very nice! I see quite a number of companies on there which I have too and it seems you have a few value/turnaround stocks in there.

Does this also include your Pillar 1e/2/3a assets? If not, how much are those pension assets compared to this and how are those invested if differently e.g. do they represent a ‘bond-like’ portion of the portfolio?

Lastly, to understand your asset allocation, do you also own real estate and how does that fit in with your portfolio?

This seems slightly off topic, I replied on FI(RE), pulling the trigger likely in 2020: ~50, male, married, one kid - Share your story - Mustachian Post Community instead.

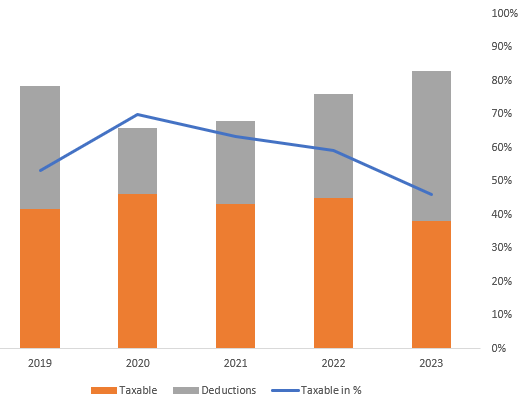

After talking to someone from abroad about taxes, I made a chart comparing income vs. taxable income. Salary still is biggest part of that. Does this count?

Highest rate was above 85% of income (not depicted), lowest below 50%.

Alas, no big jumps on the salary level without leaving a comfortable part-time job.

Update for 2024

2019 : 71.5k CHF + 1k (bonus)

2020 : 78k CHF (no bonus)

2021 : 84.5k CHF + 1k (bonus)

2022 : 87.75k CHF + 10k (bonus)

2023 : 97.5k CHF + 5k

2024 : 104k CHF + …

Still in civil engineering (VD), haven’t changed company in 6 years

Updated numbers for last & this year, full table:

| Year | salary + bonus | Notes |

|---|---|---|

| 2018 | 62k + 2k | |

| 2019 | 50k | military / studies |

| 2020 | 10k | studies |

| 2021 | 13k | internship & studies |

| 2022 | 51k + 1k | finish studies & then full time work |

| 2023 | 105k + 7k | |

| 2024 | 110k |

(non dev) IT job in finance