-200k net worth? What happened? Did your dad play poker with the Russian mafia?

Not really

Very simple resume of something that took a few years:

I worked in the family company and I believed 2 things:

- That the company had only a cash flow issue. I had access to the accounting but it was a mess, so I believed my father.

- That the people who lend cash to the company would not be able to come after me in case of bankruptcy.

Lessons learned:

Never trust people.

Read the contract.

200k is a bit too expensive for this lessons, specially when at this time I earned 6k per month …

good point after that, I learned how to be frugal and enjoy life without a perspective of having money

It wasn’t a GmbH or AG?

it was an AG. But we signed some guarantee, (Solidarbürgschaft). The company(big international consulting company …) that “help” us in the process to put the company on track told us that it was only a formal document. In practice they never try to get the money from private people. That was not true  .

.

Wow that was a rough start. Sadly it’s not that uncommon that the books of family businesses are a mess.

In any case, congrats for getting above water again. Like you said, hopefully the lessons in frugality and saving will help you for more years to come.

A post was split to a new topic: How much do you share with your family (parents/siblings/partners)

I topped up my 2 pillar with a large lump sum payment 5 years ago and it is one of the worst investments I ever made. If I would have invested it outside 2 pillar I would have earned back more than the ca 40% tax saved

Sorry to hear that. Can you elaborate your numbers? What were the buy in, tax saving and what do you base your invested outside on?

Well, putting extra money in the 2nd pillar is clearly not an alternative for the stock market.

It might only make sense as an alternative to an investment in bonds…and I’d be surprised if you can find a decent bond which delivered a 40% return over the last 5 years…

My last BVG product was self-managed (big financial company), netting 4-9% yearly in the last years. Where they screwed up and went below zero, the company compensated the losses to 0%.

The company before that topped up our 2nd pillar to 5% yearly. No risk, just fun. ![]()

Sure it’s not the SP500, but with a limited or even zero downside, plus the added tax benefits it can be a good deal.

Then you have a myopic view of asset allocation. Everything’s super easy with 20/20 hindsight. Worst decision of my life is not going all in into bitcoin when I first heard about it

That’s some serious benefit!

Is this something common? All the 2nd pillars I’ve seen in the manufacturing industry gave less than 2% interest. Does it depend on the sector maybe?

All the 2nd pillars I’ve seen in the manufacturing industry gave less than 2% interest.

Mine is 1%, which is the legal minimum.

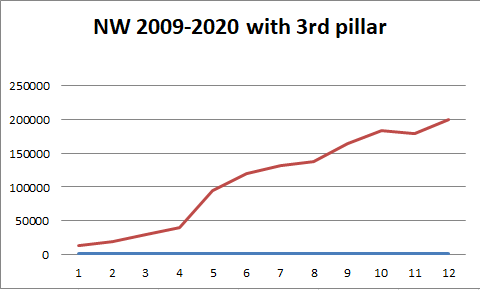

Here mine, tracked since 2009:

Red: NW, Blue: Years since start of tracking

I have been wasteful in the last few years, most NW gains came from capital gains, but will start doing better from this year.

Don’t you think the image is too big?

Can you share what the red and blue lines represent? We can guess red is the NW but what’s the flat blue line? What are the numbers starting with 1 on the x-axis?

Can you share what the red and blue lines represent? We can guess red is the NW but what’s the flat blue line? What are the numbers starting with 1 on the x-axis?

Red: NW, Blue: Years since start of tracking

You could spare the blue line, if I read it correctly

Ouch

I did not explain well. The discussion was whether it is worth topping up 2 pillar. Everyone has a different attitude to risk but my learning from experience is that if you are young and your investment timeframe is long you can have a balanced portfolio with an aggressive enough allocation such that it is highly probable you will earn more than the tax saving and investment return on typical 2 pillar

I didn’t follow this advice and I have more safe 2 pillar assets than I need for my situation

If an employer’s plan is returning 5% pa vs typical 1.5% or you are certain to use the funds for home ownership that changes the equation.

In my case I convinced myself I would buy a house within 3 years but still haven’t and in addition after a job change my 2 pillar ended up earning 0.25%

Yes it depends on the sector a LOT, but this particular employer is really one of a kind. Can’t tell more in public.

The usual rate I think is at or under 2%.