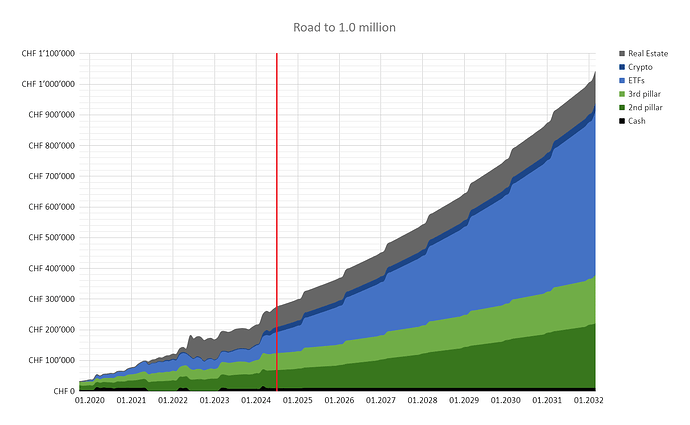

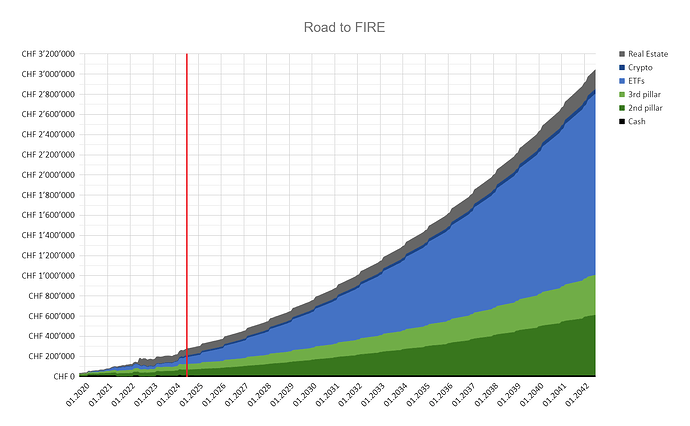

I made the “Share your networth progression” thread in 2020 and the “Share your salary progression” thread in 2021. I think it would be an interesting new take to compare our estimated future net worth progressions. By that I don’t mean just only posting a nice graph showing when you’ll reach x million or your FIRE number. But also explaining what assumptions you made and how you are calculating specific parts of the whole thing. So we might see different concepts and ideas from which everybody can learn and adjust his own if desired. I’ve just made some major updates to my spreadsheet which I would like to share.

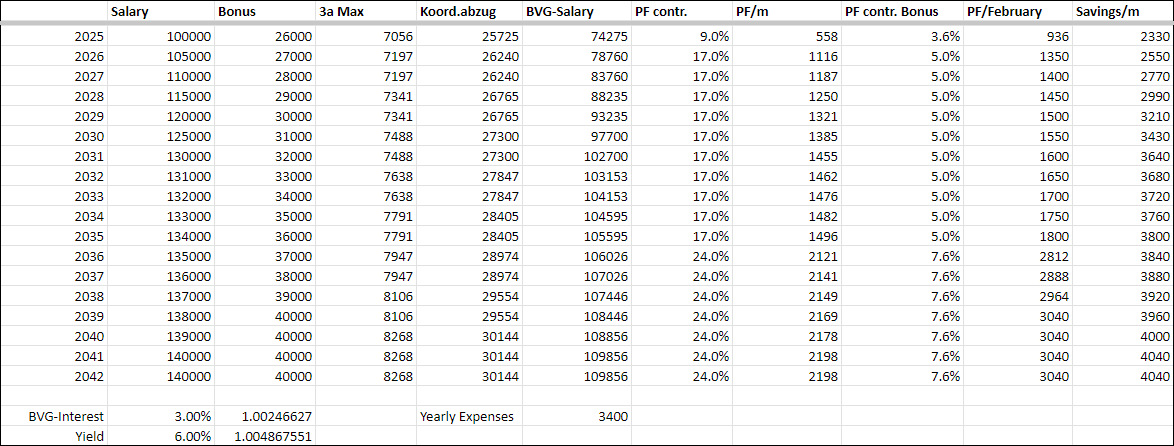

Everything is based on this table I made:

The major points:

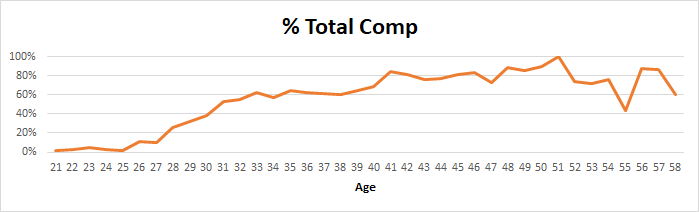

- Salary increase is due to me very likely reaching Director-level at my job which has a minimum base salary of 128k (as of today). My boss is telling me that 3-5 years is the usual range with good performance. I want to be conservative and assume that I’ll get to that kind of base salary within 7 years. I also assume that I won’t just jump from 95k to 128k in one year but that there will be a significant increase every year. After that a conservative estimate of +1k/year.

- Bonus is also conservative. I worked in retail banking and had 35k this year. It’s safe to assume that now as I switched into private banking the bonus will be higher. But again, I like to be more conservative and assume a generally lower bonus.

- 3a max. contribution is usually changed every 2 years and linked to inflation. I assume a 2% increase every 2 years. I do the max. contribution in February every year and directly subtract it from my bonus.

- Koordinationsabzug is 3.646 x max. 3a contribution. BVG-salary thus salary minus that. The pension fund contributions increase every 10 years plus there is a separate pension fund contribution on the bonus.

- I’m currently able to save/invest around 2.1k/month on average. Future savings rate is based on salary increase minus taxes with diminishing increase each year. I want to account for two things here: Marginal tax rate is increasing and I assume that there will be some minor lifestyle inflation too.

- Interest on 2nd pillar is 3% due to my pension fund having a long track record of exceptional interest rates. The last 3 years alone had 9.5%, 7% and 9%. I assume that they will stay clearly above average but I want to be conservative too as they won’t sustain that level of interest long-term. There are several pension funds with 3.0-4.5% average over the last 5 years (Schweizer Pensionskassen Rating -) so I’m just taking 3%. As it’s always applied by end of year, I’m doing that as well in the spreadsheet. I’m using the 12-month average value of the pension fund as interest is applied to the average you had through the year.

- 6% yield for ETFs, 3a and Crypto. It’s lower than history is telling us. One could be more conservative here, but I’m pretty confident that I’ll even end up with a higher return long-term.

- For RE home equity I’m taking a short-cut. I just use the 6% yield for increasing my home equity value. As it’s roughly 1/6 of the market value this translates to a 1% yearly increase of the market value. I account for Grundstückgewinnsteuer (40%) but don’t let that decrease like it would in the real world (down to 20% after owning it 10 years and so on). All in all probably my most conservative assumption of all.

Final thoughts: I might end up reaching my milestones (0.5M, 1M, 2M, 3M) way sooner than expected if I end up earning way more than expected. My total comp. 6 years ago was half of what I have now so I might get surprised again. Then there is kids. I didn’t account for that as I don’t have kids yet. They might (depends on the wife) significantly delay the time when I’ll reach those milestones. Probably moving my FIRE target from 50-52 years to 55-57 years.