Hello everybody

I am starting to investigate the posts, the community and investing in general. I am working on getting together my own “portfolio” while hitting the same question again and again…

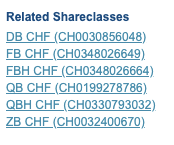

As you can see (e.g. on Credit Suisse Fund Gate) there exist a dozen share classes. While I found out that I can not invest in classes starting with E and Q, I am totally lost with the rest of them. While I figured the Q might stand for “qualified”, I can not guess F.

Is there any guide, anywhere, which makes a glossary from this mess?

Thank you for any hint