Hi everyone,

I’ve noticed that for the past 3 years VT tends to decline from end of July towards end of October, for then raising back. This, from what I understand, is linked to tax returns optimization in the US.

What’s the community view in selling at the end of July for then buying back 1st of November?

I consider cons related to transactions costs.

Thanks

Past performance is no indication of future returns.

Time in the market > timing the market

I don’t see any reason why VT should decline between end of July and beginning of October and then rise again. If this would be the case, everyone would do the same.

Can you please explain what you mean with

?

I’m quite tempted to sell. My asset allocation has drifted too much towards stocks.

My strategy is to sell on Feb 21 and buy back on March 13 because global pandemics tend to start Mid-February and the recovery typically kicks in Mid-March. Backtests over the last five years have been extremely promising…

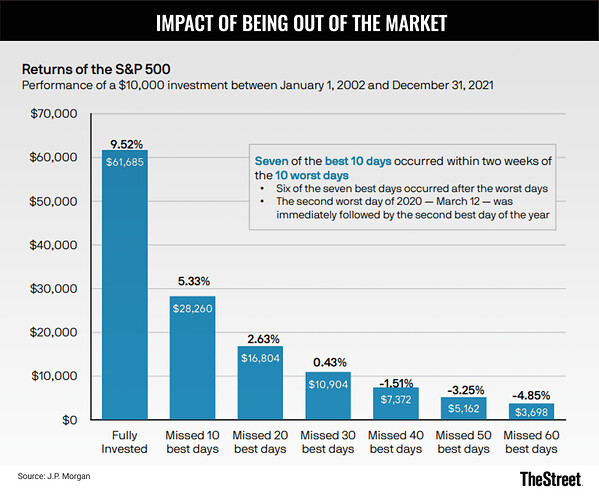

On a more serious note, I think this image shows why such strategies are a bad idea:

The best days can obviously happen in any month (as they are typically linked to news / events / releases), so this seems very risky to me.

In the articles they state that the big losers (more than 10% loss) often rebound. So if you’d want to exploit this “strategy” you’d need to buy these losers in time to profit from the rebound, however VT holds way way more securities than just these losers and as stated above you could miss out on huge gains during the time you are not invested.

Let’s say that 20% of VT are these losers and get sold for tax loss harvesting by US investors and they’d indeed rebound afterwards and beat the market by 1.9% (as stated in the article), that would be an outperformance of less than 0.4%. The probability that VT performs better in the time you are not invested is very high and don’t forget the transaction costs.

In investing 3 years is basically no timeframe at all to draw such conclusions. Not even 10.

And IF such clear trends were observed, they would be immediately arbitraged by hedgefunds and other BILLION dollar companies with THOUSANDS of phd educated personel, equipped with the best trading algorithms.

You have absolutely ZERO chance to compete with those.

Thanks gents for sharing your opinion!

…otherwise (and slightly differently) known as Sell in May and go away.

It is largely agreed that there evidence to a pattern, recurring seasonally over longer periods of time.

I would take it more like a hunch and not a data backed action. Long term investors shouldn’t indulge but traders can. Question is who do you want to be?

Both are respected approaches but need different skills. Trading in particular is very difficult to master because lot of traders end up losing money.

Many such trends have been observed as SanFran noted, but finance is not a science so I would avoid actioning any “insights”. Peter Lynch has said that more money has been lost waiting for corrections than in corrections.

Moreover as Tonyleet wrote, there’s a hell of computing and manpower (ok, peoplepower according to Justin Trudeau) deployed to find ways to capitalise on these which we can’t compete against or even hope to get some crumbs off the table by trying to do the same.

That’s the beauty of being a lazy Boglehead, you let the beasts fight it out in the jungle. If stocks are flat between May and October/November then we’re buying steady, if there’s a dip we buy more, if they go up we’re making gains. Beautiful!

Almost, but everyone knows the real rule to follow is:

Sell in May

and go away,

but remember

to come back in September.

![]()

How did that work for you?

I’ve been selling this week and got my allocation back to around 70% stocks, 30% bonds/boxx/gold.

It would be interesting to have the same chart with the worst days.

Fully invested vs missing the 10 worst days, 20 worst days, etc.

In the end, it’s the worst days that scare people. Losses impact people twice as much as gains. Losses are harder to make up too (ie. if you lose 10%, you need more than 10% gains to get back to break even).

Moved to a 50% stock and 50% cash allocation in July.

Anyone else having a similar strategy?

I was moving to a 60/40 stock/bond allocation but only got to 70/30 at the start of last week.

Can I ask you which bonds are you buying to offset the risk of stocks?

Mainly US Treasuries. But I also own some corporate bonds (MPW and in the past COIN).

Can I ask for the ISIN?