Let’s say you hold an emerging market single stock with Swissquote. Swissquote uses SIX SIS as a custodian, but SIX SIS is not a global custodian, which means your EM stock is held at a sub-custodian, e.g., Citi or HSBC.

I searched a bit. My understanding is that Swissquote is indeed comparable to IBKR by default (and less than safe than eg: Viac, or even Postfinance which uses SQ as a custodian but grants additional guarantees).

Swissquote’s Safe Custody Regulations 5.3

[…] The Bank shall not be liable for any loss directly or indirectly attributable to an action or omission, or for the insolvency/bankruptcy or similar event affecting such third parties

[…] The Client’s Custody Assets may consequently be deposited in omnibus accounts.

Swissquote’s Safe Custody Regulations 5.5

[…] The Client is aware of and accepts the risks relating to the Custody Assets being held with third party custodians. The Client acknowledges, in particular, that it may be difficult or impossible to allocate and/or return to the Client all or part of the Custody Assets in the event of a custodian’s insolvency or similar event, and that this risk is higher if Custody Assets are held in collective safekeeping accounts.[…]

In Swissquote’s case, it seems that better custody can be requested (at extra cost, 5.1). I would be curious to know if someone has tried and what’s the cost.

I think IBKR also offers that but not to private investors.

iirc there’s already a thread about broker bankrupcy, maybe move that there?

(IMO if you don’t use a neo broker, the risks are fairly low, esp. if you anyway split your assets over 2 brokers. Holding assets in street names is industry standard – and that’s what allows you to have your assets be liquid, though maybe for some people it’s a feature if they can’t trade?)

That looks different than few years ago. At that time Swissquote made quite a big deal out of the fact that they custody securities with central securities depository in the customer’s name.

Are you referring to the 3bps that they started charging in 2022? To cover those safekeeping costs of your Swiss stocks at SIX, for example? As best described/summarised in this post Swissquote new fees - #19 by jay

Or has that always been an omnibus (and not segregated) account, at SIX, for example?

I have no need or interest to dig deeper, but here are my notes about Swissquote’s T&C from around 2021-22:

En cas de faillite de Swissquote Bank SA, l’intégralité des titres est garantie dans la mesure où ils sont en dépôt auprès des dépositaires respectifs qui les conservent en votre nom.

Die Wertschriften werden im Falle eines Konkurses der Swissquote Bank AG vollumfänglich garantiert, da sich diese bei den jeweiligen Depotstellen befinden und dort auf Ihren Namen verwahrt sind.

Should Swissquote Bank Ltd become insolvent, securities are fully guaranteed if* they are held by the respective custodians in your name.

- That “if” was bothering me a lot. I decided that this was a translation error and it should be “as/because”.

Please feel free to compare with statements now.

Thanks for sharing. Not a translation error, in my understanding: the French and English mean the same, and this also matches other parts of the T&C.

For completeness sake, here is my personal English translation of the German version:

In case of insolvency of Swissquote Bank Ltd, securities are fully guaranteed, as they are held in your name, at the respective depositories.

I could not find these statements anymore, so I think we should discuss the current T&C rather than the version of 21/22. The English text I can still find but only on swissquote UK, which again might have different conditions as Swissquote CH.

At Swissquote CH, they removed the “securities” part from their FAQ since, and only write about deposits there under “What investor protection does Swissquote provide?”.

The points raised by @brice have peaked my interest a while ago, but I only got to read the relevant passages in Swissquotes and yuh’s Safe Custody Regulations only today. I share the conclusion, that both yuh and Swissquote as of currently applicable regulations offer omnibus accounts by default, which is a real bummer.

Postfinance still seems to offer segregation by name per default, although the corresponding regulations (https://www.postfinance.ch/content/dam/pfch/doc/0_399/01613_de.pdf) do offer a loophole in this regard.

It seems the brokers are trying to cut down on costs…

Edit:

For what it’s worth, it doesn’t seem to be any better at neon/HypothekarbankLenzburg…

- Verwahrung

Die HBL kann die Depotwerte in eigenem Namen, aber auf Rechnung und Gefahr des Kunden bei Verwahrstellen in der Schweiz und im Ausland verwahren, wobei die Depotwerte den Bestimmungen und Gesetzen der jeweiligen Verwahrstelle resp. des jeweiligen Landes unterliegen. Der Kunde stimmt dabei der Verwahrung seiner ausländischen Depotwerte bei ausländischen Drittverwahrstellen zu.

“21. Custody securities held in omnibus accounts

21.1 By accepting these Terms the Client agrees that Saxo Bank may keep the Client’s Custody Securities in an (open) omnibus custody account. Omnibus custody accounts are used for registration of multiple Clients’ Custody Securities in the name of Saxo Bank or any of its agents but for the account and at the risk of the Client with the relevant clearing institution or custodian. Thus, the Client is not individually or personally entitled to compensation for any damage due to errors made by the relevant clearing institution or custodian. Any foreign Custody Securities and Swiss Custody Securities, which are not registered in a separate custody account, will be kept in omnibus custody accounts with Saxo Bank or an external professional provider, depositary, or custodian appointed by Saxo Bank, and the external professional provider, depositary, or custodian will be responsible for claiming and collecting interest payment, dividends, income and other rights belonging to the Client. Saxo Bank is not liable whatsoever for any disposition or omission or insolvency of an external professional provider, depositary, or custodian and cannot be

made liable by the Client for any loss directly or indirectly owing to the action or omission or insolvency of any party mentioned above. The Client is to the same extent as Saxo Bank subject to the current laws and common practices applying to the external professional provider, depositary, or custodian and its general terms and conditions of business. Saxo Bank shall only transfer those rights that it receives from a foreign third party. If the applicable law of the foreign country renders it difficult or impossible for Saxo Bank to return Custody Securities deposited abroad or to transfer the proceeds from the sale of such Custody Securities, Saxo Bank shall only be obliged to procure for the Client a claim for the return of property or payment of the sums involved, provided that such a claim exists and is freely assignable.

21.2 At Saxo Bank’s discretion, Custody Securities may be registered to a Client or segregated i.e. held in custody under the Client’s name. The Client hereby accepts the disclosure of its name to the third-party depository. Alternatively, Saxo Bank may register the Custody Securities in its own name or in the name of a third party, in either case for the account and at the risk of the Client.”

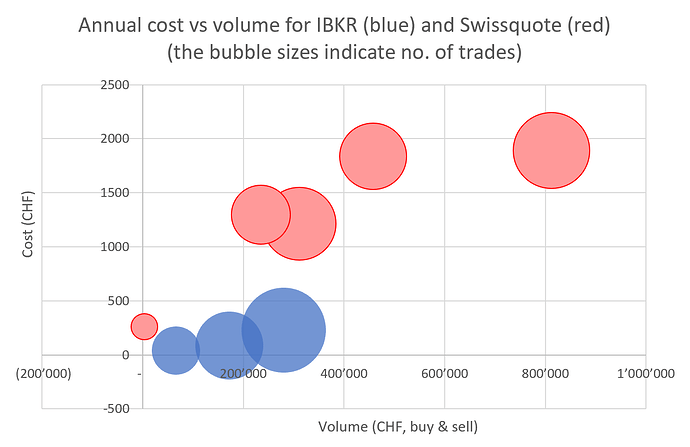

I have been using Swissquote actively since 2020 and IBKR since 2022. Here’s what I have been paying for brokerage (& stamp duty & custody) each year. I recently have done most crypto trades with SQ and been paying a lot in return for getting a (false?) sense of security due to Swiss based crypto custody. How would you optimize?

Interesting finding, thank you for sharing.

The “real” high net worth individuals are still with their (private) brick and mortar banks and I experienced the same shift of interest: the more assets I have - and I am definitely far away from being rich - the more the factor “security” is important for me. There are many reasons, why a cheap solution is cheap and hence not the best solution.

A nice diversification can be to have 50% of the assets with an foreign broker and the remaining 50% with a Swiss bank. Of course, you will pay your 0.2 - 0.4% p.a. fee just to keep the securities there on this 50% share - but in my eyes it can make sense to save costs at other topics.

We are all Excel maniacs and know, what a drag of 0.3% p.a. means to a potential value in future.

Could it make sense, to trade a crypo-based ETF as FBTC? I am specifically referring to FBTC and not IBIT since Fidelity is doing the BTC custody by themselves, while Blackrock uses Coinbase (?).

Obviously it also depends, what you are trading; BTC only or also other stuff.

But when taking the volume into account, the costs are not very high, tbh.

Trade with IBKR or a crypto exchange (but don’t hold your cryptos there when you’re not trading), which are designed for more frequent operations. Use Swissquote only for buy and hold operations, which doesn’t incur that significantly more fees than IBKR when doing so.

Trading with a Swiss broker is usually a bad idea.

Can I just point out the irony of (some of) you complaining about the cost of a Swiss broker, while simultaneously complaining about their cost cutting methods (like omnibus accounts)? Do you want them to differentiate as an extra save broker (if that even is a thing), or do you want them to close the pricing gap to IBKR? ![]()

I retain the opposite position here: Trading with a foreign entity, outside the reach of my legal system, is a bad idea. If something goes wrong (very low but non-zero risk for an established proper broker), it might be a nightmare to get your money back.

Also: Comparing Swissquote vs Yuh vs Postfinance regarding broker safety is non-sense, they are all the same Swissquote in the background. Their somewhat different T&Cs mean very little, because they don’t necessarily reflect what is actually going on, rather what they retain as worst possible option that might only affect some specific products they offer (and some customers wanted fancy features like fractional shares, how do you think that could work without omnibus accounts?). The only thing the past years and 2024 especially have shown, is that you can’t trust app-only fintech’s or any party that is only a middle man. Keep your money directly at the licensed broker, that way you get the regulatory insurance cover, and it seems unfathomable that the broker itself doesn’t remember which part of the omnibus money is yours (unfathomable applies until it suddenly doesn’t of course ![]() ).

).

PS: Not sure what @assemblyrequired and @jay are on about a couple posts back, but Swissquote still does charge the 0.85 CHF per trade fee for real-time date.

At least for me it is to lower the impact in case of (unlikely) issue. With a very simplified model, where any kind of issue is a uniform distribution with probability p, having two brokers means that we have p + p probability to encounter any issue, but only p * p that both are impacted (which is much much much smaller than p)

It’s not so simple. As an analogy, some online sellers cover damage during transportation, some don’t. They may use the same transporter, but he additional guarantee matters as well.

In the present case, PostFinance guaranteed to me today in writing that they would cover the loss if intermediaries such as Swissquote were to commit fraud. I remember inferring the same from T&C a while back but I don’t have the relevant passages to quote.

Could you please elaborate what you mean, and if possible, substantiate your claims?

My immediate reading of this paragraph would make it entirely false, but it’s hard to state confidently because each sentence could have multiple interpretations.

@cray: Your post is kinda all over the place, so I’ll refrain from answering further (and I do agree with your main point: Expensive isn’t necessarily better). But: Jingoism? Had to look that one up (apparently: extreme nationalism, marked by a hostile foreign policy), so let me just clarify that my post was in no way a call to invade the US to dismantle IBKR in favour of our most precious Swiss Banks. ![]() Besides, I believe the myth of safe(r) Swiss Banks is long gone, certainly after CS imploding last year.

Besides, I believe the myth of safe(r) Swiss Banks is long gone, certainly after CS imploding last year.

I see you still dream of your potential 10-figure net worth ![]() ? It’s a nice summary, I give you that, but us poor retail folks don’t have the option to buy a bank or a majority share in an actual exchange (and somehow improve the security of our assets that way). We can only choose between a licensed broker, a fully licensed bank, or a non-licensed third party. And as such, I uphold the practical advice of not choosing the non-licensed third party, app-only fintech.

? It’s a nice summary, I give you that, but us poor retail folks don’t have the option to buy a bank or a majority share in an actual exchange (and somehow improve the security of our assets that way). We can only choose between a licensed broker, a fully licensed bank, or a non-licensed third party. And as such, I uphold the practical advice of not choosing the non-licensed third party, app-only fintech.

As in they confirmed this to you specifically in a legally binding way upon request? Even if so, I don’t think it improves the overall loss risk for you in any meaningful way. If a SQ employee defrauded just you personally, obviously both SQ and if necessary PF would be liable to cover you anyway. If SQ as underlying broker would collapse entirely because of an internal fraud (think Wirecard where one third of the balance sheet was just made up) neither SQ nor PF will have the funds to compensate you, despite any assurances they may hand out now.