Has anyone tried to invest in RSP? It’s an equal weighted ETF for s&p 500. It should be “tilted” on small caps compared to others, since everyone get the same weight.

Why invest in this type of fund? If you would like smaller caps, just buy a small or mid cap fund

??? SP500 is a Large Cap index by definition.

It could potentially protect you when a larger sector rotation takes place (eg away from the crowded tech stocks) and provide actually quite a bit of extra upside in that case.

Sorry, I meant smaller Large Cap then. Not small cap.

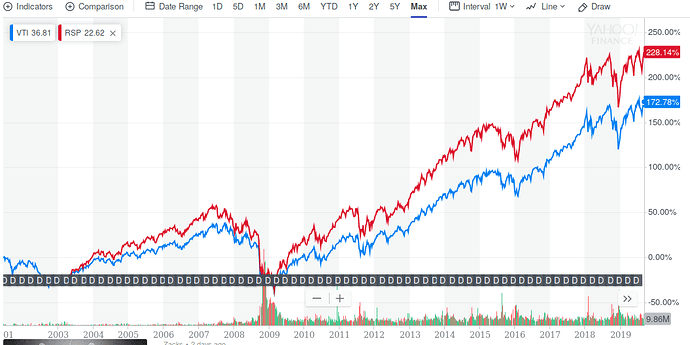

This could be a reason:

I thought about it when I was discussing about the SMI, which is too much concentrated on 3 stocks. In a sense, VTI is also heavy on Tech, of course with different percentages.

Some folks think the rotation from growth to value has just started: https://thefelderreport.com/2019/09/11/why-values-long-slog-may-finally-have-ended-along-with-the-bull-market/

Is that chart total return?

VTI vs. RSP vs. VB is almost non-distinguishable in that tool

It’s from yahoo finance. I have no idea. Also they don’t have data older than 2005.

Edit: I don’t understand how is possible to have two so wildly different charts…

I don’t think yahoo finance would show total returns by default.

I think this link refers to yahoo’s API data and not charts, but I am not sure. ![]()

it should be the same though