In 2015 i was curious about True Wealth and opend a Test Account. I trust them that the test account is idendical as I would invest real money. So I have data from 2015 till now.

From 2015 till end of dec. 2018 the account was on the “True Wealth Optimized Allocation” with:

|

Cash |

|

2% |

|

Bonds |

|

4% |

|

Real Estate Investment Trusts |

|

8% |

|

Natural Resources |

|

13% |

|

Equities |

|

73% |

This is the highest risk I could get with True Wealth according to their analysis.

From end dec. 2018 till now I discovered that you can choose your own allocation which I did. So from dec. 2018 I have now this portfolio:

|

Cash |

|

3% |

|

Bonds |

|

0% |

|

Real Estate Investment Trusts |

|

0% |

|

Natural Resources |

|

0% |

|

Equities |

|

97% |

I can’t get higher with the stock percentage.

My returns are the following:

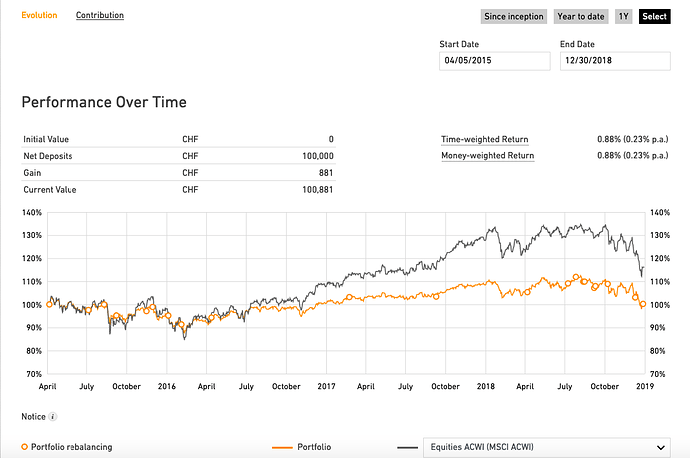

From 05.04.2015 till 30.12.2018 with the above mentioned “True Wealth Optimized Allocation”

I got this result:

Not so great compared to the MSCI ACWI (Is similar to VT)

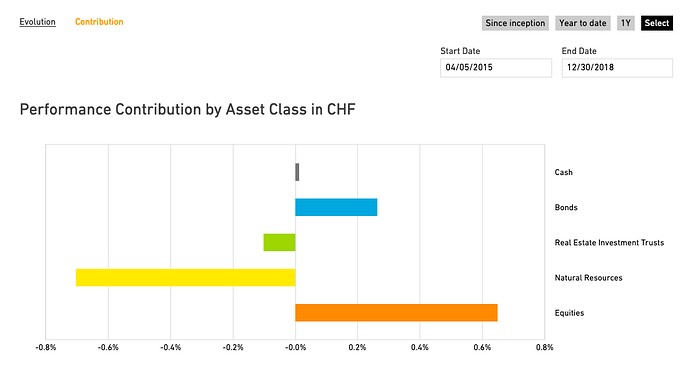

And here are the details:

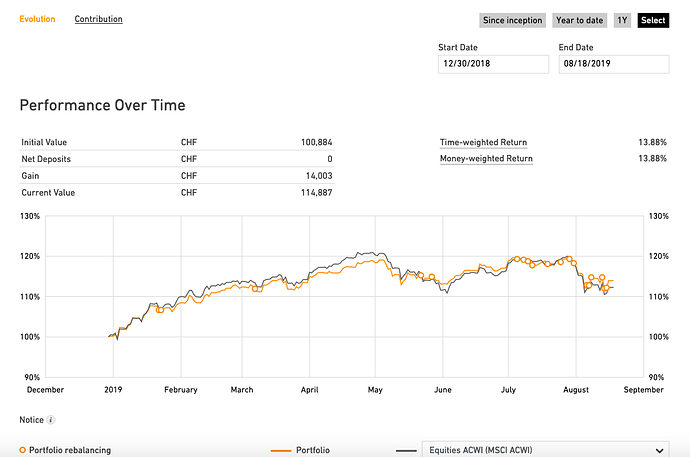

From dec. 2018 till now I’ve switcht to all stock portfolio. It should be better, right? Yes, it is better, but not so as I expected:

My return since inception is 14.89% (3.23% p.a.)

My conclusion: True Wealth seems to be ok if you put everything into stocks, then it performs well. The main selling point of True Wealth, the automatic rebalancing of the standardmix with Stocks, Bonds, Real Estate and Natural Resources didn’t pay of, at least for me.

I’ve run this test account to see how it performs, and for me it shows that it isn’t worth the 0.63% TER.

VT is cheaper and has simalar results as True Wealth.