I would put 100% in a CHF Cembra Kassenobligation for 1% and call it a day

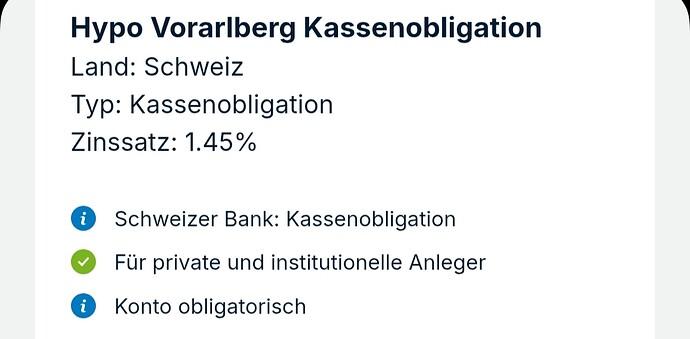

Looking at Moneyland I found a CHF Festgeld for 1.4% / 10y in Austria but there will be additional risks I can not assess.

Also holding Obligationen in CHF with a maturity of 8-10y are an option. I have seen that there are Obligationen in CHF issued by countries like Japan and Sweden.

Using 4% rule, 80k should provide around 3200 per year, which is well below any reasonable level of expenses.

The first step would be to figure out what kind of pension from both countries she can get. I don’t understand, did you say she is in Switzerland for 2 years and can expect 1000 CHF from AHV? It doesn’t fit my understanding of how it works.

My understanding of the situation is following: she should keep these 80k in a checking and savings accounts and use them for own expenses. I don’t see any point in investing, maybe some bank mid term obligations. Once these money are used up, it’s you and other relatives who should support her.

Edit: sorry, do you expect her to continue working?

Hi!

did you say she is in Switzerland for 2 years and can expect 1000 CHF from AHV?

Yes, around that amount… Or at least that’s what the simulator says, I hope it’s reliable! The assumption, as mentioned above, is that she keeps working until retirement (in 9 years from now) and contribute to the 1st and 2nd pillar.

I don’t see any point in investing

I disagree. She’s not retired yet (she’s 56yo), currently working and making her own living so this 80k are basically “available” for investing. I simply don’t think putting them in the stock market would be appropriate, given that it’s basically the entirety of her savings and that she will probably need this (or rather, part of this) money in 10-15 years from now. Also, very important detail, she doesn’t want to invest it in the stock market either, because she’s too afraid to lose it ![]()

Apologies, but I don’t think I understood the point of your comment.

Right now there is zero investment that will yield at least 10% just to beat unofficial inflation.

That’s not what I asked about though, is it?

Nobody does, ignore the troll.

Hello again,

I was confused and distracted by some comments in the thread ![]() , sorry for misunderstanding.

, sorry for misunderstanding.

Working and contributing to AHV in Switzerland for 11 years will give her a quarter of max AHV pension. So around 5-6k CHF per year or around 500 CHF per month. I don’t know how you came up with 1000 CHF.

For other things, I also suggest to stick with CHF as base/reference currency. It is clearly less depreciating and susceptible to various problems than EUR and USD.

For further advice, we would need to know

- permit B or C?

- canton of residence.

- how much she earns.

- how much taxes she pays.

- how much she saves

- marginal tax rate.

- other existing savings: 3rd pillar, pension fund.

Ok end of the thread. According to your laste sentence there isn’t much to do. You can close this thread.

You can search the thread about bank account with best rates.

Wow, ok man, chill. Didn’t mean to bother you ![]()

What’s her stance on crypto and NFTs? ![]()

Ahahah you got me wrong.

It’s just an observation. You will get 1000 of slightly correct answers here. Mostly correct. 99.99% perfect.

But at the end the slight issue is that she doesn’t want to invest in stocks. So most of the stuff you are going to read is useless.

Summary either:

- take the role of the “bank”

- invest in REIT (you might buy parking spots, seriously not always a bad idea)

- Bonds

- Bank accounts

I’d still +1 @Dr.PI and others, depending on situation a 2nd pillar buy-in can make sense as well.

To add to that as well as to point out where to search, several factors have to be considered but the actual number can be assessed through the OASI tables. The first part allows to determine which table should be looked at, then the tables let associate which pension would come with what contributions:

https://sozialversicherungen.admin.ch/de/d/6850/download?version=16

For 11 years of contributions, the standard table would be the Skala 11. For a single (divorced) person, the OASI old age pension would go between 306.- and 613.- per month (on 13 months so between roughly 4k and 8k per year).

The simulator used probably doesn’t take into account that she didn’t participate into OASI before coming to Switzerland.

You’ve probably already done it but in order to get a complete picture, you’d also have to assess what pension she can expect from Italy, as well as if there are other venues to explore as to what she should get as a result of the divorce and/or household tasks she may have performed (there is an OASI bonification for taking care of the children, in Switzerland, there may be similar things in Italy).

Edit: outside of the situation you are planing but if she stays resident in Switzerland, she may qualify for Complementary Benefits from OASI. You’d have to check if that’s a course of action she may be pursuing (if going back to Italy is set in stone, then it’s not worth it: they apply based on residency).

Personal finance is not limited to investing in stocks, so please avoid unhelpful extremism ![]() .

.

P.S. I am leading the OP to exploring if 3a contributions, even to a cash account, make sense in his mother’s situation.

After doing a bit of searching myself, more about the complementary benefits from OASI (applying only if she decides to stay in Switzerland for her retirement):

In Italian: http://www.ahv-iv.ch/p/5.01.i

In French: http://www.ahv-iv.ch/p/5.01.f

In German: http://www.ahv-iv.ch/p/5.01.d

Check the wealth and income thresholds and dive a bit deeper into the health costs coverage to factor into her decision and your advice. If pursuing them is part of your planning, make sure she can apply for them and check if there would be additional restrictions based on her personal situation (I can’t guarantee it as I haven’t paid attention to the situation of people having contributed to the Swiss OASI only for a part of their adult life).

Oh yes. I forgot pillar contributions to my list.

I still believe that sometimes a summary does help. We keep going tangential to the topics and it might make the thread helpful just once instead of being readable also for other similar cases.

Considering all circumstances I would probably use the pillars 2 and 3a.

For the first 5 years I would spend each year 16.000 CHF by contributing the max amount of 7.xxx to 3 a and the rest 8.xxx to pillar 2. Each year you should use a different pillar 3a account.

In 5 years she should be old enough to retrieve pillar 3a. Then she can each year close one 3a account and invest the money in her pillar 2 account.

Totally agree and let’s not forget that the max AHV takes into account an average salary of approx CHF 90’000 per year.

If the average salary over the working period is less than that, the pension will be reduced accordingly

Also depends on taxable income and if they’re taxed at source (which is why those questions were raised earlier).

Does it even matter? If you expect a comparably low pension and have some savings, and a high risk avoidance and low knowledge to invest (compared to many users here, not necessarily representative for either CH or IT), an average pension fund might be just the thing, even if your one-time tax savings are very low.

With 3a, she’d still have close to 0 return, or a direct investment risk (which she seemingly doesn’t want), but with pillar 2 she doesn’t.

Plus the option to get the pension, whether it’s 4% or 6% conversion in 10 years, or (partly) withdraw in case there’s higher cost e.g. for renovation etc.

Ma0’s comment above does sound harsh, but most things have been said in here.