Dear all,

I’ve been following the discussions here with great interest. As I’m currently planning my retirement, I’d like to share my thoughts and get your feedback.

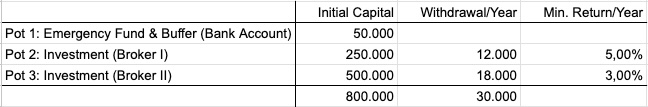

In addition to the default income sources (e.g. AHV), my goal is to generate an additional monthly income of CHF 2,500 over the next 30–35 years (the goal is CHF 30,000 per year and I do not need to preserve the capital. So at the capital can be zero). For this purpose, I have today CHF 800,000 available, which I’d like to divide into three pots.

- Pot 1: CHF 50,000 in a cash account, serving as both an emergency fund and a buffer to bridge up to two years of potential financial crisis.

- Pots 2 & 3: The remaining CHF 750,000 would be split one-third / two-thirds between two different brokers for an extra layer of security.

According to my calculations, investing CHF 250,000 at 5% and CHF 500,000 at 3% should sustain my plan for 30–35 years. Each year, I would sell resp. transfer CHF 30,000 to the cash buffer. Btw, I used an inflation-adjusted calculator (here) assuming 2% inflation for these projections.

What do you think of this overall setup as a retirement structure?

How would you approach the investment selection to achieve the targeted yields while keeping safety in mind?

For the CHF 250,000 portion I was thinking:

- CHF 100,000 → UBS ETF (CH) SPI® ESG (CHF) A-Acc

- CHF 150,000 → Vanguard FTSE All-World UCITS ETF (USD) Accumulating

The CHF 500,000 portion I find more challenging. Swiss government bonds currently yield very little, so my idea was to just replicate something like the “VIAC Schweiz 40” strategy, which typically returns 3–4% per year and is considered relatively conservative. But this strategy then consists of like 10 separate positions what I find complicate to handle (rebalancing and yearly selling).

I’d greatly appreciate your opinions, experiences, and suggestions on how to refine this plan and balance risk with return.

PS: Sorry I forgot to mention that as I am planning to maybe live a few years ourside Switzerland I won’t be able to use the newly available VIAC/Finpension “Invest” products (they all now propose customized invest with withdrawal plans, what would be ideal for my situation)

Many thanks in advance!