Has anyone considered retiring there? I don’t need to learn a new language, weather seems pretty mild. I never really considered it before as it is so far away.

Haven’t thought about it myself, but if you do, make sure to include the capital gains tax of Canada (tax on 50% of your annual capital gains up to $250,000) in your retirement calculations. ![]()

I am planning to go to Ladysmith and live with my childhood sweetheart Pamela Anderson ![]()

![]()

Ain’t it very expensive? All in all it’s supposed to be a great place according to a friend who lives in Calgary, Alberta (not a great place in any way according to him, but he’s paid extremely well as he’s an engineer working in oil), but among the most expensive provinces along with Ontario and places in Quebec.

Got a Canadian friend who’s a newfie who says there’re great deals to be found in amazing places in Newfoundland, but you’ll have to cope with brutal weather ![]()

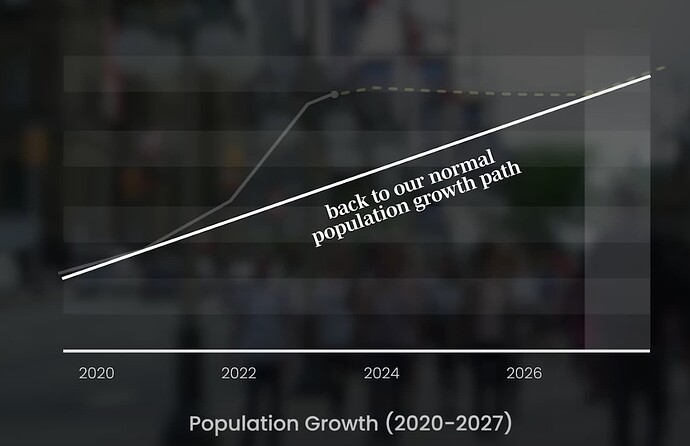

And don’t forget the global warming. Might be a nicer place to be in 20 years than now. Applies to whole Canada.

Though it could also lead to more extreme weather (esp. if there’s a breakdown of some of the circulatory systems like gulf stream, so more polar vortex in winter, more heat in summer).

I’d only consider places like Victoria where the weather is mild.

I never heard of Canada discussed as a retirement destination and wondered why. Is it the cost (not the cheapest), cold weather, something else?

I guess central Europe is closer and cheaper, though not necessarily safer and more comfortable. Southern Europe is also closer and cheaper. Classical vacation destinations like Thailand are like permanent vacation ![]() .

.

Looks like Canada is having some issues lately: Tara Henley: What happened to Canada? - The Hub

There is even a service to help people who want to leave Canada: Are you ready to leave Canada? - The Wandering Investor

Leave Canada is for you if…

- You’re independently wealthy or have passive income and want lower taxes and a better quality of life abroad.

- You’re an entrepreneur with a location-independent business or anticipating the sale of your business.

- You’re a homeowner looking to sell your home and explore the world during the housing bubble in Canada.

- You’ve received or are expecting a significant liquidity event and wish to maximize it and improve your lifestyle.

- You’re motivated by political reasons, seeking personal freedom, or simply want to diversify globally.

Having visited Canada (East Coast), I can say that when talking to locals, most of them mainly mention the soaring rents and house prices, as well as the high inflation rate. Generally speaking, it seems that Canada is developing very rapidly, but the quality of the work carried out is often poor, requiring additional efforts to complete the initial projects (real estate). It also appears that the healthcare system is very complex; for instance, if you need to see a medical specialist, you often have to wait months for a first appointment.

Interestingly, during the last few weeks Youtube has thrown at me some “what’s wrong with Canada” material (both economic and social/political).

Here’s one:

I suppose if you mostly only have VT (etfs) you could maybe sell them in early December, and move to Canada in early January. That way you pay swiss taxes (0% capital gains that year), and then rebuy it all back when in Canada the next year.

I guess if you hold other assets (international / swiss real estate, etc.) it would be more complicated.

OMG. I can’t believe how incompetent politicians are. If you plan to bring in tons of immigrants, you need to build out the infrastructure in advance to avoid inflation and social problems.

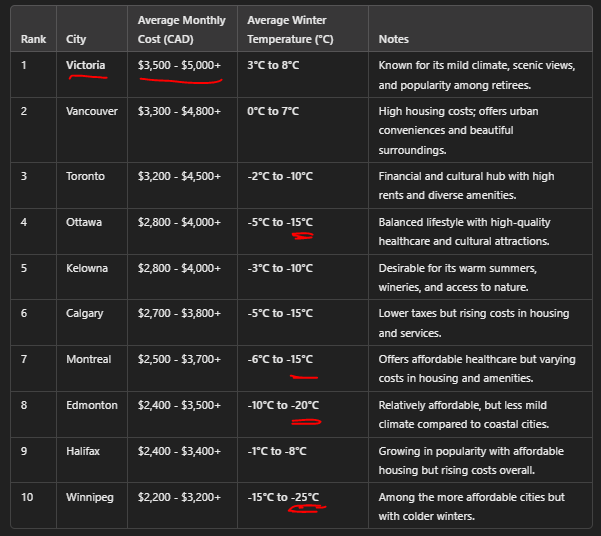

From GPT

Sounds like Victoria is the “first class” of Canada for retirement, good choice @PhilMongoose. ![]()

With the CHF so strong it might not be so bad ![]()

I don’t think many retiree’s could survive the winter in Winnipeg though ![]()

Also by paying monthly for health care premiums (Switzerland), the costs seem to be more transparent.

Waiting for care (Canada) is probably extremely unfortunate for the person and their families (as well as the medical teams trying to keep up the service levels)… that is definitely something important to consider for retirement.