Note: people would also declare the gross dividends instead of post WHT, that’s a 15% increase at the marginal tax rate.

Just read recently about a start-up (growth stage) who wants to specialize on claiming back the WHT: Streamlined refunds of foreign withholding taxes on dividends | Divizend

Huge respect. It is a great project.

Lot of people here do not want to own US ETFs but choose them because of lower WHT.

I believe following needs to happen

1- We find a way to check what would take tax authorities to accept these reports ? Perhaps someone on this forum is a lawyer/tax expert

2- How can we support you to get the information you need

I think the buy/sell of ETF is always going to be individual, so you don’t need to worry about it.

But what is important is what was the holdings of ETF on a daily basis because ex-div dates for each stock is different.

amen

Easiest would just be to ask the respective tax office.

The json for the holdings (quarterly) for the iShares Core S&P 500 UCITS ETF would be this one. In the ETF you can just change the “As of” Holdings date and get the URL from the Dev Console.

Yep, that’s one of the biggest problems I’m at right now. The percentage of daily holdings. I don’t know if quarterly is good enough. The outstanding shares, etc you can get the daily history through the Excel.

Yooo, WTF.

Seems like I can get the daily holdings through a bit of sneaky way.

![]()

Instead of using the predefined dates on the website (quarterly) just write the date you want in the URL and get the holdings for that day. I’ve got to investigate a bit more, but seems to be working for me.

Now I have finished the code to scrape literally everything from iShares ETFs. I can scrape any of their ETFs within 30 seconds now, including daily holdings.

Apart from that, I’ve now hit kind of a mental roadblock on how I want to tackle the reporting, because I think it wouldn’t matter how many shares you held at any Ex-Dividend date for a specific stock, right? The only important thing is how many shares you held at the Ex-Dividend (or payment for accumulating) date of the ETF.

So, I’m using the SP500 UCITS ETF and the payment date is 31st of July (financial year end) with gross return of 5.066. The only imporant thing for me to know is how many shares I held of the ETF at that date, right?

I can discard any information about my holdings (for my calculation), except the amount of shares on the ex-date/payment date, being the 31st of July.

This would also mean, that I can only show dividend payments up to the 31st of July, because after that you haven’t received any money from the fund. So for 2023, all the dividends I would have to show are from 31st of July 2022 up to 31st of July 2023 or something like that. And for the next year the same again, just with the year increased.

Am I missing something?

I think it is a bit complex.

IUSA is distributing dividends once a year but IUSA is collecting dividends from underlying companies on different days during the year.

So I believe what is needed is following

- how much dividend did ETF collect from its underlying companies

- how much dividends were lost in that process

- This means for an ETF to lose tax in US , it needs to be holding the underlying stock on the date of dividend for that stock.

So to make it work, we need to have daily holdings of the ETF and then if the ETF was holding for example MSFT on the day of ex-div MSFT, then dividends of MSFT will count and so does the tax loss.

If for whatever reason ETF was not holding MSFT on the day of ex-div MSFT then the tax was not lost.

Do you have all this data already for 1 Aug 2022 to 31 July 2023 ?

Here is the ETF (not all dividends in here, because Pastebin has a file-size limit): { "Name": "iShares Core S\u0026P 500 UCITS ETF", "Accumulating": true, - Pastebin.com

It contains:

- valor, isin, name, taxable value, gross return of the ETF

- all underlying payments information from it’s equities (gross amount, company info, how many shares of the company, how many outstand shares in total the ETF had at that date). Everything for the year 2023, according to ICTax. If something is missing, then it’s probably because ICTax doesn’t have the data.

Sorry for wall of text, I really tried to analyze and solve the problem in depth.

Analyzing the problem

Don’t let yourself be blocked by uncertainty. You can put the uncertainty in a function and implement the more likely (or easier) case first. Ask questions in parallel. If it turns out that the other possibility was correct, you just refactor the implementation of this one function. The rest stays the same, so you can nearly finish all the work without knowing everything.

The question itself seems hard to answer, since normally ex-dividend and payment are tied together.

From a theoretical market view, the stock price loses the dividend amount on ex-dividend. Now this future dividend is owned by the ETF (and owed by the company). So, the ETF price shouldn’t change, even though the underlying price dropped by the dividend. If the ETFs creation and redemption process accounts for accrued dividends, I don’t know.

From the perspective of the tax administration, it seems the payment date is tax relevant. I couldn’t find any regulation, but the data you provided included the “Allstate Corporation”. Their dividend had the interesting property that it went ex-dividend on 2022-11-29 but was paid on 2023-01-03. ICTax now says this was taxable in 2023. So that is a good indication that the payable date counts.

This means that ex-dividend matters for the ETF and payable date matters for tax (but only for what was accrued on ex-dividend, because only that will actually be paid).

So both are important.

Let’s work backwards:

In the end you want to know per share of ETF for each day per country:

- gross dividends

- tax withheld (see complications #2)

For “gross dividends” you need to know at payable date:

- total ETF shares

- total gross dividends (per country)

For “total gross dividends” you need to know for each day per ISIN:

- total shares going ex-dividend

- gross dividend per share

- payable date of the dividend

- share domiciles

Edit: After getting gross dividends and tax withheld, you could additionally product-sum with the shares of ETF held each day to get a yearly number (per country).

Complications

#1

Tax can be withheld and then released afterward. For example, many ETFs announce the split of their own distributions between ordinary income, short-term capital gains, long-term capital gains only after the year has finished. Since capital gains are not subject to withholding taxes, your broker should get those back for you (and IBKR apparently does).

But if this happens inside an ETF, it could be that tax was withheld, but you sold the ETF before they got it back.

But capital gains are not taxable for natural persons in Switzerland. You just got tax credit on capital gains, but actually paid normal income taxes on it (and also raised your tax bracket). So you paid more taxes than you should have and that shouldn’t irk the tax administration too much.

Conversely, if you buy an ETF and then it gets previously withheld taxes back, you don’t pay taxes on that, because it is capital gains.

But all of this doesn’t hold if you are a legal entity.

#2

Looking at the data and your link, you don’t know what was actually withheld. You could try to apply (to the gross dividends) the lower of the two DTAs (Switzerland-ShareCountry and ETFCountry-ShareCountry). But while you will not pay too few tax, it is also not hard accounting data.

The ETFs could calculate the needed numbers (gross dividends and tax withheld) much easier. They have all the accounting entries.

So basically what you are suggesting is that this exercise becomes much easier if ETF provider can share the data on following

- dividend collected during the financial year (broken down by underlying ISIN)

- tax withheld for those payments

The question is how can one get this information? As an investor in these ETFs, can we ask for this information?

I did send a note to ishares seeking this information for their ACWI ETF (SSAC). Let’s see what they say. Maybe they will not even respond ![]()

I think the best ETF to find this info might be FWRA. They are trying to grow and seeking various partners. If they can provide these reports, then FWRA can become interesting for Swiss residents vs VWRL and also a very good alternate to VT……

Good thinking.

I wonder if you @oswand have made any progress on your interesting project?

Has anybody already tried reclaiming withholding taxes for past years using this method?

Unfortunately, I didn’t continue. I reached out to BlackRock Switzerland and asked them if they could somehow give me information about the underlying dividend payments, but they wouldn’t make that data available to me.

Through trial and error I might come to the same dividend amount the ETF pays out. With that I would then have a working solution, maybe look into it in the future once I have more time.

Hm, maybe BlackRock doesn’t. But maybe others will?

Edit: Also they do produce reports about the applicable foreign withholding taxes inside the fund. They do so for the US and the German tax administration (as I’ve just found out). Although they don’t do it by country, but as a lump sum by the relevant laws, which has to be more complicated actually…

So another avenue would be ESTV directly. They also get all kinds of other data from the bigger funds.

So for example ETF like IUSA reports how much tax was withheld in US for dividends ? I didn’t actually see that in reports.

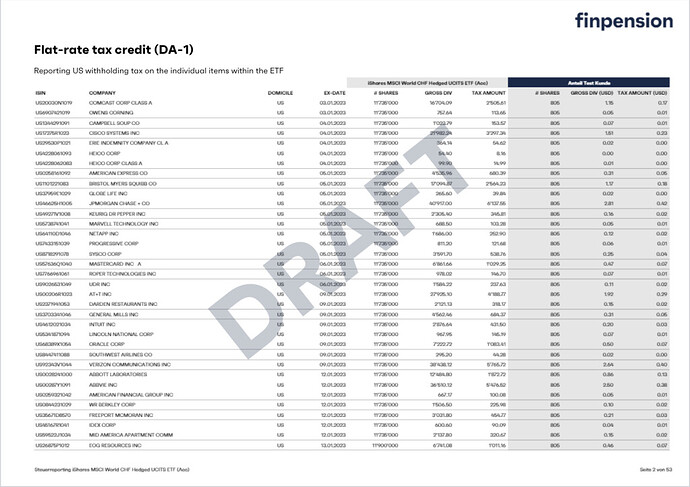

The data I need are all the dividend payments from the underlying companies, e.g. from the SP500 etf. If I get to the exact amount, the fund paid out I can then generate the report similar to Finpension.

I was not precise enough with my wording. I’ve slightly edited my comment.

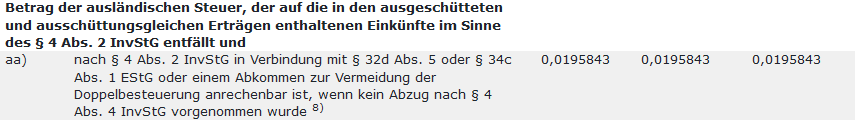

If you go to bundesanzeiger.de, you can search the publications. E.g., searching for “IE0031442068” (IUSA), you get “Bekanntmachung der Besteuerungsgrundlagen gemäß § 5 Abs. 1 Investmentsteuergesetz (InvStG)”. Find the section of IUSA, and within:

There are other kinds of reports containing such information.

Don’t you need the gross dividend and withholding taxes paid by country? For a single-country ETF you could just add taxation (which nearly all annual reports have) to the ESTV net dividends to get the gross.

What the fund providers do for the USA and Germany, is that they calculate the total deductible foreign taxes according to the laws of the USA respectively Germany (like this it doesn’t need to be by country). Why couldn’t they do it for ESTV?

Finpension reports it on company-level [1]

If it could just be achieved on country, level it would be very easy, indeed.

Well, the USA and Germany even accept a single number (not by country). I don’t see why Swiss authorities couldn’t, if it was calculated correctly.