Hi all,

TL;DR below.

I received €200,000 inheritance into my German bank EUR account due to my parents’ passing and I’m preparing to invest it long-term into one single global equity ETF — passive, diversified, buy & hold.

I’m weighing two practical options:

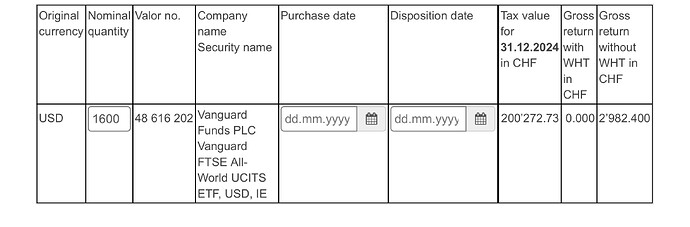

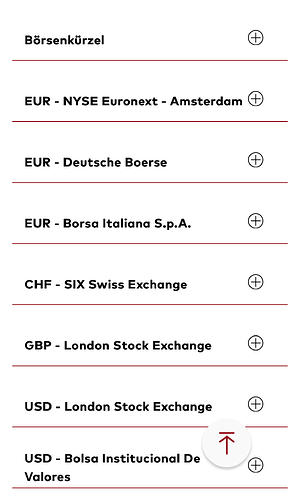

1. Keep the funds in Germany, use a German broker (e.g. my bank DKB) to invest in VWCE (Vanguard FTSE All-World UCITS ETF, accumulating, EUR-denominated)

2. Transfer the money to Interactive Brokers, convert to USD, and invest in VT (Vanguard Total World Stock ETF, USD-denominated, distributing)

Some personal context:

I’m 50 years old and I currently live in Switzerland (wife is little younger)

However, a large portion of my spending is in EUR, due to regular business travel

In 10–15 years, I may (or may not) retire in the Eurozone, so future expenses might be fully EUR (or may not be)

My goal is global diversification and long-term simplicity

Option 1: German Broker (VWCE – EUR)

![]() Low TER (0.22%)

Low TER (0.22%)

![]() Accumulating — no dividend reinvestment hassle

Accumulating — no dividend reinvestment hassle

![]() No FX conversion costs

No FX conversion costs

![]() Matches my current EUR spending and possible future EUR-based retirement

Matches my current EUR spending and possible future EUR-based retirement

![]() Some potential tax/reporting friction being a Swiss resident using a German broker

Some potential tax/reporting friction being a Swiss resident using a German broker

![]() EUR/CHF currency risk if I stay in CH permanently

EUR/CHF currency risk if I stay in CH permanently

Option 2: IB (VT – USD)

![]() Broader global market exposure (VT includes small caps)

Broader global market exposure (VT includes small caps)

![]() Very low fees and spreads at IB

Very low fees and spreads at IB

![]() Can convert EUR to USD at minimal cost

Can convert EUR to USD at minimal cost

![]() Full control over FX timing (convert now or later)

Full control over FX timing (convert now or later)

![]() Matches IB’s strengths: flexibility and global access

Matches IB’s strengths: flexibility and global access

![]() Distributing ETF = dividend taxation might get tricky (esp. in CH)

Distributing ETF = dividend taxation might get tricky (esp. in CH)

![]() USD exposure — not my spending currency today or possibly in retirement

USD exposure — not my spending currency today or possibly in retirement

My current thinking:

While I do live in Switzerland, my spending is EUR-heavy now, and could be entirely EUR later. That makes VWCE via a German broker the cleaner choice today — no currency conversion, accumulating ETF, aligned with my lifestyle.

That said, IB + VT gives me flexibility and access to broader exposure, but introduces USD exposure and dividend complications.

In summary, I very much prioritise simplicity over the pursuit of marginal returns.

-–

TL;DR:

I’ve got 200k EUR. Should I:

→ Invest in VWCE via a German broker (no FX risk today, clean accumulation)

→ Or invest in VT via Interactive Brokers (more flexibility, but USD exposure + dividend hassle)?

Who’s been in this boat — or jumped ship and regretted it?

Thanks for your input!