Hi Everybody,

I’ve been looking at QYLD and it looks really interesting as a income/yield strategy. however I’m wondering how it’s taxed in Switzerland? is anybody investing in QYLD and has figured out how it’s taxed? maybe already in the 2020 tax declaration?

For those who don’t know QYLD, https://www.globalxetfs.com/funds/qyld/

- it’s a NASDAQ 100 covered call ETF, TER 0.6% (TER it’s not great, but it compensates on the monthly dividend). it follows the BXN index, https://www.nasdaq.com/market-activity/index/bxn

- it has 12,75% dividend. this is based on the last 12 trailing month, it pays dividends monthly. Basically 100K worth of QYLD will pay 1K monthly dividend

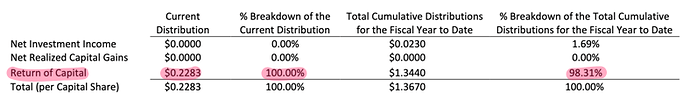

- And it pays most of the dividend as return of capital. Because most of the dividend is coming from writing covered calls. image below from Aprils 20th dividend payment https://www.globalxetfs.com/content/files/19a-notice-QYLD-4.19.21.pdf

From what I understand 1.69% is the NASDAQ 100 dividend, 98,31% is the income generated from the covered calls.

If the dividend is return of capital then it should not be taxed in Switzerland. When you put that together with a 12% dividend yield it looks really interesting. Thus I was wondering if anybody is clear on how taxes work for it.

If the return on capital is not taxed in Switzerland, i’m seriously thinking on buying some. I might even use IB margin to buy it.