Inspired by @finalcountdown’s recent post and other stories from fellow mustachians (hi @elmago), especially in this “Share your story” section, I thought I’d share where I stand with this whole FI(RE) thing.

I got interested in FIRE around 2015–2016, at a time when I had a significant change at work that took away much of the “enjoyment”. That was the trigger! ![]() I started looking seriously at our family finances and realised that, continuing as we were (lifestyle inflation

I started looking seriously at our family finances and realised that, continuing as we were (lifestyle inflation ![]() , saving a bit here and there, but nothing structured), I would never be in a position to take strong career decisions. I decided that I needed a certain amount of FU money !

, saving a bit here and there, but nothing structured), I would never be in a position to take strong career decisions. I decided that I needed a certain amount of FU money !

I started following MMM, learned the basics, and began saving more deliberately, without depriving the family. One thing we always valued – and still do – is travelling, especially to less developed regions. We wanted the kids to experience different cultures and ways of living. We never cut back on that. My wife was never fully onboard with the FIRE mindset, but ‘tolerated it with patience’…![]()

In the meantime, I changed jobs and found some stability, at least initially. But the FIRE “obsession” (maybe that’s the right word - for me at least) had already taken hold. Even when things were fine, in the back of my mind I was counting the days until I would reach a number that felt “safe enough” to pull the plug.

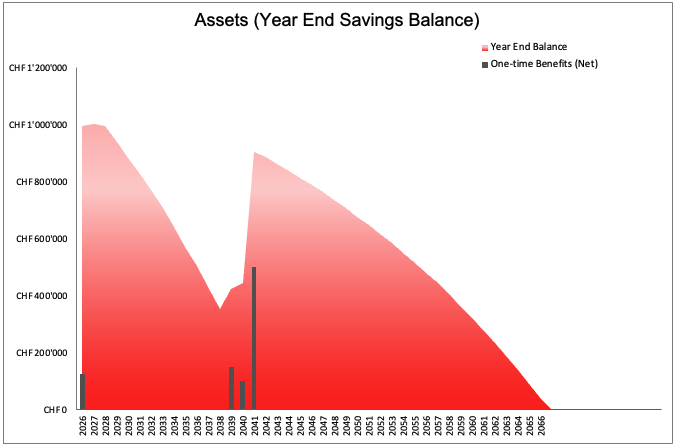

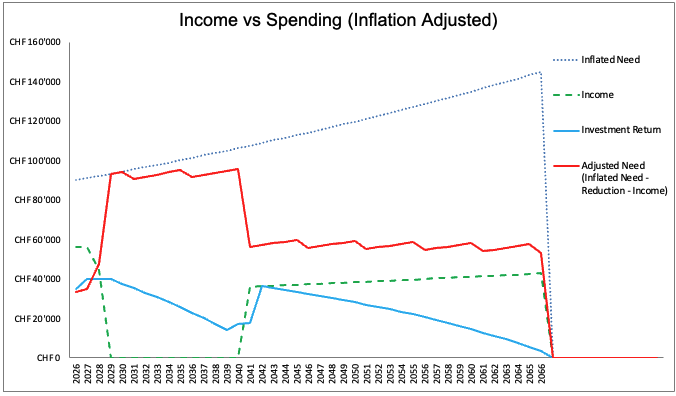

I never really thought in terms of SWR. Quite quickly I realised that, given our income, family situation, and the thousands of “what if” scenarios I could simulate, I was unlikely to ever reach a net worth where any “safe” withdrawal rate – neither 3.14% nor 0.0001% (let alone the infamous 4% rule !) – would make me feel fully comfortable. So my thinking drifted more toward a “die with zero” type of approach, even though I only read Bill Perkins’ book a month ago.

Over time this turned into endless retirement calculator simulations. Changing assumptions. Adjusting parameters. Seeing if I could shave off a few months…

Fast forward to 2026. Our net worth today – also due to some extraordinary (although planned and enjoyable) expenses in the last couple of years, which meant we saved almost nothing in 2024 and 2025 – is still way below what I once thought would give me confidence. But the target was never stable anyway, because the assumptions kept moving…what did grow steadily was the mental pressure.

The focus slowly shifted from FI (which was originally - for me - about optionality) to RE as an escape. Combined with decreasing job satisfaction and the feeling that I couldn’t easily change direction because of family “constraints” (kids still in school, mortgage, responsibilities), the stress increased. In the last couple of years I started feeling anxious at the beginning of each workday. And worse, I was bringing that negativity home. My wife (a saint !) had to patiently listen to my continuous “rants” and “psychoalanlyse” me every second day ! ![]()

Recently, a few serious illnesses among people in my neighbourhood – same age group – acted as a catalyst. To protect my own sanity and avoid poisoning family life with constant frustration, I felt I had no real alternative but to pull the ![]() . I gave notice at the end of January. By the end of April, I will be jobless.

. I gave notice at the end of January. By the end of April, I will be jobless.

My wife works about 50%, with an income much lower than mine. It won’t cover all our expenses. So yes, we will have to start consuming part of our nest egg ![]()

My current plan is to “decompress” until the end of summer. Not really a sabbatical, but I won’t actively pursue jobs. I’ll remain available for small freelance assignments - if they come. From autumn onwards, I’ll see whether I can build some limited freelance activity to bridge part of the gap between my wife’s income and our spending. I’ll try to keep expenses under control, especially in this first year, and see how it feels to withdraw money, rather than accumulate it.

At this stage I don’t see myself going back to a full-time salaried position. In a way, the FIRE obsession has made me “unemployable” – at least mentally.

In a couple of years, once the kids are closer to finishing their education or have chosen a direction, the idea would be to travel more extensively. Until then, while my wife continues working, I’ll have to figure out how to use my time meaningfully. And also observe how the portfolio behaves – because, as always, Mr. Market will have a say ! ![]()

![]()

![]()

More than anything, I hope to relearn how to enjoy “today”. For years, each passing day felt like one day closer to RE. At the same time, it was also one day of life gone, one day older for the kids. Even tough my rational me could already recognise this, still I was continuously “waiting for tomorrow”…

I don’t have a clear lesson learned to share. I think this is highly individual, and depends on how each of us is wired. Even knowing what I know now, I’m not sure I would/could have behaved differently.

What I do know is that I’m grateful for a very patient wife and two wonderful kids. I’ve been lucky. The challenge now is to actually enjoy that luck to the fullest, day by day, instead of postponing life to some future number on a spreadsheet.