All that I know. I’m talking exclusively about the RE phase and what happens then. Higher costs for selling then for sure, you might make it up with automated reivestment during the acummalating phase of your wealth…

I probably pay like 3 CHF when I trade 40k, it hardly matters.

Though that’s not what the qojenniffa asked in his/her original post. ![]()

In any case, you can switch from one ETF to the other later on, if need be or the tax situation changes, i.e. before a new comes into force. Might Switzerland introduce a capital gains tax? Maybe. The Germans even did it retroactively. Kind of. Limitedly. Switzerland though? No way.

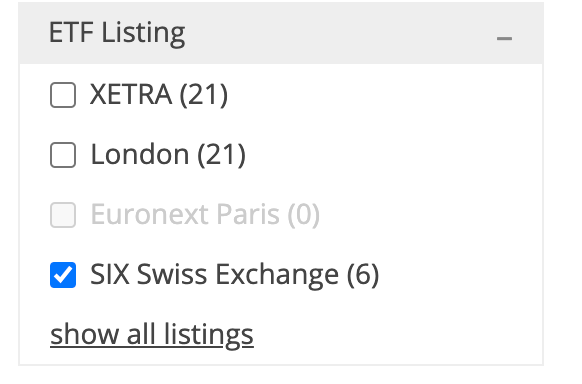

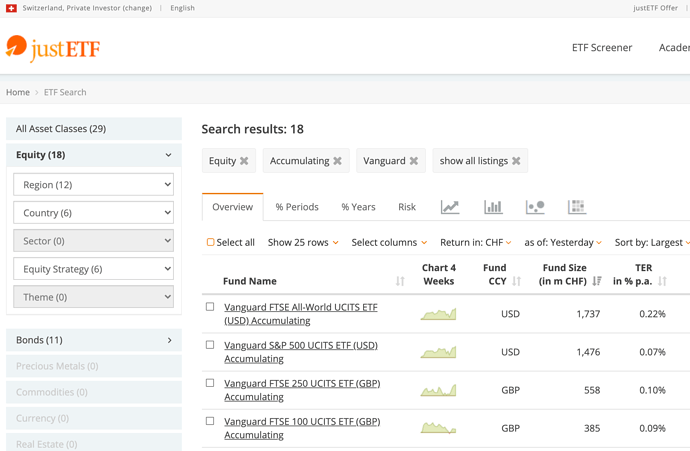

VWRA is not listed on SIX. You can make it visible on JustETF when you click “show all listings”

Then how does it work? Do you know 100% that there is no risk? I think @MUFC_OK raised a very good point. Once retired, if all your income comes from either dividend or selling your stock, you have two options. Let’s say you need 4% per year:

- option 1: 2% from dividend, 2% from selling stock. the capital gains from selling the stock are lower than 50% of your income, no need to worry

- option 2: since you own an accumulating fund, you need to sell 4% of your stock each year. Much more of your income comes from capital gains.

I think for a Swiss investor it’s just easier to invest in distributing ETFs. Since you do it periodically, you can just reinvest the dividend on top of whatever you planned to invest. The time not in the market is negligible.

It also makes it easier to rebalance over time. As long as you invest at least each quarter (best after dividend) you can put the money back in with your normal order.

I don’t think there’s any world where realizing capital gains when selling long term holdings is not “private wealth management”. The circular 36 even explicitly recognizes that dynamic management of wealth is allowed (so frequency of transaction doesn’t imply professional status).

The one clear thing that might be a trigger is using external financing (e.g. loans).

By the way the Circular 36 is fairly readable (chapter 4 explains how they would decide and the weighting of the criterias).

Searching around there’s some fun jurisprudence, e.g. 2C_389/2018 - 2019-05-09 - Finances publiques et droit fiscal - Staats- und Gemeindesteuern des Kantons Luzern 2014, direkte Bundessteuer 2014; where someone actually wanted to get the pro status (they had massive losses), when they were doing 88 transaction per year with 5M CHF. But since they were losing money they obviously can’t be considered professional ![]() (because professional would seek a profit).

(because professional would seek a profit).

You mean this thing?

1-036-D-2012-d vom 27.07.2012 (PDF, 254 kB, 12.05.2017)

Where do you find things like this? You read somewhere online or you did you stumble upon it at work? When I have a free minute, I will give it a look. Reading 8 pages of legal German is not my favourite free time activity ![]()

It’s easier for me since it’s available in my native language ![]()

The one thing I’ve found is that some cantons do publish some clearer guidelines, e.g. Bern: http://www.taxinfo.sv.fin.be.ch/taxinfo/display/taxinfofr/Commerce+professionnel+de+titres (less than 100 transaction per year gives you safe harbour)

That‘s good to know that our canton has this sorted out! So if you stay under 100 transactions and especially if you buy and hold as loads of us do we should be fine

What in life is 100% certain? There’s about as much 100% certainty in life as for the price of oil never becoming Zero (cause it costs money to produce oil, so it can’t drop below zero, can it?).

Otherwise the intention of the lawmakers and the interpretation of the tax authorities and the Swiss supreme court are pretty clear.

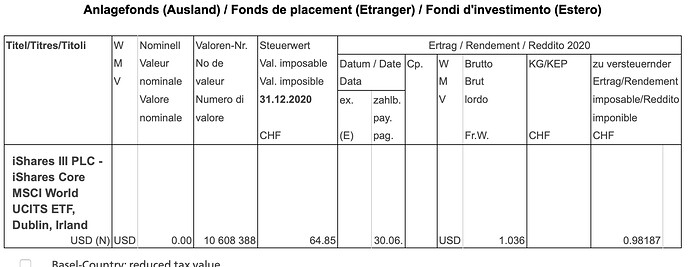

It’s just taxable income. Take a look at any accumulating fund (well, except VWRA, incidentally, cause they’re late reporting and it’s a new fund), and they’re taxable income:

…which will not be treated differently than in distributing funds.

Put differently: Not even today are dividends in accumulating funds treated as capital gains from a tax standpoint. For the very reason that this enables them to (transparently) tax them just the same as distributing funds.

I am using monthly investment plans to invest in ETFs. I’ll make 400 EUR payment to my broker - and the whole 400 EUR gets invested into the ETF I’ve chosen. It’s all automated, so I don’t have to worry about any remaining balance from dividends. Much easier than accounting for that each month.

If get 20’000 dividend and sell 22’000 (bought for 2’000 so capital gains are 20’000) then capital gains are 50%.

If I sell 42’000 (bought for 4’000, 38’000 capital gains) 20’000 of “virtual” dividend gets taxed. capital gains are 66%.

Not sure about the correctness of this calculation, but you see the problem? Anyway, maybe this circular 36 solves it.

No, can’t see it. But I just can’t quite wrap my head around the calculation:

Why would you buy different amounts or at different prices?

That doesn’t make for a reasonable comparison.

Also, there won’t be 38’000 in capital gains. A large part of “capital gains” in your example have arisen from dividend payments that the fund has received - which have already been taxed as non-capital gain income every year on your tax returns.

We know that the accumulated dividends in the fund are taxed as non-capital-gains - but instead as (or like) regular income. Every year.

And then after 20 years or something of holding the fund, when the investor will be selling it, you suddenly start considering them as capital gains for tax purposes?

Sorry, that has got no coherence whatsoever and wouldn’t hold up in a reasonable court.

Now, I’m not saying the Swiss tax system is always 100% fair. You could in fact argue that the distinction between tax-free capital gains and taxed distributions isn’t in itself. But saying something is something over the course of 20 years - and then it’s suddenly something else… that doesn’t make any sense.

Thanks for you reply ! I feel quite stupid that the answer was so simple…

Dear fellow amateur investors

I sell put options to generate income, usually on positions expiring in the next 4 to 6 weeks max; as a result i will have a high number of trades, each for small amounts.

Will the short duration of the options be seen as active trading by the tax authorities and therefore taxed on the assumption i behave as a professional trader?

The precise answer is : maybe

Trading of derivatives that goes beyond hedging risks of your investments is considered one of the main three criteria for professional trading, if the trading volume is sufficiently high relative to your wealth.

As you write you’re selling options to generate income, I assume it’s not just tiny volume to play around with and thus, classification as professional trader seems like a real possibility. However, there are many people who sell options without being classified as professional trader. I.e. see @REandSTOCK’s comment.

See also https://www.swisstaxlaw.ch/datenbank/kreisschreiben-nr-36-gewerbsmassiger-wertschriftenhandel/

It mainly depends on the canton you live in. Some cantons (e.g. Schwyz) are notoriously pesky and follow the already mentioned Kreisschreiben Nr. 36 very closely. The main problem is that the 5 criteria have to be fulfilled cumulative. By writing options, you are already violating points 1. and 5. in Kreisschreiben Nr. 36

You might be able to get away with it if you live in canton Zurich or Zug. Still, if the generated income writing put options is high enough compared to your annual income, you might be classified as a professional trader.

To elaborate a bit, if you fulfill all of the 5 criteria of the “Vorprüfung”, you’re guaranteed not to be classified as professional trader. However, violating one of these 5 criteria does not necessarily imply that you are classified as professional trader, even when the authorities strictly follow Kreisschreiben Nr. 36.

The 3 criteria (somewhat vaguely) described later on decide the classification: trading volume, use of leverage, and trading derivatives beyond pure hedging. The use of leverage is the most important criterion.

![]()

I agree. Thanks for elaborating more on the 5 criteria. Indeed, I should also have mentioned your points as well.

I met someone 2y ago during a meetup (not from this forum, but another one) who lived in canton Schwyz and just sold put options. He didn’t use leverage at all, but of course it was not hedging in his case (how can selling put options and earning the premium be counted as hedging anyway?), and yet still he was classified as a professional trader and had to pay capital gains plus AHV on his trading profits. I don’t know about his trading volume though. Unfortunately, I don’t have his contact details, but maybe I’ll meet him during the next month.

Thank you for the insightful comments Jay and FireStarter

Further thoughts:

- if one is classified as professional trader, then he /she will need to pay taxes and AHV only on the portion of Investments where the 5 rules are not met, or also in the rest of the investment universe of this person?. For example extending into capital gains of a portfolio of stocks that are kept for the long haul?

- if one has a full time employment, the professional trader classification might count as a violation of the employment contract ? Will the employer be notified of the authorities decision reg. Professional trading?

Thanks for any further insights.