99% of my tobacco I buy online ![]()

Probably the most bullish outcome for Bitcoin, the US Government being the ultimate bagholder:

It seems the idea is not US Govt to be bagholders but push other nations to be bagholders if they get lured into buying BTC because US bought it. USD is more and more being considered as bad idea because nations have seen US using it as weapon and also the debt issues of US. So why don’t create another option to transfer wealth from other nations. Of course depends on other National banks if they go for it or dump USD because of such tactics.

Simply said -: US have big debts without any clear plan to reduce. So buy BTC at price X, hope others follow and your investment value goes to Y. if Y is much higher than X, then net assets in balance sheets artificially inflated without doing anything in reality. And most ironic part is to inflate Net Assets by using entity which is not productive itself. Now all you need to do is to keep „supporting“ and „motivating“ others.

This has worked well so far for early BTC buyers & MSTR. MSTR is just promoting Bitcoin so that their asset value is inflated. And maybe US govt wants to try the same. Bitcoin design clearly helps this because it has a liquidity restriction by default which means to pump price of bitcoin to 1 MM, you just need to buy newly minted BTC at higher prices. In other words to increase value of your own assets, you just need to buy more of that same asset. Isn’t this perfect money glitch ![]() but only lasts till people call you out and say „awesome you own all these coins, have fun“

but only lasts till people call you out and say „awesome you own all these coins, have fun“

Similar tactic was employed in a famous scam in India in 90s by Harshad Mehta when he bought most floating shares of known companies and massively pushing prices up. It was termed scam. Nowadays it seems like a normal thing to do publicly

Meanwhile in El Salvador -: the poster country (if it can be called that) might need to remove legal mandate for BTC to receive funding from IMF

MSTR to join NASDAQ - the momentum train keeps building.

On another note, AXON also joins. This was a stock I wanted to buy but felt it was ‘too expensive’ only to watch it go to the moon.

You make a lot of good points here, but if you replace BTC with gold, it would also be true.

I think both BTC and Gold are actually in danger due to the governments. It happened already with gold many decades ago, that you had to change it to USD due to regulation. It can happen again, also with Gold, also with BTC.

Governments want to inflate our savings because that’s an easy way to reduce debt. So if there are assets in which you could exit, for sure governments will not like them. Maybe they realized that they cannot ban BTC, so decided to get into it, and try to control it.

Given the current trends, soon there might be some restrictions already about how free you spend your capital. The governments are telling their companies where to invest for projects, the next step is to tell them where to invest their savings. They will not tell them to keep gold or BTC, rather advising them to invest locally, invest home.

So I have very big doubts about the free market in the next years. Imagine a governmentally controlled market, where Inflation is a target. This narrative is part of my BTC strategy

I understand this but if strategy to hold BTC is to not be controlled by government, then isn’t US politics is going in entirely different direction?

BTC recent rally is driven by US president. And if Trump says tomorrow „BTC is very volatile and not very energy efficient “ then BTC will fall 50%

So in a way, now BTC future is entirely in hands of US president. For most BTC holders it doesn’t matter because they are in it for money and not for principle. But for principle hodlers, this must be weird

P.S -: what I said might be true for gold too. However since gold is around for hundreds of years, it’s part of our being. Most people believe gold is valuable. But most of them don’t think gold will become more valuable than everything else in world. It’s mostly a way to protect buying power.

In addition. gold was always there and it was controlled by people who were in power or governments. This meant the wealth was already in hands of people controlling it. BTC is not the same. It is created out of thin air. So if US tax money is going to be used to buy BTC, it would only make current BTC holders rich , not US government.

Rich people own gold, they didn’t become rich by owning gold

And now let’s imagine that governments do not want to inflate away the debt. That is also a scenario for gold and BTC.

The only way out I see is that AI or free green energy, or something else boosts our global economy. But currently what I see is that more and more debt ends up inefficiently in growth. 10% more debt, maybe 1% growth, not sustainable

The US president can further boost it or cool it…but fundamentally, if there is more and more inflation, people will want BTC. If you remove the noise and hype cycles, you can see the trend.

So the strongest enemy of BTC would be a very smart government, which reduces debt, focus on CAPEX, and creates economic growth. Can be done, but currently this is not the trend.

Once I see that governments are taking care of debt, and not via Inflation, I would sell BTC & gold.

Luckily where I live , there is no more and more inflation. Actually it’s less and less inflation ![]() if you hear SNB , they are concerned about deflation and not inflation

if you hear SNB , they are concerned about deflation and not inflation

Of course can’t say about US because they have a very different leadership and mindset. It could be US locals have lost hope and don’t see light at end of tunnel

Not quite. About half of gold is in the form of jewelry and so privately owned. Over 20% is held as investments.Under 20% is held by central bank.

I prefer told to BTC as gold has natural buyers: half of annual global demand is jewelry and about 7% is consumed in electronics. So there should always be buyers.

For now BTC is fine as there are more and more buyers so short term outlook is good, but BTC is volatile and who knows when it takes its next dip.

The debt is the issue. Inflation is the solution.

So by low inflation, central banks will go to very low rates, making sure that simple savers money is losing value.

The Inflation in my opinion is rather created by the governments, at least lately that’s the pattern.

Switzerland has also a huge debt, but that’s true that the government is smarter than average. But if the others are not that smart, Switzerland will import the Inflation anyway.

CHF too strong → negative SNB rates → stocks, gold, BTC, real estate UP

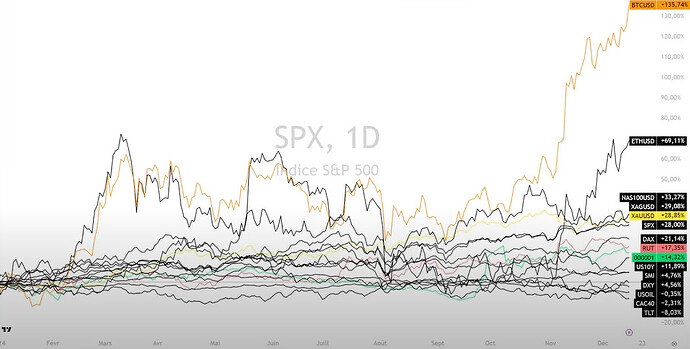

Missing PLTR & NVDA stock on the chart & also SEZL and WGS

Might make the chart more interesting

I wonder how green goody goody California champagne socialists buying Teslas feel when their main guy is in bed with everything they profess to stand against?

If you look at it from a cynical prism of “there are no morals, just laws” everything’s clearer ![]()

- Cocoa which outperforms BTC YTD

In case you use LastPass, watch out, it was hacked and hackers are breaking into bitcoin wallets:

This is hyperbolic. I’d argue that BTC future is very much not in the hands of the US president, even if it’s short term price can be influenced by this. Yes Trump can maybe tank it but even if it goes to the price that it was 12months ago (where Trump wasn’t so much in the picture) do you think that BTC is done? I think it’s a very clear no, so by definition it’s future does not depend on Trump or anyone else.

If Trump says that electric cars are a scam and for weak little men also TSLAs price will fall 50% for example. This can be said for a number of companies/fields as well. It is the world we live in.

Tell me again how much did your healthcare premium rose for next year? And food at supermarkets/restaurants?

I joined this thread quite late and there was some heated discussion above with some factually wrong statements but it’s probably best to not bring that up again now. In the next cycle we can get around to those ![]()

I believe you are talking about what happened in past but SNB is talking about what is expected to happen in future and latest inflations prints

I wouldn’t count healthcare increases. It’s not driven by inflation per say only. It’s driven by what is covered and how much people fall sick.

If average age of country will go up, then healthcare costs will go up even if medicine prices don’t.

I am not saying BTC will disappear if Trump starts talking bad. I just said it would Tank in price. I never said BTC will be done. I just said the whole idea to be not dependent on government is not true anymore.

I guess you don’t agree. It’s fine.

And yeah let’s keep something for when price is 1 million