You can’t rely on this and trust that it’s the same thing as in the online trading app. I would like to see somewhere a description of the FX conversions that they offer or a live example if anyone has access.

I had a phone call with the PF Service desk last week, cuz I am about to decide whether I should open the E trading account there. The guy told me that I need to factor in about 1% markup for converting the currency. But this is only valid for the often traded currencies like EUR and USD. Depending on the market situation it could also be 1.2%. Not seen an official document yet, but some article like in NZZ that the big banks take about 1-2% markup.

I’d also like to ask you who next to rolandinho and Dunkoff are using E-Trading from Postfinance? My impression is that there is a strong IB bias in this forum. Which is fine. I just want to buy 1 etf each quarter and maybe another one every semester. I’d like to go for simplicity. IB package looks great, but TWS is a sophisticated application. No Webtrader demo. And I’m not keen on doing cash management regularly, i.e. deposit money in IB (which is a Broker, not a Bank), convert money, withdraw money - potentially with costs associated with this.

I’m just curious about your experiences.

postfinance is too expensive for the ramen eating crowd on this forum

@gsheert I’m not using e trading, just considering to use it.

About currency exchange fees and other fees, I think it’s good they are a one off cost at the beginning rather that X% annually.

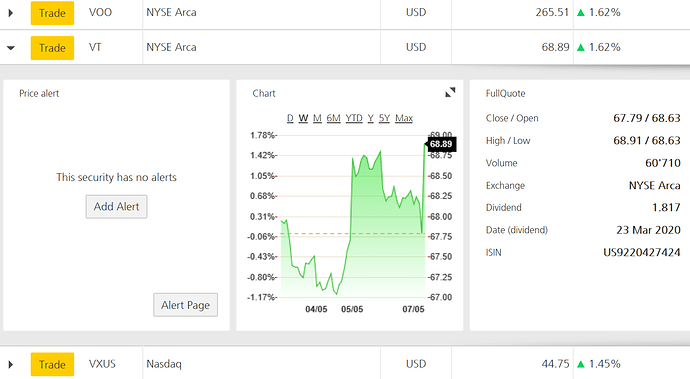

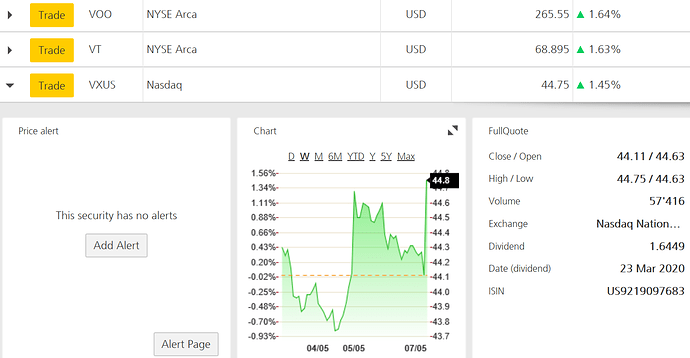

That was me, in this thread, 6d ago, incl. Screenshot. ![]() but it was VTI not VT, in USD at NYSE Arca.

but it was VTI not VT, in USD at NYSE Arca.

I had the USD already though, else I would’ve just bought VWRL at Pf.

@rolandinho can you please let us know if US9220427424 , US9229083632 & IE00B3XXRP09 are available for purchase with PF ?

Considering Swiss legislation: Capital gains are not taxed but dividends are taxed, would it not make sense to choose a Growth version of an ETF as opposed to the high yield or regular one ?

For example, looking at SP500 ETFs I’ go for VOOG ( growth) rather than VOOV - value or VOO-regular

Excluding the fact that VOO is more liquid compared to VOOG & VOOV

If I remember, there was a Ben Felix video talking about how pointless dividends are ( when they pay out the price of the stock/ETF is diminished by that amount anyway)

Just saw that Postfinance increased once again fees, this time for their funds, under the guise of new innovative wealth management services. They added a 0.15% depot fee, and that‘s in addition to the 0.5-1% retrocession fees they receive from the fund companies, usually Ubs. So they are already not cheap. New fees apply from the beginning of 2022.

I had some fondsparplans for diversification. I‘ll liquidate them until then and increase Swiss stocks in e-trading to 25000.

But I wouldn’t be surprised if they introduce an innocent 0.15% fee also for e-trading in the next few months or year. They constantly raise their fees in the last two years with the excuse of the negative interest rates, even though they are still profitable. They just want to reach big bank bonus levels.

That does not sound to promising. Just opened an account at PF and trying to move away from UBS. For doing basic operational banking, I’m still ok with their package and fees. For investing I’m starting to get doubts.

just to clarify: for the funds depot or for the e-trading depot? if it would be for the e-trading depot than they’re above the Swissquote fees, 0.025 per quarter. And the transaction fees at Swissquote are lower. And PF is using the SQ backend and GUI.

Just to be clear it‘s only for the funds depot, not e-trading, at least for now. I don‘t know anything more, I just saw their website today.

Here is the new pricing for fund depots, the old depot was renamed as self-service and they added a few more types.

thanks for sharing.

welcome to the “new normal” with the low interest rates (since 10 years).

what do they do: increase the fees, trying people to convince to buy their funds or funds of partners (with getting retrocession…).

seems like it’s getting even more important build up knowledge in investing and fess structures ourselves

switch de with en…

I am still waiting for an email or some other sort of warning.

Then I might sell everything and leave 3a > 25k.

Are 3a’s ETF still considered for the removal of fees?

Usually there are no custody fees for 3a funds. At least it was like this in the past.

But I’m curious to find out if you have a 3a solution based on ETFs? At least at PF? I am not aware of any 3a fund solution based on ETFs. Usually they use indexfonds, but are often funds of funds

Well yes, funds of funds of funds of ETFs… It’s something like that.

What I meant if the 3a funds count against the cost of a PF account. I would like to keep my 20++ year old PF account ![]() but I don’t want to pay their fees, at least not directly.

but I don’t want to pay their fees, at least not directly.

- No account management fees shall be charged for investment assets of at least CHF 25,000 per customer relationship. This means that a customer with a private account and investment assets of at least CHF 25,000 is exempt from the account management fee. If they also have a partner account with investment assets of less than CHF 25,000, they will however be charged the account management fee for this account.

- Customers with a youth/student account

What is classified as investment assets?

- Fund investments (including retirement funds in the retirement savings account 3a and the vested benefits account)

- and custody account assets in e-trading.

How are investment assets calculated?

Investment assets are recalculated monthly. The amount at the end of the month – made up of the total of investment funds (PostFinance funds, funds of third-party providers), retirement funds and e-trading (custody account assets without cash) – is taken into account.

About the FX fees, I asked PostFinance about the “Aufschlag 1.2% vom Interbank Rate” in E-trading that I calculated. I calculated it from the difference between Buying CHF for USD, and Buying USD for CHF, the difference was 2.4%. So for me, half that is the spread when buying or selling.

This I calculated for smaller amounts - 5k. I can’t test it for bigger amounts, as I don’t keep much cash there.

I asked about how the % changes for bigger amounts, > 50k, and for other major currency = EUR.

Answer:

Bitte beachten Sie, dass die Wechselfunktion im E-Trading vollautomatisiert ist und Swissquote keine verbindlichen Angaben zu der Kursstellung gibt - der Kurs muss immer Live angefragt werden. Erfahrungsgemäss beläuft sich der Spread aber tatsächlich auf etwa 1.2% und ab ca. CHF 50’000.- Gegenwert ist mit einem besseren Kurs zu rechnen. Somit besteht nur die Möglichkeit unter “Wechsel” die jeweils geltenden Kurse/Konditionen abzufragen.

VT = Yes

VOO = Yes

IE00B3XXRP09 = Vanguard S&P 500 UCITS ETF - but buying a S&P500 ETF with domicile Ireland is not ideal dividend-taxwise.

1.2% seems like a robbery, no? So I just exchange currency, hard earned 100’000 CHF, and they happily take 1’200 CHF for that service!

I agree 1.2% is robbery!

OK at 100k it may be less than 1.2%, but even 1.0% (if you lucky) is robbery.

I had USD on a Swiss bank account already from previous times. I stated that all the time (Post number 12 in this thread). I was just answering the question, “can one buy VT at PostFinance”, which led to “how much does it cost at PostFinance”?

I exchange CHF to USD at IB

I exchange CHF to EUR with Transferwise