Also GDP inscrease is not correlate to market performances

Didn‘t claim they were ![]() (though your points are very valid!)

(though your points are very valid!)

It was just to give some perspective. I think it is not necessarily „right“ or „optimal“ to (geographically) allocate investments purely on the basis of market capitalization. Unless, of course, you strive for a portfolio performance that just most closely tracks the world investable market based on weighted market capitalization. Though that’s probably far from the worst of approaches, there might be more preferable ones.

GDP or population might be among the important factor‘s I would at least consider, too (from a growth perspective, for instance).

-

Different markets will different structures and ownership of corporations. The U.S. should undoubtedly have a much a higher percentage of publicly held and stock exchange listed companies than other countries.

-

There will be „local“ companies. Not even every S&P 500 company will be highly globalized, or all of them to the same degree. Despite many big corporations‘ businesses being international, there will still be index-listed companies with disproportionately high shares of domestic revenues and earnings (From the top 25 constituents of S&P 500, Bank of America, Verizon, UnitedHealth, Home Depot and Wells Fargo would be among my suspects, without even researching).

-

The U.S. is just one jurisdiction, with its particular business and tax „climate“ and associated risks and opportunities. With more than 50% of worldwide market capitalization, it does present a cluster risk.

Just wanted to update (myself and everyone) a bit on this, and open a discussion whether it makes sense to keep doing what I planned, long term (15 years).

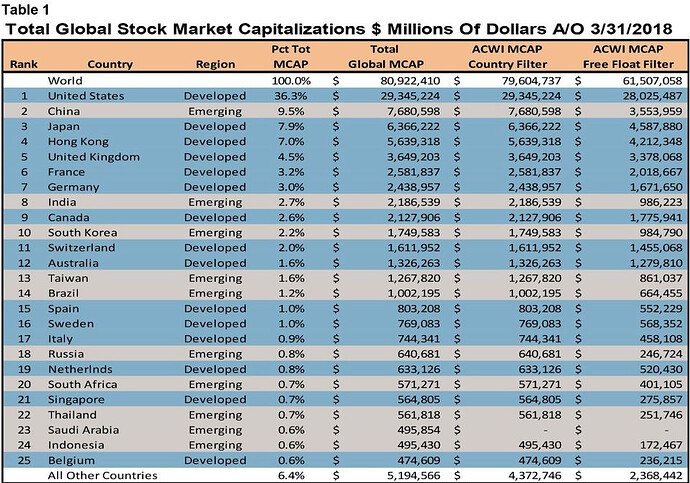

According to this article on Forbes, US today (or, end of Q1 2018) amounts for only 36.3% of global market cap!

Now I had an idea of my “basic” portfolio to be something like 50-40-10 split between US-DevxUS-EM.

Yet today, as I am starting to build my own IPS, I felt like questioning my decision and plan. ![]()

What is your take on this, and growing China (and other emerging) markets?

Do you still stick to your ~50% US allocations; or with VT even putting it up to 58%?

I know, on the other hand, that companies domiciled in a country don’t only do business (and make profits, and thus grow) in that same country; example all US companies, and even for CH Novartis/Roche/Nestle.

So I am a bit shaken now as to how to approach my “optimal” distributions. ![]()

Happy to read your inputs!

Cheers,

D

The missing % in other counties are hard for an ETF to invest into. I’m not sure if you can just substitute the missing companies with other companies from the country or the region. I just hope that along with the development of other countries, their stock exchanges will become easier to access for foreign investors, and will get added to ETFs.

Fair point, it would be interesting to dig deeper, and see which exact (large cap) companies of those countries are inaccessible via ETFs.

I just find it still quite disproportionate, with VT having for example:

- US @ 54% vs. 36%

- HK @ 1% vs. 7%

- CH @ 3% vs. 9.5%

But again, pure market cap is probably not the only criteria to go for.

Thanks for opening my eyes a bit further. ![]()

One other thing to consider is market cap vs. investable market cap. For example, Saudi Aramco is the worlds biggest company, but you cannot invest in it¹. Does that mean you should plow money into random Saudi companies to compensate for this?

¹ Yes, I know, for a few years now the Saudi regime has been indicating that they might IPO a small % of the company so this may change…

I swear you will outperform most portfolio managers if you stick to this strategy. I would find accumulating version of the ETFs you listed. You could also decrease equally your exposure to the US and Pacific ex Japan to get some exposure to Japan (between 0 and 5%) and increase your exposure to China by investing in a China specific ETF

This is an excellent view on that portfolio, thanks for sharing it