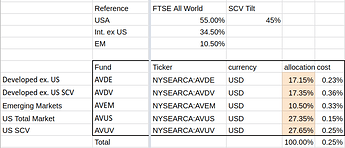

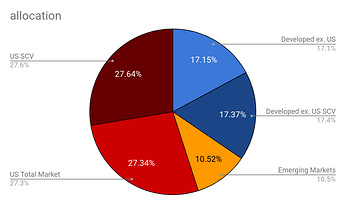

Here is my allocation for taxable. I have a higher factor tilt in taxable because I can’t have a factor tilt in 3a, overall tilt is 35% in small cap value.

I don’t think there is enough evidence to support that gold is negatively correlated with stocks. It is also far too volatile if you want to reduce overall volatility. I would just stick to cash for that part until bond yield raise.

VT + AVUV + AVDV is fine, but be aware that you underweight emerging markets if you go that way.

Just VT is also a good option.