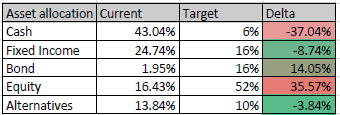

Well, I’ve finished putting all my assets together in a spreadsheet and this is how it looks like when it comes to asset allocation.

Regarding my target portfolio here are some explanations:

- Cash: 6% to cover the daily cashflows plus some emergency buffer (aprox 2 salaries worth)

- FI + Bond: 16+16 to sum up my age: 32. According to the grandpas’ strategy

- Alternatives: 10% correspondst to my current 13.84% stake in Bitcoin. It is a higly-risky highly-speculative investment that so far has provided my excellent returns. My strategy with bitcoin is “Zero or Hero” so I will not sell them even if a massive price dump occurs. I’m thinking of leaving them out of my total asset calculation.

- Equity: all the rest

So basically I should exchange cash for equity and it should be more or less balanced.

Now some questions:

What do you think overall of the portfolio distribution?

Do you guys include your Pillar 2 and Pillar 3a on the asset total? I have included them so far as they are heavily exposed to Equities and I wanted to have a clearer picture of that exposure.

Any ideas are welcome!

Have a nice weekend ahead!

Cheers