Hi everyone,

First off, a big thank you to all of you for your valuable insights—I’ve learned a great deal just by reading through the discussions here.

Today, I’d like to ask for your feedback on my portfolio. I started investing about four/five years ago, and since then, I’ve been gradually expanding my positions while continuing to learn.

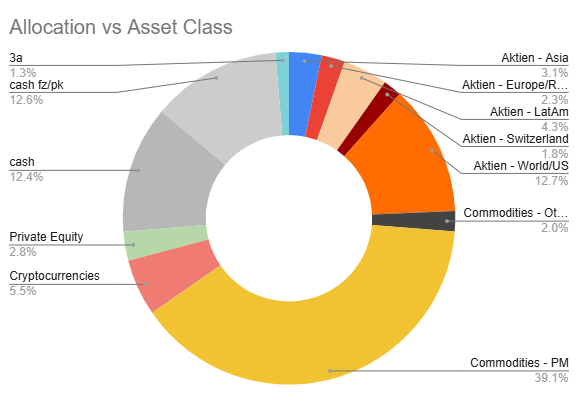

Here’s a snapshot of my current allocation:

- Cash: 57.3%

- 3rd Pillar (Frankly + Swiss Life Select): 14.9%

- Crypto: 12.9%

- Swiss Life Select: 11.1%. Composition:

- UBS Vitainvest 75 World

- PIC Precious Metal-Phys. Gold

- FID Global Industrial Fund

- Gold: 2.2%

- IBKR (80% VT + 20% CHSPI): 1.6%

As you can see, I’m holding a significant amount of cash and a very low quantity of VT/CHSPI as I started quite recently. I have mixed feelings with the Swiss Life Select product even though it has a “good” performance. I wasn’t fully aware of the long-term impact of fees. It was one of the first “investment” decisions I’ve taken, with a lack of “DYOR”… I’m considering closing this account and reallocating those funds more efficiently (VT/CHSPI).

Investor profile:

- Dynamic/Balanced risk appetite, with around 36 years before retirement

- I appreciate liquidity and returns but understand the investment triangle

- I’m comfortable with drawdowns, provided I understand what I’m investing in

- My goal is to build a resilient, growth-oriented portfolio over a 5–10 year horizon

- In an ideal scenario, I’d like to buy a flat in Switzerland within 3–5 years, potentially alongside a real estate investment in France. If I go through with the purchase, I’d still like to maintain a low amount of my current investments (IBKR, crypto, 3rd pillar), rather than liquidating and restarting my DCA from scratch. I realize this goal partially conflicts with my time horizon, and I’ve yet to run the full rent vs. buy analysis.

My main question:

What would you do with the cash portion of my portfolio to improve performance, diversification, and reduce volatility (except increasing VT shares)?

Specifically, I’m considering:

- Adding bonds (government or corporate) for stability and added diversification. Finding a good ETF is a bit tricky, do you have any valuable feedback to share?

- Adding another ETF that could balance the US exposure

- Private Equity exposure, via something like the IPRV ETF, or platforms like Swisspeers or Raizers. I’m aware that PE typically requires a high entry ticket (100k+ over 5 years), but if there are other routes you’ve tried, I’d love to hear about them!

- REITs (e.g. VNQ, iShares Developed REITs), or Swiss real estate funds like UBS Swiss Real Estate as I believe real estate is a strong lever for financial growth

- Invest in France real estate (Real Estate Investment Company with family members)

Next moves:

- I’ll rebalance my VT/CHSPI allocation soon (target: 20% of portfolio), particularly in light of the first effects of the One Big Beautiful Bill Act. Depending on this law, I’ll probably switch to another world ETF

- I plan to continue my DCA on gold until it reaches 5% of my portfolio for a very long term investment (+40 years). I might switch to the ZGLD ETF on IBKR for better liquidity and ease of management

- I’ll also keep my DCA on my current assets (3rd pillars, crypto)

Thanks a lot in advance for your input—looking forward to hearing your thoughts and recommendations!