Hey !

I’m working on a tool to analyse the evolution of my portfolio on Interactive Brokers, which contains ETF, shares and cash.

As a prototype, I’m writing it in Python programming language, using the Jupyter Notebook framework and some data files in YAML standard. To me the requirements are:

- dynamic computation of the portfolio content (dynamic = updated with the last data for the products),

- manage

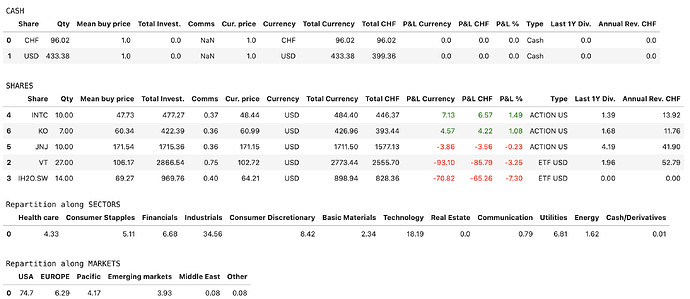

CHF,USDandEUR, - one global view the content as a table with:

- product symbol,

- quantity,

- mean buy price (mean computation if I buy the same product at different times),

- last known value,

- P&L (CHF and %),

- dividende estimate for the year,

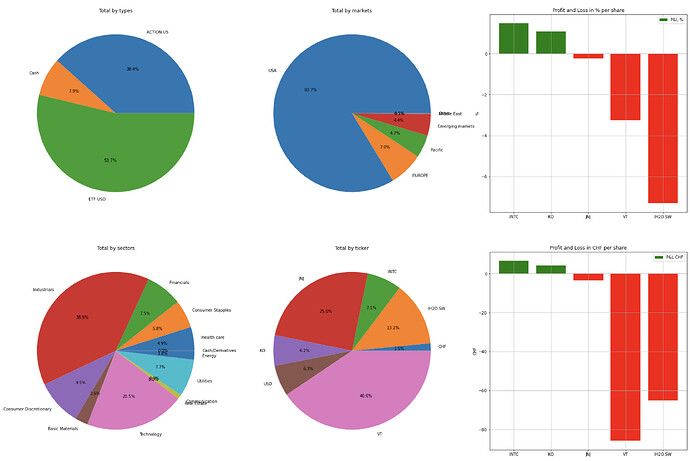

- one detailed pie by ratio (%) with the markets repartition (USA, EUROPE, EMERGING, PACIFIC, MID. EAST),

- one detailed pie by ratio (%) with products types (CASH, ETF, SHARE),

- one detailed pie by ratio (%) with sectors (TECH, FINANCIALS, ENERGY…),

- one detailed pie by ratio (%) of products in the while portfolio),

- a graph of positive/negatives P&L in % and CHF for each product.

To feed the tool, the data to process must be ‘easy’ to setup. I choose a text format (YAML):

- a file for products descriptions (tickers.yaml): it contains the definition of each product (symbol, description, geographic repartition, sectors repartition)

- a file for transactions (transactions.yaml): it contains the list of the whole transactions I have made for the portfolio. It could be:

INSERT_MONEYwhen I move money from by bank account to IB in CHF (qty, date),BUY_CURRENCYto convert CHF to USD (from/to currencies, qty, rate),BUY_SHAREto buy a product (symbol, qty, rate, commission, date).

The technology behind this uses: yahoo finance for dynamic products information, pandas for dataframe manipulation and matplotlib for graphs.

Afterwords, I’m not really convince in the way I manipulate the data and it may be more powerful to setup a real database (SQLite?) to increase the modularity.

Have a look here to view the files (still in development ![]() ). The

). The transaction.yaml contains data for testing.

Example of outputs:

My questions:

- any of you has already think about a kind of tool ?

- do you already use something DIY or on the shelf ?

- any constructive comment ?

Thank you for your attention.

πR