Polish economy is growing steadily. This year has been very good so far on Warsaw Stock Exchange. Out of curiosity, doesn’t anybody hold any shares from companies listed on WSE? Or is considering this market in the market screener or own analysis?

Do you have any suggestions?

(also, feel free to drop those company names in the stockpicker’s topic: Any Stockpickers out there? - Investing / Portfolios - Mustachian Post Community)

I can provide couple of suggestions but I am considering more comprehensive analysis of polish market. I wonder if there would be people interested in reading market’s overview + about 10-15 interesting companies.

I own WSE:KER, a Ukrainian sunflower oil producer. It is very much depending on war/peace intentions.

Oh, wow.

Not a company for me, but I applaud your efforts to invest in an Ukrainian company.

(Obligatory FASTgraph:

Personally, interested in the 10-15 companies interesting to you. A little less so in the market overview (though I’ll probably still read it), just because I believe market overviews are kind of macro which is just above my … pay grade.

Kernel is interesting company which I had in my portfolio until ~2 years ago. I lost ton of money on it. Now it is interesting but risky bet on end of war in Ukraine. However, the issue of Kernel’s delisting and the related violation of minority shareholders’ interests is what deters me from this company.

At the end of 2024 the court in Luxembourg (this is where Kernel is registered) sided with the Ukrainian oligarch Andriy Verevskyy (main stakeholder owning ~95% ot shares) and issued a ruling dismissing one of the five claims brought by minority shareholders who disagree with the way the company plans to delist from the Warsaw Stock Exchange. According to the small investors, this will happen at their expense.

DOM Development, real estate developer

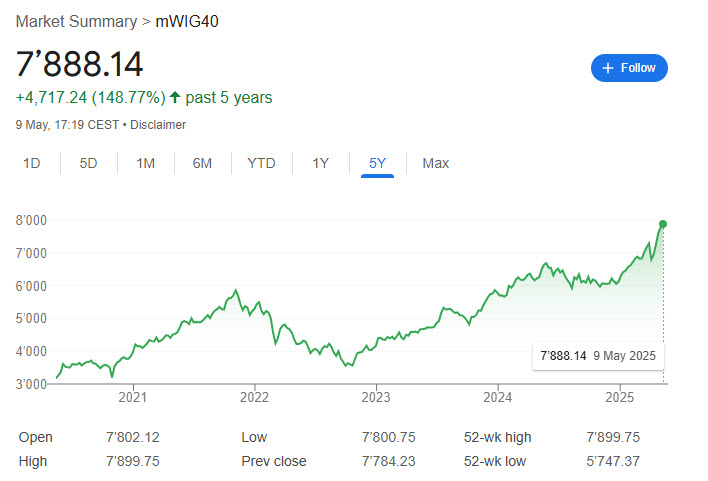

Have also observed (both in high level metrics and ‘on the ground’) that the Polish economy has been wonderful for many, many years and in addition the stock market has done very well past 12 months.

It’s a market which I’m considering entering with an investment but was thinking more of a broad based Polish ETF. Anybody here already done the home work and willing to share?

This one looks more interesting to me. FASTgraph:

Anyone know off the top of their head the withholding tax sitution with Poland and how Swiss tax authorities treat it?

I would avoid ETFs following WIG20 (20 biggest polish public companies). Half of index’s capitalization comes from state-owned companies. They are often not managed efficiently and are treated as “cash cows.”

I would rather look at ETFs following medium (mWIG40) or small (sWIG80) cap indexes. For example those from BETA ETF ETFBM40TR or ETFBS80TR (I have no affiliation to BETA ETF and don’t own their ETFs).

*The information contained in this post represents the author’s personal opinions and do not constitute investment advice.

Dom Development is interesting taking into account anticipated interest rates reduction (first, by 0.5bp took place on Wednesday). It is biggest polish real estate developer selling above average apartments in biggest polish cities. The have huge land bank in their possession.

Here is my summary on the situation of Dom Development:

1. Strong Sales Performance Amid Market Volatility

Dom Development (DOMDEV) consistently reported high monthly and quarterly sales figures through late 2024 and early 2025, outperforming many peers who showed signs of market slowdown. For example, in Q3 2024, the company sold 1,156 units, up from 1,081 in Q3 2023, and continued this momentum into Q1 2025 with 1,033 units sold.

2. Expansion of Offerings and Supply

Dom Development regularly refreshed its offer with hundreds of new apartments monthly. Major contributions came from:

- Warsaw: A strategic and leading market, often accounting for the bulk of new launches (e.g., 500+ units in Nov 2024 alone).

- Trójmiasto (Gdańsk area) and Wrocław: Important secondary markets, with growing contributions.

- Kraków: Slower integration post-acquisition; performance and alignment with core operations still evolving.

3. Rising Unit Values and Premium Segment Growth

According to Trigon’s March 2025 summary:

- Average apartment price in 2024: PLN 833k (+12% YoY).

- Kraków average: PLN 955k (+36% YoY).

- 22% of all 2024 sales were for units priced above PLN 1M.

4. Financing Trends

There was a rising trend in mortgage-financed purchases, growing from 43% in 2023 to 49% in 2024, and 56% in Q4 2024, showing stronger reliance on credit.

5. Inventory and Land Bank Growth

By end of 2024:

- Offer volume: 3,776 units (+57% YoY).

- Land bank: 19,008 potential units, slightly down YoY.

- Units under construction: 7,657 (+14% YoY).

6. Profitability and Strategic Focus

- CEO and management see no need for price cuts, signaling pricing power.

- Plans for higher investment in land in 2025 (over double the 2024 level of PLN 600M).

- Expansion beyond current cities is not immediate but considered for the medium term.

- The company sees limited value in PRS partnerships, instead focusing on JV structures where they retain operational and brand control.

7. Operational Notes and Anomalies

- Occasional discrepancies between user-tracked and official sales data (e.g., December 2024 sales possibly shifted from January).

- April 2025 saw unusual activity in Warsaw (many units returning to offer), with Trójmiasto outperforming the capital in sales — a rare occurrence.

Conclusion:

Dom Development continues to perform robustly, showing strong demand resilience, aggressive expansion, and price discipline despite broader signs of cooling in the Polish housing market. Warsaw remains its core strength, though challenges in Kraków and market anomalies (like sudden sales drops or returns) suggest room for closer monitoring.

*The information contained in this post represents the author’s personal opinions and do not constitute investment advice.

Wow, you must be an analyst bot … ![]()

(Half) Joking, of course, I like the details, though I find them harder to consume (e.g. what does “500+ units in Nov 24 in Warsaw” actually mean from an investment perspective? Anyway, side conversation, thanks for sharing).

I pay 19% withholding tax on dividends in Poland. There is also 19% capital gains tax, which is paid after year ends. There are currently discussions in Poland to introduce capital gains tax-free allowance which would reduce the burden and potentially attract more individual investors.

I suppose you’re describing being taxed by Poland as a (tax-) resident of Poland?

Thank you, appreciate such feedback. Keep it coming. It will help improve quality of analysis.

They added almost 500 apartments to their offer in Warsaw in November 2024 which was record high. It means that when those apartments are sold and hand over to the buyer, company can recognize revenue. I included it as curiosity but indeed it is not super useful information.

Personally I would not bu Dom Development now. This is decent and stable real estate developer with very good profit margins (EBITDA margin: 23%), good FCF (~12% of revenue) and solid dividend pay out ~6% at the current price. Company is at ATH and I think all positive news are already in the price.

I am Swiss tax resident but I am taxed in Poland for dividend and capital gains. I didn’t find a way to “avoid” it.

Don‘t invest in polish stocks:

There is. Zero correlation among economic growth/outlook and Stock market performance.

Isn’t it that any country in the world probably did worse than the US (which is the biggest part of ACWI)? Past performance no indication of future performance?

No particular view on Polish stocks/economy etc. But still one of the best performances YTD.

I do wonder whether Poland will be a beneficiary of a potential end of the Ukraine war, or quite the opposite as millions of Ukrainian refugees might leave Poland, I.e. a loss/drag on the Polish property market/economy etc?

How is this even technically / mechanically possible for Poland to collect taxes on capital gains on your holdings traded on Polish exchanges if you’re a Swiss (tax) resident?

It seems feasible, technically, but also probably only in super capital control / flow regimes (like South Korea) … but not Poland?

Now I’m a little closer to believing you’re a bot.

No offense.