Mustachians I need you help, here is some replies from the AXA agent this week in Italics. what shall I do especially for point number 1? would be grateful for your helps

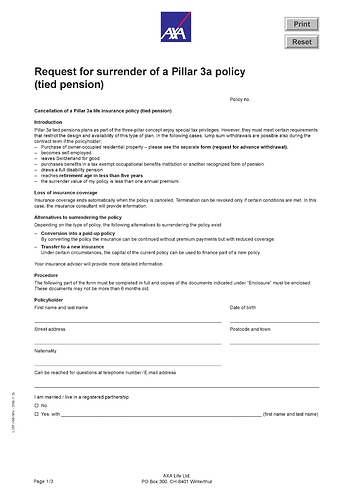

- The AXA agent sent me the attached form to fill to close my account, here is his comment, shall I sign it? Hope it doesn’t mean that I accept to only get the current surrender value. I still want to fight for the amount if it is possible to get back more:

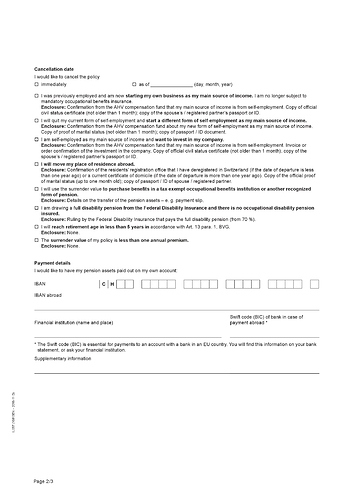

You do not have to tick a box on page 2 for the moment, because you do not have the bank details of your 3rd pillar in the bank. You can open it later, whenever you want, it’s not a problem. Then, when you have the account details of your 3rd banking pillar, you can send them to me so that I can transfer the money on it.

On the first page, you must choose: “Conversion into a paid-up policy” and that’s all.

Just complete it and sign it, I’ll do the necessary.

- when I requested him “Wert- bzw. Kostenaufstellung”, which is a formal listing of what components of my policy cost what money, i.e. how much went to the saving’s part and how much for the death and disability parts respectively.” His reply is below, I insisted to have it and asked what is the 311 CHF as I never saw this number but no reply since 2 days…

However, I do not have a list of your premium details. To do this, simply do the following calculation:

- you have paid 6768 x 3 years (20’304 chf total)

- the payment of premiums cost 311 chf per year (933 total chf )

- the current value of your contract is 12’125 chf

So the cost of the life insurance and the contract costs are 7’246 chf.

- When trying to ask him a confirmation of the amount I can get if I close, I get below reply:

I confirm that if you close the policy with the form, you don’t need to pay the premium of this year.

The amount of your savings will then be 12’125 CHF (11’641.00 +484 bonus).

But…you can only remove it for the following reasons:

- leave Switzerland

-buy a property as a principal residence

-carry out renovations in his or her principal residence

start a self-employed activity

- Below is some general info he gave to me:

In your third pillar, you don’t have full life insurance.

Currently, in the event of death, we pay back the premiums you have saved to your beneficiaries…but not the final capital when you are 65 year’s old.

two insurances included in the contract:

- we pay the premiums after 2 years on your behalf in the event of disability due to illness or accident.

- after 5 premiums payment (so from next year), you can pause the contract and therefore not pay the year. You can do this 4 times maximum (in a row or not).

If the goal is to reduce the premium for this year, we can lower it if necessary, but if you don’t pay at all, then effectively, the contract ends.

if you leave Switzerland, you can touch your 3rd pillar, The value to date is 11,809 CHF.

You can also withdraw this amount for the purchase of a principal residence. But normally this is not done. The 3rd pillar is used for mortgage amortization. Because in this case, the tax savings are kept for the duration of the mortgage.

This is the same amount as if you cash out the money. There is no difference between transfer it to a 3a bank account or cash it out.

@Cortana @xorfish @nugget @Mr.Paprika @ilvalesco @pandas

![]()