Hello Mustachians,

After all the very useful tips/opinions given so far, I had a discussion with the Axa agent yesterday, sent him an email with the summary and obtained the following confirmation from him. I have copied the email below.

As per our discussion, please find below the summary. Please correct or add your points in case if required.

"

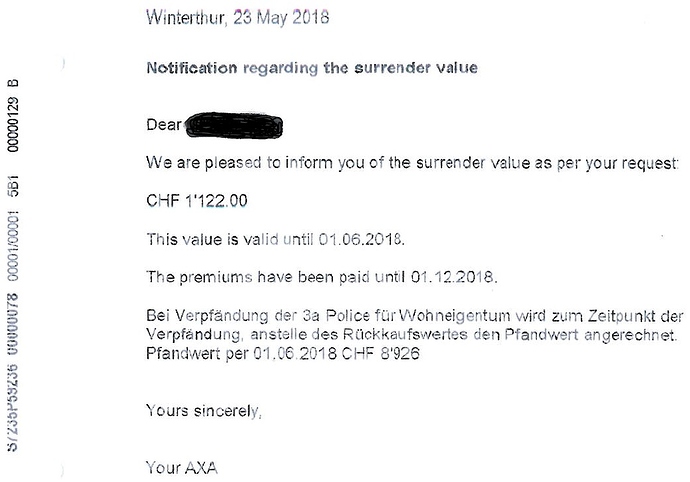

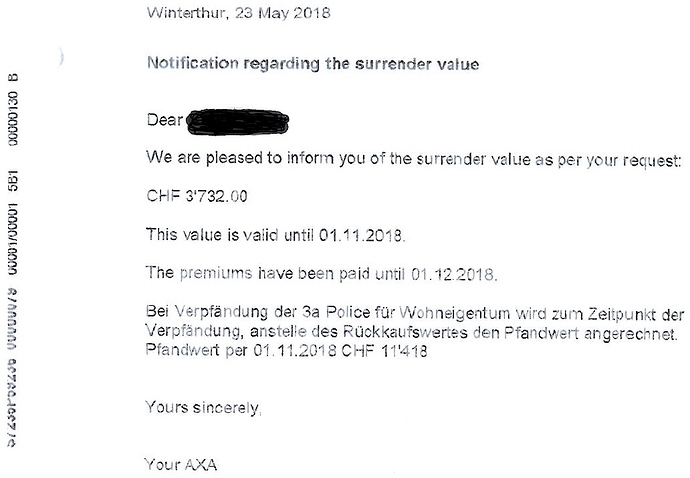

As I mentioned earlier, I am holding the Axa policy no. XXX. I have paid 2 annual premiums till now, CHF 6,768 in 2016 and CHF 6,768 in 2017.

I would like to cancel this policy and not pay any further premiums as I wasn’t aware when I bought this policy, that the surrender value of the policy is less than the amount of premiums that I have paid in

From our discussion over the past week, I have the following 3 options:

-

Completely cancel the policy effective 1st Nov 2018. The registered cancellation letter should reach Axa latest by 15th Nov 2018. In this case, the policy would be completely cancelled and I would get back a total amount of money which is approximately CHF 4,250. This amount would be directly transferred to a Pillar 3A account with another company of my choosing.

-

Convert the current policy into a zero-premium policy effective, for e.g. 1st Nov 2018. This means that I would not pay any further premiums than what I have already paid so far (CHF 13,536) and the new zero premium policy remains in effect beyond 2018, until the new term of the policy.

In case I want to completely cancel this zero-premium policy in, for e.g. 2020, then I will get back a total amount of money which is approximately CHF 4,250 + any applicable bonus from start of zero-premium policy to the cancellation of zero-premium policy. This amount would be transferred directly to a Pillar 3A account with another company of my choosing.

- Convert the current policy into a zero-premium policy effective, for e.g. 1st Nov 2018. This means that I would not pay any further premiums than what I have already paid so far (CHF 13,536) and the new zero premium policy remains in effect beyond 2018, until the new term of the policy.

In case I want to buy a house in, for e.g. 2022, then I will pledge the zero-premium policy with the bank (from whom I am taking a housing loan) and the amount of money which I will get from the zero premium policy for buying a house in, for e.g. 2022, is approximately CHF 4,250 + any applicable bonus from start of zero-premium policy to the date of pledge with the bank.

Please review the above statements and correct or add anything if required.

Please reply back with the corrections and confirmation. That will help to have a better understanding between us.

"

His reply:

"

Good morning,

Thank you for your friendly call and the mail.

Your points are correct. When you change the policy in to a premium free policy you will not have a worth of pledge. So if you give the policy to a bank after you made a premium free policy we will show only the new surrender value plus any applicable bonus. The value at point three is the same as in point two.

I wish you a good day.

"

In light of the above reply, I will be cancelling the policy effective 1st Nov 2018, using a registered letter and reference the already received official letter + official email while cancelling.

Thanks very much for your time in reading and providing any advice!