https://www.ahv-iv.ch/en/Home

Here you should find all information you need.

You must pick either FR,IT or DE. The english version is not the same.

I will check, thx. ![]()

The link of ma0 is the first social safety net, provided by the federal government, that your wife can benefit.

The second safety net is through the social security provided by your employer which not only builds up a capital for your retirement but also provides a protection for widows and children.

Any life insurance you can contract within the 3a system will be only a fringe benefit in comparison to the two social benefits mentioned above.

I see that makes sense + I found out there is also a lump sum if anything happens to me from my work insurance so seems I don’t need any extra insurance ![]()

Hello Mustachians,

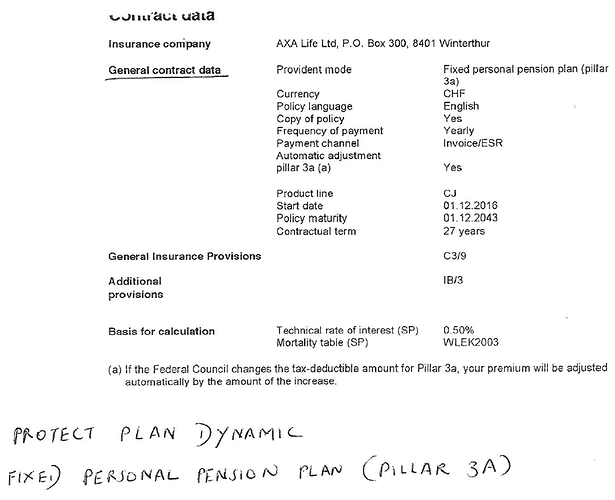

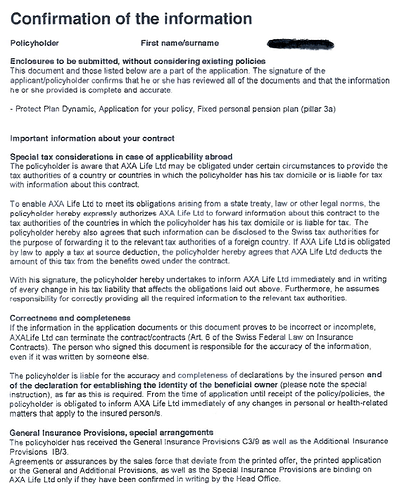

I signed for a Pillar 3A insurance two years ago (01 Dec 2016) from axa winterthur

Recently, after having thought a great deal about it, I have come to realise that I totally misunderstood what it was. I now regret the fact that I signed up for the insurance and would like, if possible, to either cancel it altogether or change it to another company.

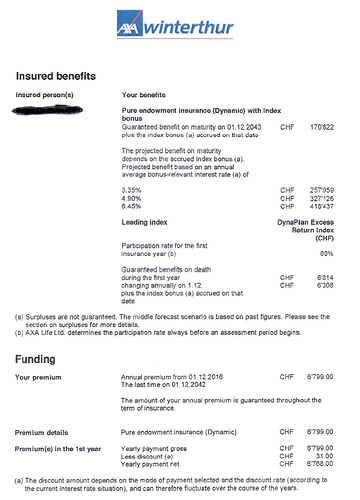

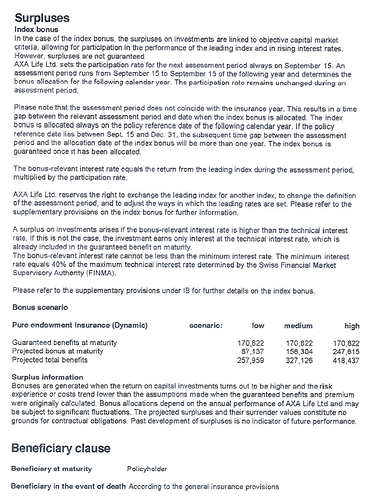

It is a pure endowment insurance (dynamic) plan. The plan is called “protect plan dynamic”.

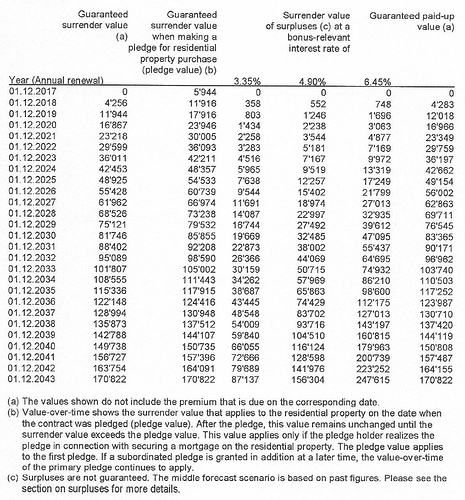

There is a guaranteed benefit on maturity on 01 Dec 2043 (plus bonus depending on market, which I am not considering).

The guaranteed benefit on maturity is lower than the sum of all premiums.

I have claimed the entire premium amount of 6,768 CHF against taxes in 2016 and 2017.

•The premium paying contract runs for 27 years.

•First premium paid on 01 Dec 2016.

•Last premium payment on 01 Dec 2042

•Annual premium amount: 6,768 CHF

•Total premium amount paid so far: 13,536 CHF

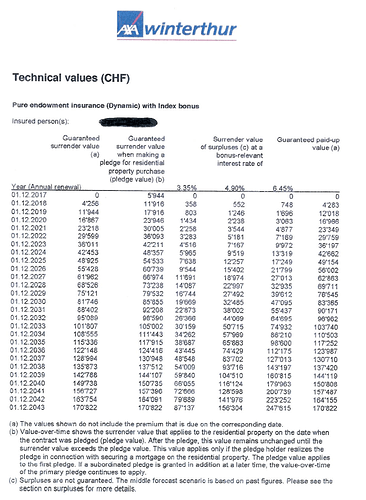

I have attached the relevant pages of the insurance policy.

I did not understand that I would get so little money if I ever want to move abroad or decide to purchase a house here.

I am looking for a way to get rid of it without losing everything. Transferring it, buying it for a lesser price, terminating outright or anything else.

If anybody has any expertise or previous experience on this matter, I humbly request you to share your knowledge. Thanks very much.

I know that I have made a mistake and any reprimand or harsh words are justified.

If it helps in any way, my personal situation is as follows:

40, Indian national, C permit, Basel Stadt.

Plan to get married in 2019, start a family in 2020 and buy a house in Basel Land (reasonably close to Basel Stadt) in 2022.

Thanks for reading,

Sirob

Dear @Sirob,

i am sorry to tell you that you got ripped off. my advice: cancel asap, consider the losses as sunken costs. it will get worse with every premium you pay, so don’t fall to the sunken cost fallacy.

Where i know from that you got ripped off? same happened to me, i described my case here. in summary, i payed 4 years worth 12 kCHF, of which 10kCHF went to the stash, of which i got back about CHF 7.5kCHF on cancellation…

you should avoid whoever sold you this, as that person on purpose did not tell you about the tax advantage of splitting your 6768 CHF p.a. into 5 separate accounts.

I am sorry for your losses, but i can tell you: if you get out now and put the remaining money into a reasonable passive index portfolio, you will be better off in 2042 moneywise than if you stayed with axa.

[addendum]

to be more precise: if you want to save and stash away money, then go do it the classic mustachian way. if you need insurances that are usually bundled with the axa life insurances, then get them independent from each other: work-inability insurance (corresponds to axa’s “we pay the premium if you get impaired”) and death insurance. when i checked back then, the free market offered better policies than what axa puts into these life insurances.

[addendum 2]

if you really want to know the extent to which they rip you off, request a “Wert- bzw. Kostenaufstellung”. you will see what’s actually in there, in my case these numbers were not listed in the contract.

I post to add my sympathy as nugget said it all.

Much of your loss will probably be, to add insult to injury, the reward paid to the agent.

Dear @nugget thanks a lot for your advice and kind words.

Yes, I intend to cancel this policy asap. Right now, I am trying to contact Axa and get the relevant details on what will it cost me (worst case scenario all the money). As expected, I am being asked to call different numbers and speak to different “advisors”. I really should have foreseen this. Anyway, no use crying over spilt milk.

As you might have seen, the next premium payment of 6,768 CHF is due on 1st Dec 2018.

My main question at this point of time is whether it would benefit me (in some way) by either cancelling it right now or possibly later in the year, through a registered cancellation letter.

Cheers.

Thanks @cray, yes thats the most irritating point, that the money will be as a reward to the agent at this point in time.

Lesson learnt and onwards from here.

I have not been asked, but to be at least a bit helpful:

You should check the contract for clauses about early cancellations. Do you have to give notice? Are there dates? Worst case would be if cancellation would only be effective after your next payment obligation is due.

Second and subordinate to that, the contract gives coverage for risks. I would expect those to be running costs.

Third, I do not know whether the index development has an influence or not. If yes, this create an additional uncertainty for waiting.

Last, I hate the game of call centers and phone ping pong wasting my time. In your place, I would probably send a courteous registered mail stating want I want / need.

Those are the points I can see.

back in my case, i started emailing the suport requesting the “Wert- bzw. Kostenaufstellung” and the buy-back-value. a week or two later they sent me the numbers, upon which i send another email requesting to buy-back and naming the 3a-account that all the remainings should be transferred to. no phone calls ![]()

You lost the money already by signing something you didn’t understand, insurance is not free. Lesson not learned yet? If you still want to stick to it and continue paying DO THE F*ING MATH FIRST, you have all the numbers and if you can’t afford excel after losing all this money, I believe google spreadsheets is passable free alternative

Not losing any money is not really an option here, these types of contracts are designed from the ground up to suck blood from clueless investors by people with much better math, legal and sales skills than any of us here. You could try going to court, claiming they misrepresented the product, there’s a small chance you might win, but it’s gonna cost and to the best of my knowledge you’d be the first to pull it through. (imho more likely insurer would try to settle privately to avoid setting a precedent then, all legal fees are all yours of course still)

Thanks for the tough love @hedgehog

Exiting is the best term option right now.

I’ll speak to the axa agent and see what can be retrieved out of the 13,536 CHF.

Same happened to me in 2016 here. Long story short : I contacted the salesguy, asked what was recuperable, which was nothing, so i stopped paying. After 4 months of warning letters my life insurance provider told me that the contract is void and worthless.

So, same advice as everybody here, cancel right away without waiting and stop sending money into this trap.

I spoke to the axa office just now. As I mentioned before, I had to do a merry go round from the hotline to Basel office to a completely different number and then finally to the correct person.

The axa person was surprisingly quite frank and said that the cost of covering the risk was what made the final payout less than the sum of the paid premiums (plus insurance fees and other administrative fees).

He will send me a letter tomorrow mentioning the exact complete surrender value of the policy based on a surrender date of 01st June and 01st Nov.

He also said that If I wait until 01st Nov to completely surrender the policy, then I would get around 2,500 CHF more (not sure whether to believe him or not).

He sounded sympathetic on the phone. I was firm and did not press too aggressively.

I will post the letter here when it arrives on Monday or Tuesday. Hopefully it can throw some positive light.

Hi @Sirob,

did the same two years ago (after 6 years of paid premiums).

Insurance company in my case is Vaudoise.

Check their terms and try to exit asap ! As other stated, the more you wait the more it’ll cost you…

edit: good to read Axa agent was “empathic”, had the same experience with the Vaudoise guy. I also have home insurance with them, though…

I would say it is important to understand why this should be so if any decisions are based on it. Is this guaranteed payout? You also need it in writing (at least email).

While not conclusive, be reminded that you have been sweet-talked into the contract in the first place. Making oral statements of questionable value is not unheard of by insurance agents.

Also, the delay might be proposed in the hope that you forget it. If you decide to go that way, don’t forget that you can of course request today the buy-back, effective Nov 1st.

Thanks for the tips @cray yes, thats why I requested the axa person to send me an official letter with the exact surrender value of the policy as of 01st June and 01st Nov.

I intend to use this official letter from them as basis of any further communication and correspondence.

As they say, fool me once, shame on you. Fool me twice, shame on me!

Good morning everyone.

Thanks a lot for all the inputs, opinions and tips provided so far.

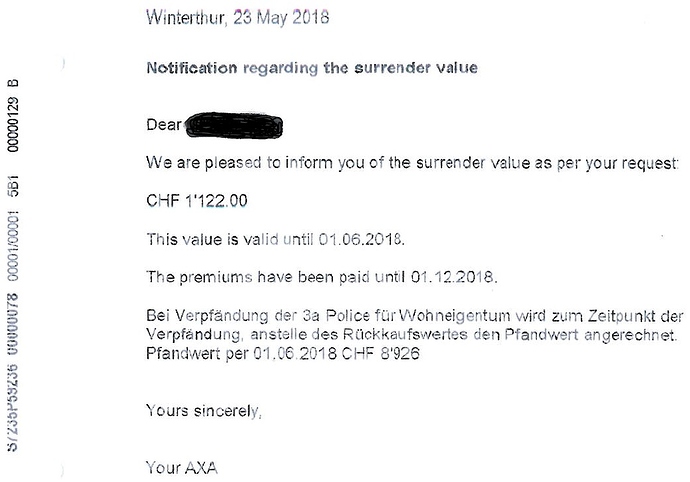

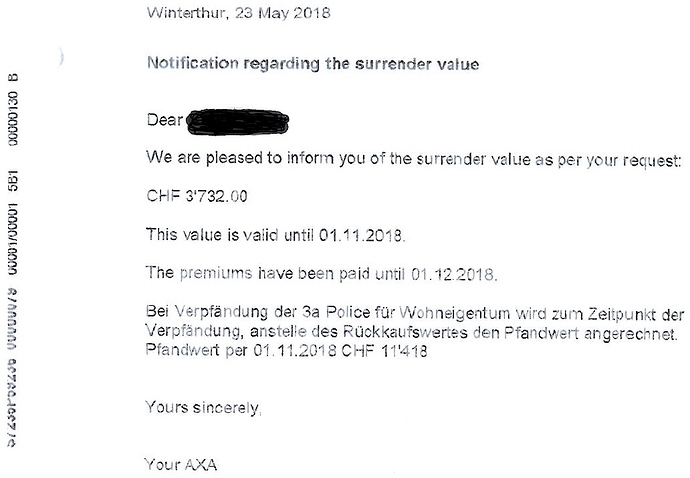

As mentioned in my last post, I received 2 letters from Axa yesterday. They are attached.

The first letter shows the surrender value of the policy as of date 01 June 2018. It is CHF 1,122.

The second letter shows the surrender value of the policy as of date 01 Nov 2018. It is CHF 3,732.

My proposed next step would be to send a registered letter to Axa informing them that I wish to cancel the policy with effect from 01 or 02 Nov 2018 (I will confirm the exact date after speaking with the Axa agent today, in order to get the higher amount).

I will try to see if I can get the full refund (unlikely).

Based on the attached letters, please provide your advice on whether the above would be the best way to approach or there could be an alternate way.

Thanks again for your time and effort in reading and replying to this.