Dear all, many thanks for the interesting comments.

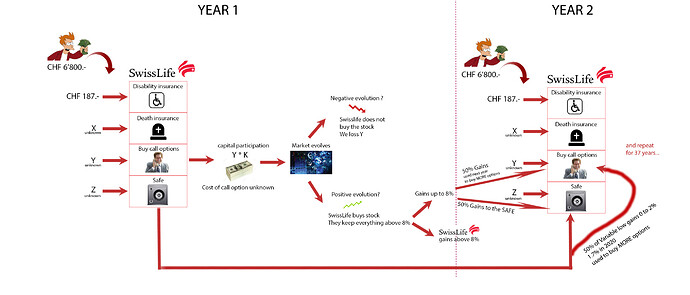

I spent some time drawing my understanding of the contract:

The X, Y, Z, K are the parameters I am looking for, nowhere to be found in the actual contract. And the value of X, Y, Z, K could change this contract outcome from good to bad.

I do not know if I can reverse engineer these values, probably not.

First year, capital participation was CHF 654.- = Y . K

Second year, I had CHF 0.- gain from index-basket participation + CHF 154.3 of gains from safe capital excedents + risk excedents.

Second year capital participation was CHF 2’857.- = (Y + 50% of 154.3) . K

Which gives K = 28.6 ( buying 1$ of option secures 28.6$ of stock) and Y = 23 (CHF 23 taken to buy options each year, assuming it is the same value every year)

Checking the K value against market data:

1 year call option for 3’800 of S&P500 is around 300 so 12.6 factor. Not very close to 28.6!

I tried different approaches, but expecting anything from these calculations is probably not wise.

Anyway, I think I have enough to organize a meet-up with SwissLife and directly ask those questions.